The Fed Will Be Tighter for Longer

2022 Fed Pivot Is Officially Dead

In August, the S&P 500’s bear market rally finally lost momentum following Fed Chair Powell’s hawkish comments at the 2022 Jackson Hole Economic Symposium. In his remarks, Powell emphasized the Fed’s commitment to bringing inflation back down to 2%, while acknowledging that higher rates for longer will, unfortunately, lead to below-trend economic growth, higher unemployment, and financial pain for households and businesses.

As a result of Powell’s comments, Fed Fund futures are now pricing in a terminal interest rate of 4% by 2Q23. Although we think this is still not hawkish enough to bring inflation down to 2%, we believe it’s a step in the right direction to correcting asset markets.

With that backdrop, let’s jump into our economic and market outlook.

Outlook (TLDR)

Short Term (< 1 month)

While Fed Chair Powell’s hawkish comments at Jackson Hole put the kibosh on the multi-month bear market rally, investors remain confused, awaiting key macroeconomic data that will inform the Fed’s next moves. With the S&P 500 bouncing off its 200-day moving average at $4,300, options positioning is now in negative gamma, which historically leads to higher volatility (typically to the downside). In addition, with options skew so low, this indicates investors lack downside options protection, opening up the possibility of sizable gaps down.

Looking ahead, we believe the August CPI report on 9/13 will be a key catalyst for future Fed policy. Recall, the July inflation report decelerated at a historic rate, emboldening bulls that the fight against inflation was over and that the Fed would soon pivot. However, inflation is a sticky and stochastic (random) monetary phenomenon that doesn’t move in straight lines. A hotter inflation print would likely put further pressure on risk assets, while a cooler inflation print would be a reprieve for bulls.

As well, the Ethereum merge to Proof-of-Stake (PoS) will occur on 9/15, which has led to excessive price speculation. On 9/16 we will also see the September equity options expiration, which may open up markets to further volatility as investors roll their hedges forward. On 9/21, the Fed will meet once again, where they are expected to raise interest rates by another 75 bps. Again, we believe the Fed’s commentary will be a function of how the August inflation report comes in. Lastly, as we move into mid-October, 3Q earnings season will begin, which may give us more insight into the probability of an actual recession.

We continue to believe risk/reward is skewed to the downside; however, we respect that incremental macroeconomic data will likely drive Federal Reserve policy (and markets by extension) from here. Until monetary conditions begin to ease, we believe building a cash position is prudent. As well, we would prefer to own lower-risk assets (defensive equities, Bitcoin) rather than higher-risk assets (growth equities, Ethereum, etc.).

Medium Term (2-6 Months)

Although the July CPI decelerated at a historic rate, we believe the market narrative will soon shift from peak inflation to persistent inflation, as the path to 2% inflation will be more challenging than policymakers and investors currently expect. Historically, Central Banks have had to raise interest rates above CPI to stop runaway inflation and keep it down. While we think it’s unlikely the Fed will take interest rates to high single digits, Fed Fund futures are now pricing in a terminal interest rate of 4% by 2Q23. Where we differ from consensus, however, is that we believe the Fed will need to keep rates higher for longer, as opposed to cutting rates immediately once we reach 4% (as the market is currently pricing).

According to our top-down market regime analysis, 40% of markets are currently pricing REFLATION as the dominant market regime, leading both INFLATION (26%) and DEFLATION (23%). This market pricing is inconsistent with our bottom-up macro regime analysis which expects a 58% chance of DEFLATION as the global macro regime over the next 6 months, ahead of both INFLATION (34%) and REFLATION (3%). As such, we believe the recent strength in risk assets, which outperform during REFLATION, will likely be short-lived as we continue to progress over the next 2 quarters.

While we’ve been on global recession watch since the beginning of the year, we believe the U.S. economy is far more resilient than our European and Japanese allies, given the strength of our labor market and household/corporate balance sheets. As of now, the U.S. economy can absorb the Fed’s hawkishness (which should continue to put pressure on risk assets), however, we remain on high alert in case of a true Fed pivot (which would mark an inflection in the liquidity cycle and be positive for risk assets).

Long-Term (6-12 Months+)

Netizen’s investment thesis is that the fiat currency world, supported by debt and political power, will shift towards market-based money, as has always occurred at the end of empires. We believe the Great Power competition between the West (U.S., Europe, Japan, etc.) and East (China and Russia) will result in a sovereign debt crisis and usher in a multi-polar world.

While the U.S. is facing its highest levels of inflation in decades, we believe USD strength relative to foreign currencies may catalyze a debt crisis in emerging markets. Looking ahead, we believe the USD is in a secular bull trend driven by 3 key components: 1) Japanese yield curve control, 2) the European energy crisis fueled by Russia, and 3) a global USD shortage.

As Russian President Vladimir Putin said at the St. Petersburg International Economic Forum this year “global currency reserves will be converted from weakening currencies into real resources like food, energy commodities, and other raw materials…which will further fuel global dollar inflation.” His recent decision to restrict natural gas exports to Europe is only one of many chess moves he can make to weaken the West.

We believe the period from 2008-2020 was dominated by monetary intervention, however, we are now entering a period of fiscal dominance, where politicians will do everything in their power to appease the populist majority (ie/ Europe proposing subsidies to cap the price of Russian gas). These short-term band-aids will only exacerbate future inflation and lead to long-term social disorder and distrust in government.

While we’re temporarily in a cyclical downtrend in growth and liquidity due to persistent inflation, we suspect we’re headed for a global monetary re-ordering fueled by massive fiscal stimulus as politicians scramble to “fix” the economy. We view energy-related assets such as Bitcoin, energy, agriculture, metals, and commodity-related infrastructure (ie/ real things) as the best stores of value AFTER the coming deflationary recession.

Interest Rate Expectations Still Too Dovish

Since Fed Chair Powell’s comments at Jackson Hole, many Fed Presidents have since come out publicly saying that the Federal Reserve’s official interest rate policy stance will be higher for longer, causing Fed fund futures to not only re-rate higher to 4% but to also price-out a 4Q22 Fed pivot and price-in a 2Q23 Fed pivot instead.

As we look ahead to the September FOMC meeting on 9/21, Fed-whisperer and WSJ writer Nick Timiraos leaked that investors should expect a 75-bps interest rate increase. And although the terminal interest rate is expected to reach 4% by April 2023, Fed fund futures are still prematurely pricing in interest rate cuts immediately once we hit that level. Given how sticky and stochastic inflation reports can be month to month, we believe inflation will remain much more resilient and persistent than consensus expects.

While it’s impossible to predict where the terminal interest rate ends up, we find it highly unlikely inflation will come down enough over the next two quarters to facilitate an immediate Fed pivot and interest rate cut (unless of course we experience an acute deflationary event). As such, we think markets are too optimistic at current levels and risk/reward is skewed to the downside.

Source: Jim Bianco Research

Fed Pivot Pushed Out To 2Q23

With Fed fund futures now pricing in a 2Q23 pivot, it’s clear bulls have gotten ahead of themselves over the past several months. Following stock market weakness in late August, Minneapolis Federal Reserve Bank President Neel Kashkari had this to say on Bloomberg’s Odd Lots podcast:

“I was actually happy to see how Chair Powell’s Jackson Hole speech was received <by the markets>. People now understand the seriousness of our commitment to getting inflation back to 2%. I certainly was not excited to see the stock market rallying after our last Federal Open Market Committee meeting <in July>.”

Kashkari’s views are in alignment with comments we’ve written about before from former President of the New York Fed Bill Dudley. Specifically, the Federal Reserve wants to lower demand via the negative wealth effect, which means tightening financial conditions so that the price of real estate, stocks, and other financial assets goes down. Their logic is simple: the poorer people feel, the less they will spend.

With the summer bear market rally seemingly over, risk assets have begun to roll over. Specifically, the S&P 500 failed off its 200-day-moving-average, while Bitcoin failed to get meaningfully above its average realized cost basis of ~$23,500. We continue to believe that the lows in risk assets will be re-tested and remain bearish on equities and crypto.

Source: Netizen Capital

Bitcoin Holders Close To Capitulation

Even the most ardent Bitcoin maxis sometimes lose conviction. The chart below shows the distribution of Bitcoin owned by short-term holders (less than 5 months holding) and long-term holders (more than 5 months holding). According to Glassnode, STH are statistically more likely to sell their BTC than LTH. That is of course true until STH age into becoming LTH after 5 months.

Following the Jackson Hole selloff, 51% of all BTC supply is now in profit, down from 64% of supply when BTC was above $24,000. However, 96% of STH supply is now held at a loss, meaning – the lowest conviction BTC holders are likely close to capitulation. Furthermore, there is little BTC supply held on a relative basis between $12,000 and $17,500, suggesting this could be a reasonable range to test if equities were to continue selling off from here.

Given Bitcoin is down nearly 70% from all-time highs, we would start to get constructive on allocating below $15,000 regardless of the macroeconomic backdrop. Bear markets are a time to accumulate your favorite assets at a discount, and we want to avoid getting too clever with our entry price especially given the long-term risk/reward to the upside.

Source: Glassnode

Ethereum Merge May Be A Sell-The-News Event

On the other hand, Ethereum has materially outperformed Bitcoin since July, which is odd given we’re in a bear market. Historically, the ETH/BTC ratio has traded between 0.01 and 0.1. As a general rule, ETH/BTC typically increases during a bull market (ie/ risk-on) while ETH/BTC decreases during a bear market (ie/ risk-off). Although ETH/BTC traded down to as low as .05 in June, the ratio has since bounced back up to multi-year highs at 0.085.

We believe the recent strength in ETH/BTC despite clearly being in a fundamental bear market has been driven by Ethereum’s transition to Proof-of-Stake (PoS) after the merge. According to the Ethereum Foundation, ETH is moving from Proof-of-Work (PoW) to PoS because it’s more secure, less energy intensive, and better for implementing scaling solutions. While I won’t deep dive into this decision, I am skeptical of the merge and think it will create a misalignment in incentives between ETH holders and ETH users.

Originally planned for 2019, ETH 2.0 is arguably the most important crypto event of the past several years, and speculators have been driving the price higher since July in anticipation of a successful merge. However, if you look at Ethereum futures contracts (which are typically dominated by institutional investors, not retail), the futures curve is currently in backwardation, meaning futures prices are lower than spot prices. Generally, futures prices are higher than spot prices, as investors believe the future price of an asset will trend higher over time, but for ETH it’s the opposite.

Given the ETH/BTC ratio has rallied back to multi-year highs despite an obvious risk-off macroeconomic environment (including weakness in BTC and equities), we would be very cautious on ETH’s price action here and think there is material downside from current prices regardless of whether the merge is successful or not. The easy money has already been made, and as such, we would be playing the opposite trade and would prefer to buy BTC and short ETH.

Source: Netizen Capital

USD Wrecking Ball Is At 20-Year Highs

As we’ve discussed before, another key contributor to risk asset weakness is USD strength, which is now at a 20-year high. Historically a strong USD has acted as a wrecking ball for the global economy, triggering emerging market crises in countries that are over-encumbered with dollar-denominated debt. Put simply, all goods, services, and assets can be valued in USDs. When the USD strengthens relative to other currencies the prices of those goods, services, and assets go down in value.

Although we’ve been calling for the end of the secular USD hegemony, we believe cyclical USD strength will persist as the Fed continues to tighten, which will be exacerbated by 1) Japanese yield curve control, 2) the European energy crisis, and 3) a global USD shortage. As such, we would expect risk assets to continue to underperform as the USD strengthens.

Source: Netizen Capital

U.S. Allies Are Swimming In Debt

Recall, that the DXY measures the strength of the USD relative to other foreign currencies. Specifically, the Euro (57%), Japanese Yen (14%), and British Pound (12%) make up a significant portion of the index. And while the U.S. has undoubtedly committed many financial sins since 2008, the European Union and Japan are even worse offenders of money printing, which has created unsustainable debt burdens.

While the Japanese economy has posted stagnant real economic growth for the past 2 decades, we believe the European Union is also going down a dangerous path. Specifically, Russia’s decision to halt natural gas exports to Europe has left the country with its highest energy prices in history. As a result, the European Commission and U.K. Parliament have proposed more money printing to cap the price of energy prices, despite already historic levels of inflation.

While the U.S. is trying to reduce its balance sheet, the Japanese, Eurozone, and U.K. are doing the exact opposite. It appears we’re transitioning to an era of fiscal dominance, as populism takes hold in modern democracies. Populist-led fiscal deficits will continue to drive a weaker JPY, EUR, and GBP, which will strengthen the USD on a relative basis.

Source: Santiago Capital

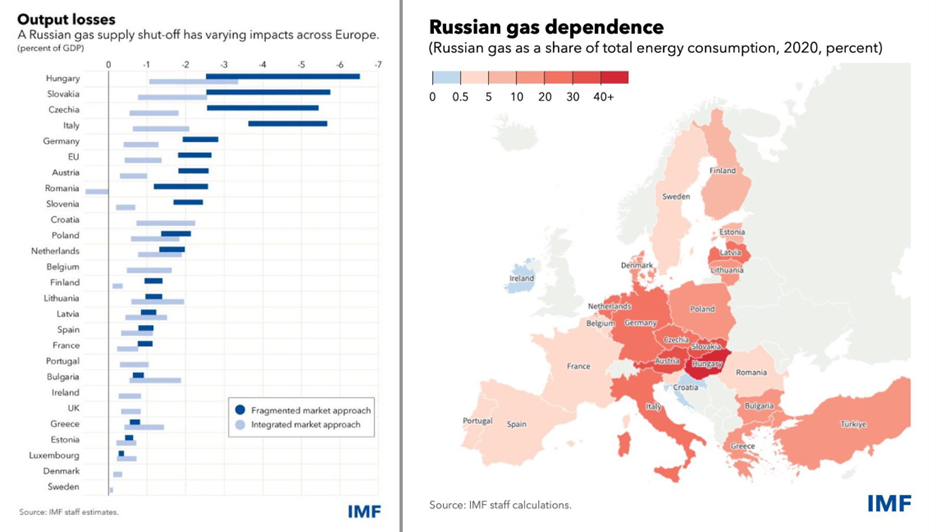

Russia Has Declared Energy War On Europe

While the White House and mainstream media would have you believe Western sanctions have crippled Russia, the opposite is true. Following Russia’s expulsion from SWIFT and the seizure of Russian USD and EUR currency reserves, Russia has flexed its energy dominance over the European region. Putin's decision to cut off natural gas exports to Europe has exposed the region’s key weakness – lack of energy independence.

Although the European Union has enough natural gas inventories to survive the winter, their lack of energy infrastructure will leave them dangerously exposed if the Russia-Ukraine conflict and associated sanctions persist into 2023. While there was disagreement on a European Union government bailout on Russian gas price caps, newly elected British Prime Minister Liz Truss proposed a £180 billion rescue package (8% of U.K. GDP or half the 2020 COVID relief package) to support their economy from rising energy prices.

While I empathize with the difficult decision to protect households and businesses from Putin’s energy war – printing more money will only further destabilize the Eurozone’s economy and worsen inflation. Our fear now is what if Russia decides to also restrict oil exports to the Eurozone. Will European politicians print or maintain sanctions? Let’s watch.

Source: IMF

The U.S. Is Not In An Actual Recession, Yet

Although we’ve been on recession watch since earlier this year, the U.S. economy remains resilient in the face of rising inflation and tightening monetary policy. Our original call was based on the temporary inversion of the 10Y/2Y UST yield curve in April, which has been more persistent since July. We would note, that the 10Y/2Y inversion doesn’t necessarily guarantee a recession, however, a 10Y/3M inversion has a 100% hit rate on calling recessions since the 1960s.

With the 10Y/3M UST yield curve within 30 bps of inversion, we would be watching this metric very closely in anticipation of a deflationary event in financial markets. While there are obvious headwinds facing the U.S. economy, the labor market remains overheated and household/corporate balance sheets are still flush with excess cash. However, beware – the longer the U.S. economy holds up, the more aggressive the Fed will tighten monetary policy to slow economic growth below trend.

Source: 42 Macro

Labor Market Is Slowing But Still Overheating

Given the rising cost of living, this is one of the best times to 1) switch jobs, or 2) request a raise. The labor market is so tight that there are two job openings for every unemployed worker, which means that high-skill workers have leverage over their employers. This labor market tightness is inconsistent with the Fed’s price stability mandate because a competitive job market leads to higher wage inflation – which is the opposite of what the Fed wants (they want you less wealthy). In fact, the Employment Cost Index (ECI) is growing at 5.5% (all-time highs), materially above the Fed’s 2% inflation target.

Although private payrolls are slightly down on a 3-month SAAR basis to 3.5% (from 3.6%), job growth is still more than double the 2015-2019 pre-COVID trend (1.7% on a 3-month SAAR basis). Based on Powell’s comments at Jackson Hole, the Fed wants to see the labor market slower than the pre-COVID trend. Until this happens, however, we would expect the Fed to continue tightening until the U.S. economy can’t handle it anymore.

Source: ADP

The Fed Can’t Pivot When Income > Supply

When inflation began rising in 2021, much of the blame was put on supply chain disruptions, which were explained away by policymakers as transitory. And while a component of inflation related to supply chain disruption was indeed transitory, the real underlying problem is that Gross Domestic Income (GDI) has been outpacing Gross Domestic Product (GDP) since the 2020 stimulus.

With GDI/GDP at the 100th percentile of all time, it’s unlikely the Fed can credibly ease monetary conditions when so many households and corporations are flush with cash. Specifically, U.S. households have $3 trillion in excess savings relative to pre-COVID levels, while U.S. corporations have about $1 trillion in excess savings. This supports why real personal consumption expenditure remains positive, growing 0.6% on a 3-month SAAR basis vs. 2.5% in 2015-2019.

Although the rising cost of living has weighed on middle- and lower-class income families, the data suggests that demand is still robust relative to the number of goods and services being sold in the economy. With so much excess savings on the sidelines, the Fed has much more tightening to do to generate a negative wealth effect on consumers and businesses.

Source: 42 Macro

Peak Inflation May Become Persistent Inflation

In our view, the July CPI report was the biggest macro surprise of the year. Median CPI decelerated from 8.8% MoM to 6.3% MoM (still significantly above the 2.6% pre-COVID trend). Meanwhile, Sticky CPI decelerated from 8.1% MoM to 5.4% MoM (still significantly above the 2.5% pre-COVID trend).

In the 33 times median CPI decelerated more than 247 bps, next month’s median CPI accelerated on average 168 bps. Over the next 3 months, the cumulative change in median CPI accelerated by 201 bps. Over the next 12 months, the cumulative change was +31 bps. The same analysis holds for the deceleration in sticky CPI and core PCE (the Fed’s preferred inflation metric).

The takeaway here is very important. Inflation is a sticky and stochastic process that occurs randomly over time. Inflation doesn’t move up and down in straight lines. Historically, when inflation decelerates sharply, on average, inflation reaccelerates over the next 1 month, 3 months, and 12 months cumulatively.

It’s statistically unlikely that the current magnitude of negative core inflation momentum can be sustained over the next three months. We believe investors positioned for a continued sharp deceleration in inflation momentum will be surprised on 9/13. If core inflation reaccelerates to the upside, this will signal to the Fed that the fight vs. inflation is nowhere near over, and the September FOMC meeting on 9/21 will be much more hawkish than is currently expected.

Source: 42 Macro

Higher Inflation = Volatility = Uncertainty

Building on the prior point, the higher inflation is, the more volatile the inflation readings will become. This intuitively makes sense because the economy must adjust to higher prices over time and there is typically a lagged effect on the rest of the economy as businesses and consumers adapt to higher prices.

Higher inflation volatility leads to higher nominal and real economic growth volatility, which makes it more difficult to forecast the economy. By extension, this makes driving monetary policy even more difficult, because the Fed will need several monthly data points to establish a true trend and can’t simply rely on one data point (July CPI as an example) to justify policy changes.

Volatile economic growth eventually flows through to equity valuations, which see their earnings become more volatile and therefore see earnings multiples compress due to investor uncertainty. In short, volatility leads to uncertainty, which leads to lower asset prices over time as investors can’t confidently allocate capital. While these dynamics take time to flow through to markets, it’s worth reiterating that one data point doesn’t make a trend.

Source: 42 Macro

The Only Way Out Is An Actual Recession

We’ll reiterate a point we made in last month’s letter – the only way to get back to the Fed’s 2.7% core PCE target by year-end 2023 is by having an actual recession – meaning higher unemployment and lower asset prices.

If we look at historical core PCE data going back to 1960, we have never seen a 210 bps decline in core PCE over a 17-month period without entering an actual recession. We would also remind readers that 2.7% core PCE is still 70 bps above the Fed’s 2% long-term target.

The notion that the Fed is about to pivot is asinine. Although commodity prices have sold off from their 1H22 highs, it’s surprising that their price has held up so much despite the USD at 20-year highs. If the Fed were to hypothetically pivot earlier than expected, a weaker USD would quickly flow through to high commodity prices (energy, food, metals, etc.) which would catalyze an actual recession.

While we expect the Fed will eventually pivot, it won’t be until there is an actual recession. However, until the 10Y/3M UST yield curve inverts, the Fed still has cover from a “strong” U.S. economy to continue tightening monetary policy. We will remain bearish on risk assets and will roll with the volatility until there is a true inflection in monetary policy.

Source: 42 Macro

Final Thoughts

Although markets have taken a breather since the euphoric bear market rally in July and August, we believe markets are still mispricing the amount of risk in the global economy. Since January 1 we’ve seen economic and geopolitical uncertainty continue to rise. Considering most of the problems we’re dealing with (ie/ inflation, energy crisis, war, etc.) are self-inflicted by our politicians, we’re skeptical that they will also be our saviors.

As incremental data is released, we’ll fine-tune our positioning and front-run changes in the economy and policy. For now, however, we continue to expect the following:

The Fed is not about to pivot anytime soon,

we’re headed for a global recession, and

the bottom for risk assets is not in yet.

In our view, the balance of risk/reward is skewed to the downside in risk assets. Despite inflation, right now is ironically a good time to build a cash position and prepare for a potential deflationary recession. By the time this bear market is over, we expect we’ll be rewarded with a generational buying opportunity that will be catalyzed by a pivot in Federal Reserve monetary policy.

As always, don’t fight the Fed and keep your head on a swivel.

-Netizen Velez