The question of whether we’re headed into a global recession is no longer “if” or “when,” but instead “how bad?” As we explored last month in The Summer of Deflation, we now believe the probability of a deflationary recession is near certain.

With that context, let’s jump into our economic and market outlook.

Outlook (TLDR)

Short Term (< 1 month)

According to our fractal ranges, the S&P 500, Nasdaq, Bitcoin, Ethereum, and ominously the USD is overbought, while Gold and High Yield Credit Spreads (CDX) are oversold. With the Federal Reserve on the path to over-tighten the economy to destroy inflation, the risk/reward in markets is skewed to the downside and we are not interested in participating in the current bear market rally. July will be pivotal for asset markets as we officially enter 2Q earnings season on 7/14 with JPMorgan. We expect earnings to be dismal, corporate guidance to be revised lower, and sell-side estimates to soon follow. Based on the strong correlations we’ve seen all year, weakness in equity markets will spill over to crypto and will likely lead to lower lows as we finish earnings through August.

The biggest event of the month will be the FOMC meeting on 7/27, where Fed funds futures are pricing in a 93% probability of a 75-bps interest rate increase and a 7% probability for a 100-bps increase. This is in stark contrast to last week’s estimate of 50 bps (13.8%) and 75 bps (86.2%), suggesting investors now believe the Federal Reserve will tighten monetary policy even further due to an overheated labor market (372k payrolls added in June vs. estimates of 268k). Before then, we’ll receive June CPI on 7/13, jobless claims on 7/14, retail sales, UMich consumer sentiment, and inflation expectations on 7/15.

We suspect the mainstream narrative will shift toward recession fears once 2Q GDP is announced on 7/28, and as such, we would be taking profits and selling/shorting any strength in equities and crypto. Given the downside risk, investors should materially de-risk investments and hold as much USD cash as possible.

Medium Term (2-6 Months)

Last Wednesday, the Federal Reserve released the minutes from the FOMC meeting on June 14-15. In the meeting:

“Many participants judged that a significant risk now facing the <Federal Reserve> was that elevated inflation could become entrenched if the public began to question the resolve of the Committee…”

They further communicated that a

“firming of monetary policy, together with clear and effective communications, would be essential in restoring price stability.”

The challenge the Fed faces is that inflation is a psychological phenomenon that can snowball. If inflation expectations aren’t anchored, consumers may pull forward consumption and further worsen supply/demand imbalances.

Unfortunately, core goods, services, sticky, and median CPI continue to accelerate on a 3-month annualized basis, proving the Fed has not destroyed enough demand to make a dent in inflation momentum. While the reacceleration of May CPI to 8.6% YoY kept us in the INFLATION regime (growth decelerating, inflation accelerating), we are patiently waiting for the Fed to over-tighten into the DEFLATION (growth decelerating, inflation decelerating) regime in the coming months.

Most notably, the Eurodollar futures curve, which represents trillions of dollars of global hedging against Fed interest rates, is now betting the Fed will pivot from tightening monetary policy into cutting interest rates before the end of 2022! The only way the Fed would pivot from raising to cutting interest rates would be due to a deflationary liquidity crisis that requires Fed intervention. The Eurodollar futures curve first inverted on 12/1/21, shortly after Fed Chair Powell admitted the Fed’s mistake by calling inflation transitory. Since then, the Eurodollar futures curve has incrementally steepened – suggesting a deflationary bust (and pivot) may happen sooner than expected.

While we are skeptical of trying to predict the future, we slightly revise our outlook and believe the Fed may pivot dovish between October 2022 and January 2023, and as such keep our fingers on the trigger to cover our short positions and buy risk assets hand over fist when the opportunity comes.

Long-Term (6-12 Months+)

As we’ve described before, Netizen’s investment thesis is that the fiat currency world, supported by debt and political power, will shift toward market-based money, as has always occurred at the end of empires. In particular, we believe the Great Power Competition between the West (U.S., Europe, Japan) and East (China and Russia) will result in the unraveling of the Petrodollar system that was established in 1971 after the U.S. defaulted on their gold obligations. Over the coming years, national self-interest will likely continue to drive wedges in geopolitical relations, especially between commodity-producing nations (like Russia) and hyper-financialized economies (like the U.S.).

In the U.S., we believe the exacerbation of wealth gaps driven by decades of short-sighted monetary and fiscal policy has led to the rise of populism and polarization between conservatives and liberals. In fact, foreign intervention has become a core principle of our nation, despite warnings from our past. Specifically, John Quincy Adams famously warned of a U.S. empire as he wrote the Monroe Doctrine:

“<The United States> has abstained from interference in the concerns of others, even when conflict has been for principles to which she clings…but she goes not abroad, in search of monsters to destroy. She is the well-wisher to the freedom and independence of all. She is the champion and vindicator only of her own. <Otherwise> the fundamental maxims of her policy would insensibly change from liberty to force.”

Re-read that again. That was written 200 years ago. Of course, modern-day foreign policy is the complete opposite. Our international policy is based on economic and military intervention, at the expense of the U.S. government’s balance sheet. In 1960, economist Robert Triffin testified before the U.S. Congress, explaining that the U.S. would need to run impossible fiscal deficits to serve as the reserve currency of the world, which would eventually collapse the USD onto itself – an idea that Russia and China are stress-testing in real-time.

Our philosophy towards the global monetary re-ordering is that as investors we want to own real assets, as their price will hyperinflate as fiat money debases. Given energy is the master commodity input in any economy, we believe investments in Bitcoin, energy, agriculture, metals, and commodity-related infrastructure will be the best stores of value AFTER the coming deflationary recession.

The Fed will Over-Tighten and then Over-Loosen

The first half of 2022 has been one of the most painful markets for investors in recent history. Of the U.S. or world stocks and bonds shown below, not a single asset provided a positive return. With the S&P 500 down nearly 20% YTD, investors are now left wondering if the bottom is in, or if there is more downside from here.

Source: Jim Bianco Research

For months we’ve been saying “don’t buy the dip.” But don’t take it from us, that mandate comes straight from the Federal Reserve, as communicated by insider Bill Dudley, former president of the New York Fed. In a recent Bloomberg piece, Dudley explained how the Fed uses the negative wealth effect to destroy demand to fight inflation:

“It’s hard to know how much the U.S. Federal Reserve will need to do to get inflation under control. But one thing is certain: To be effective, it’ll have to inflict more losses on stock and bond investors than it has so far. The reason the stock market is important [is] because a lot of people have exposure to the stock market and the level of the stock market affects their wealth…”

In other words – when the stock market goes up, people feel wealthier, and therefore are more likely to spend. This dynamic works in reverse as well. And with YoY inflation now 8.6% (and continuing to build upward momentum), it’s obvious that there is too much money chasing too few goods.

For decades the Federal Reserve has oscillated between tighter (higher interest rates) and looser financial conditions (lower interest rates) to equilibrate the real economy. However, raising or lowering interest rates is more akin to a light switch on the economy rather than a dimmer. As a result, the Fed consistently ends up over-tightening or over-loosening the economy, resulting in wider wealth gaps through each business cycle. This is because those with financial assets disproportionately benefit from loose economic conditions (as the value of their assets increases), while the working class (who typically own less financial assets) have to deal with the fallout of higher cost of living and higher rates of unemployment.

Source: Bridgewater Associates & Ray Dalio

The divergence in U.S. wealth shares in the chart above is a function of the U.S. breaking away from the gold standard in 1971 in favor of a financialized world “smoothed” out by short-sighted monetary and fiscal policy. This decision came at the expense of working-class Americans in favor of the top 0.1%.

Since the inflation of the 1970s and 1980s, the Fed has oscillated interest rates to expand and contract the economy – funded by increasing levels of debt. As a result, each successive interest rate hiking cycle has led to lower highs, and lower lows, until the 2008 Global Financial Crisis when we finally cut interest rates to 0%.

While the move to 0% interest rates, quantitative easing, and printing of $700 billion to bail out banks in 2008 was marketed as saving the U.S. (and global) economy, it left the global economy (and in particular the U.S. Treasury market) addicted to quantitative easing. Fast forward a decade, and another crisis (COVID) forced us to shut down the U.S. economy and run the same playbook – this time with nearly $10 trillion in Federal Reserve and Legislative actions.

Once again, government intervention overstayed its welcome and over-loosened the economy. As a result, the 0.1% have benefited tremendously, while the working class was left with the highest inflation we’ve seen in 40 years. After incorrectly declaring inflation would be transitory in mid-2021, the Fed is now trying to reconcile its mistake by raising rates at the most aggressive rate we’ve seen since the 1970s. In March 2022, the Fed raised rates by 25 bps, in May by 50 bps, and in June by 75 bps. While the Fed projects the Fed funds rate to be 3.4% by the end of 2022, history suggests something in the economy will break before then, forcing the Fed to pivot and print once again to “save the economy.”

Source: Netizen Capital

With the majority of household wealth stored in real estate, home mortgages, stocks, and bonds, the Fed is singularly focused on deflating the COVID asset bubble via the negative wealth effect to fight inflation.

For some perspective, back in 2007, American households held $23 trillion in real estate financed with $11 trillion in home mortgages, $16 trillion in stocks, and $5.6 trillion in bonds. In 1Q22, American households held $40 trillion in real estate financed with $12 trillion in home mortgages, $46 trillion in stocks, and $8.6 trillion in bonds. In other words, since the last crisis, housing equity has more than doubled, stock market ownership has nearly tripled, and bond holdings are up by more than half.

Source: Myrmikan Capital

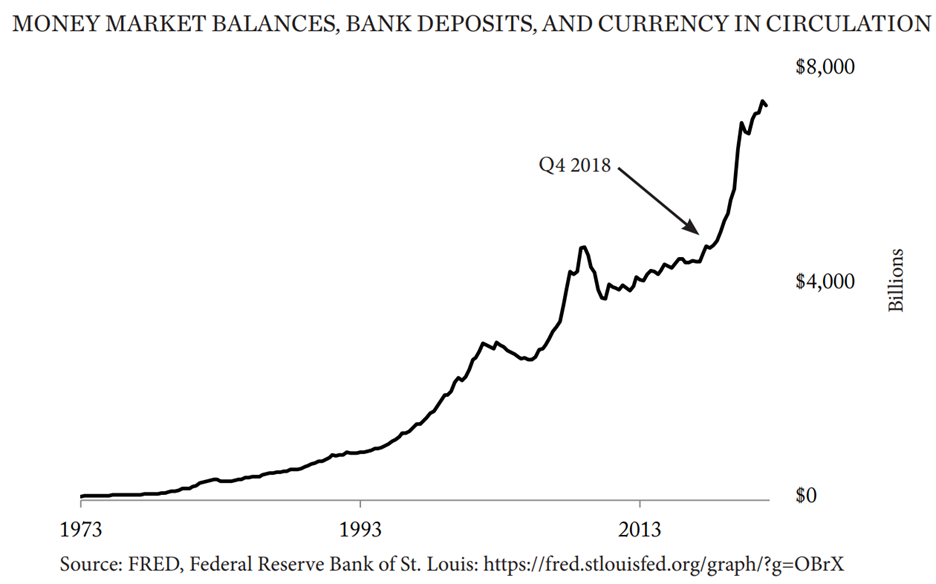

However, it’s worse than just asset bubbles. Household liquidity (which includes money market balances, bank deposits, and currency holdings) has jumped 50% from pre-COVID levels to nearly $8 trillion.

In theory, rising interest rates incentivize debt holders to reduce consumption and pay down debt, thereby extinguishing excess cash in the economy. However, in practice, it’s generally the most debt-burdened businesses and households who cannot repay their debts, and who instead must default as financial conditions tighten.

The one caveat here is FDIC-insured banks as we learned in 2008. In a free market, if a bank fails, the depositor (ie/ customer) loses their deposit, and the bank goes out of business. However, in our interventionalist system, depositors are not allowed to lose money, and instead, FDIC bailouts, Fed QE, and stimulus create outcomes where those impaired assets are transferred to the government balance sheet as debt. As a result, the Federal government is the lender of last resort. “In God we trust” is simply a nicety. The dollar bill should instead stay “In the Fed we trust.” That is true of course until credibility is questioned.

Source: Myrmikan Capital

At $30 trillion, the U.S. national debt is almost triple what it what back in 2008 (~$10 trillion) and nearly six times (~$5 trillion) what it was before the dot-com bubble in 2000. The reality is that there is no political will from either party to create a government budget in surplus. This idea was communicated clearly by President Roosevelt’s Fed Chairman from 1936-1948, Marriner Eccles (which ironically is who the Federal Reserve building is named after):

“Congress appropriates the money; they levy the taxes; they determine whether or not there should be deficit financing. The Treasury then is charged with the responsibility of raising whatever funds the Government needs to meet its requirements. . . . I do not believe it is consistent to have an agent so independent that it can undertake, if it chooses, to defeat the financing of a large deficit [by raising interest rates], which is a policy of the Congress.”

In short, the Fed can contain the money supply in the private economy via higher interest rates, but not so much that it constrains the government balance sheet. That is of course until participants in the global economy begin to question the Fed’s credibility - a reality that is beginning to set in.

With that backdrop, I’d like to investigate how the Fed’s current tightening phase is going, and what we should expect from the economy and markets as we move ahead in 2H22.

The Technical Recession Is the Warmup

Several weeks ago, the Fed released the updated summary of economic projections (SEP) during the June FOMC meeting. Compared to their last estimates from March, the Fed now expects GDP to grow 1.7% (vs. +2.8% previously), unemployment to be 3.7% (vs. 3.5% previously), PCE inflation to be 5.2% (vs. 4.3% previously), and the Fed funds rate to be 3.4% (vs. 1.9% previously). In short, the Fed lowered its growth outlook and raised its unemployment, inflation, and Fed funds rate expectations.

While it’s encouraging to see a more realistic set of projections, we think some of those estimates may still be too optimistic. While not an official forecast of the Atlanta Fed, the GDPNow model can be directionally reliable in predicting upcoming GDP results. As such, the most recent Atlanta Fed GDPNow reading is showing a 1.2% contraction in 2Q GDP, which if correct, would officially put us in a technical recession (two consecutive negative GDP prints).

While a technical recession may get the mainstream worried, we believe the negative GDP prints are a harbinger of an actual recession to come. As we progress through the balance of the year, we expect to see manufacturing contract, unemployment increase, and corporate earnings deteriorate.

Source: Atlanta Federal Reserve

Rising Financing Costs Will Constrain Manufacturing

Although we’re not even halfway to the projected terminal Fed funds interest rate of 3.8% by 2023, rising interest rates have already begun to constrain financing costs for corporate borrowers and mortgages. Specifically, we’ve already seen a 2 sigma move in real interest rates, a 2.6 sigma move in corporate borrowing costs, and a 2.6 sigma move in mortgage rates.

Rate moves of this magnitude are historically associated with the peak and rollover of the US ISM manufacturing index, which is a monthly indicator that measures U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms.

Given the Fed is months away from a policy pivot, interest rates should continue rising. By extension, we expect the US ISM manufacturing index to contract (below 50) in the coming months, which contrasts with the Fed’s current economic projections of positive growth in 2H22.

Source: 42 Macro

Consumption Is Already Weakening

If weakening manufacturing wasn’t enough, the consumer is already languishing. Real personal consumption expenditure for both goods and services has decelerated on a 3-month annualized basis. While aggregate consumption only decelerated to 0.2%, we would expect this number to contract in the coming months as negative momentum continues to build. Furthermore, the prevailing narrative that post-COVID would lead to a services economy boom is unlikely to materialize, given the decelerating 1% growth in the most recent data.

In the next several months, contracting manufacturing and consumption will solidify us in an actual recession, which is a necessary outcome to break inflation momentum.

Source: 42 Macro

The Labor Market is Overheating

The strength of the labor market is a double-edged sword. On one hand, it’s a backward-looking indicator suggesting the economy was strong, but on the other hand, an overheating labor market causes incremental inflationary pressures through wage inflation and gives the Fed the “cover” to overtighten the economy.

In the Fed’s most recent SEP, they estimate unemployment will rise to 3.7% in 2022, 3.9% in 2023, and 4.1% in 2024, all while GDP miraculously continues to grow by roughly 1.8%. Mathematically, it’s unlikely for growth to stay flat if unemployment is rising, especially given the reduced levels of labor participation following the Great Resignation.

With private payrolls, average hourly earnings, and aggregate labor income nearly twice the rate of the historical trend and accelerating, we believe the Fed will remain committed to tightening the economy for fear of letting a wage-price spiral fuel further inflation.

Source: 42 Macro

Inflation Momentum Continues To Build

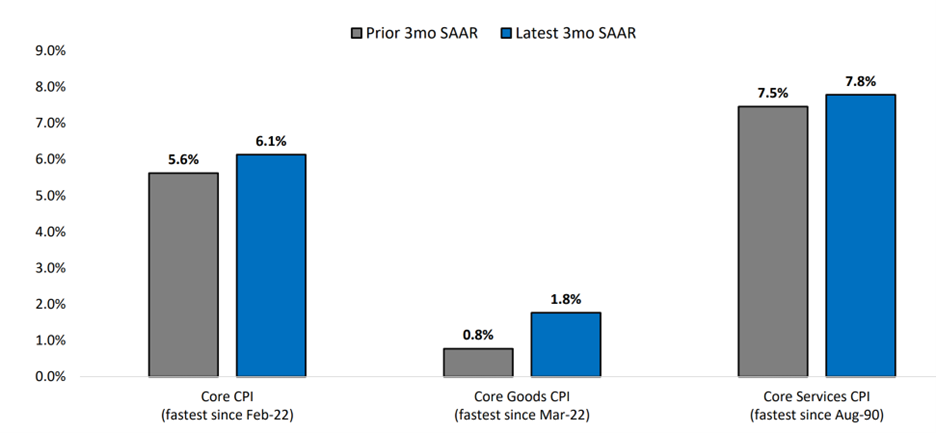

If higher financing costs, slower manufacturing, slower consumption, and a hot labor market weren’t challenging enough, inflation momentum continues to accelerate, suggesting the Fed has not tightened financial conditions nearly enough. Specifically, core CPI, core goods CPI, and core services CPI are all continuing to accelerate on a 3-month annualized basis.

While supply chains were primarily blamed for the recent goods inflation, YoY base effects are not slowing down the momentum. Furthermore, service inflation is now the biggest contributor to core CPI. Given shelter inflation is one-third of the CPI basket and owner’s equivalent rent (OER) is 75% of shelter inflation, we’re likely to see services inflation continue to accelerate as we move through the next 12 months. Recall, OER typically reacts on a 12–18-month lag from housing prices and given the recent run-up in home prices, we would expect to see rental prices continue to increase over the following year, even despite higher mortgage rates (which should weigh on housing prices over the same period).

Furthermore, the broadest measure of inflation, median CPI, and sticky CPI have accelerated to the fastest rate ever and the fastest rate since August 1990, respectively, suggesting inflation is broad-based throughout the economy and not constrained to a few sectors. Given inflation is public enemy #1, we think the Fed is looking for at least a core PCE of 2.5% on a 3-month annualized basis (currently 4.1% vs. 3.9% last period) before they consider pivoting monetary policy.

Source: 42 Macro

US Consumer Confidence at All-Time Lows

The University of Michigan’s June survey for Consumer Sentiment fell to the lowest reading on record, as consumers across all incomes, ages, education, geographic region, and political affiliation all expressed discontent with economic conditions. Specifically, 47% of consumers blamed inflation for eroding their standard of living.

In a similar survey, the spread between the Conference Board Consumer Confidence expectations and present situation survey grew to historic levels, which have often preceded recessions. Indeed, with a spread of nearly 80 pts between current conditions and future expectations, this would put consumer sentiment on par with the 2000 dot-com bubble and 2020 COVID crisis.

As we’ve discussed before, inflation is a psychological phenomenon, and beliefs about the future can often become self-fulfilling. With consumer confidence at all-time lows, we expect this sentiment to be self-reinforcing as households and businesses proactively adjust their behaviors and consequently slow the economy.

Source: 42 Macro

QT Can Bring the S&P 500 to $2,900 (Down 25%)

While raising interest rates will slow economic activity, quantitative tightening (reducing the Fed’s balance sheet) will drain liquidity from financial markets.

Recall, that QT began in June with $30 billion of USTs and $17.5 billion of mortgage-backed securities (MBS) per month. For perspective, $47.5 billion of QT per month is close to the fastest the U.S. has ever tried to reduce the balance sheet, and the last time we attempted this we ended up having a Repo market crisis in 2017-19. Looking ahead, the Fed expects to double QT to $60 billion of USTs and $35 billion of MBS per month beginning September!

Based on our projections, this means the Fed will reduce its balance sheet by nearly $918 billion through year-end over 6 months, which is more than the $825 billion the Fed did during the 2017-19 QT program over 21 months.

Given the S&P 500 historically trades in lockstep with net liquidity (ex-2018-19 which benefited from Trump’s Tax Cuts and Jobs Act of 2017), a $918 billion reduction in net liquidity from QT would put the S&P 500 at $2,900, a 25% decline from current levels.

Source: 42 Macro

Actual Recession Will Begin with Corporate Earnings

Despite the cracks in the economy, sell-side earnings estimates remain clueless. As a former research analyst at an investment bank, earnings estimate revisions are generally reactive because investment banks need to maintain positive relationships with public companies.

The problem today however is that S&P 500 operating margins are already at all-time highs at 16%. Furthermore, US corporate profits as a percentage of GDP are near all-time highs, while unit labor costs are near 40-year highs and corporate productivity is at 40-year lows. Based on the next 12-month earnings estimates, analysts are expecting 10% earnings growth in 2H22, which we think is laughable.

If corporate earnings grow 10%, inflation will persist, forcing the Fed to get even more incrementally aggressive with raising interest rates and reducing the balance sheet. As we move through July and August, we expect companies to lower their forward guidance likely driven by higher input costs and lower consumer demand.

Source: 42 Macro

The Eurodollar Futures Curve Is Betting On A Fed Pivot This Year

The Eurodollar futures curve allows institutional traders to bet on future interest rate moves. In general, corporate borrowers want to protect themselves from rising interest rates, while lenders want to protect themselves from falling rates. As a result, trillions of USDs flow into the Eurodollar futures curve to hedge against changes in Fed interest rates.

An inversion in the Eurodollar futures curve signifies that market participants believe the Fed is going to cut interest rates at a specific point in the future. We saw the first Eurodollar inversion on 12/1/2021 on the June 2025 contract, signaling that interest rate cuts were finally being priced in by investors. As time passed, not only has that inversion steepened, but it has also moved closer to the present day.

As of last week, the Eurodollar curve was in steep inversion for the December 2022 contract, meaning the market is pricing in a Fed interest rate cut before the end of the year. Based on everything we’ve discussed regarding the Fed’s resolve to cause a recession to destroy inflation, this bet would seem to be at odds with what the Fed is telegraphing. The recent steepening has also been in conjunction with the USD reaching 20-year highs vs. the EUR and JPY (which economies are likely already in recession). Historically, a strong USD is a deflationary signal – which the Eurodollar futures curve is also confirming.

Given the steep inversion in the Eurodollar futures curve and the USD breaking out to 20-year highs, we believe market participants are hedging themselves for a deflationary recession likely to hit before the end of 2022. This is in stark contrast to the Fed’s estimate that they won’t be cutting interest rates until 2024. We believe the next 6 months will test the Fed’s resolve to tighten the economy, and if they cut rates before inflation is under control, it is likely because the economy already crashed.

Source: Eurodollar University

Collateral Shortages = Fragile Banking System

Despite all the negative data presented thus far, we believe collateral shortages represent the largest and most misunderstood downside risk to the global economy. While everyone remembers the 2008 GFC as a sub-prime mortgage collapse, the real problem emerged in 2007 when banks irresponsibly began treating sub-prime mortgage bonds as high-quality collateral. In the global banking system, collateral is effectively used as a form of currency, which is often rehypothecated into loans with other banks.

Today in 2022 we’re experiencing similar problems as 2007 and 2019, where low-quality collateral like junk corporate bonds and Eurobonds have found themselves into the banking collateral system. Now that the global economy is facing the prospect of a global recession, we’re now beginning to see demand for the best quality collateral, which is in limited supply.

According to the Federal Reserve Bank of New York’s Primary Dealer Statistics, in April 2022, the Repo market (interbank overnight lending) fails were the worst we’ve seen since the worst week in March 2020. Then most recently in late June, we saw Repo fails that would have rivaled the second-worst week in March 2020, suggesting that there are serious collateral shortages, which itself is an extreme signal for monetary deflation.

The traditional global banking system is already showing signs of collateral shortages, which could quickly send us into a deflationary recession. As legendary investor Warren Buffett puts it, “only when the tide goes out do you discover who’s been swimming naked.”

Source: Eurodollar University

Commodities Sniffing Out Deflationary Recession

Interestingly, commodity markets, which have been a major driver of the global inflation we’ve seen YTD, sold off significantly over the past several weeks. According to our volatility-adjusted momentum signal (VAMS), industrial metals and agriculture commodities are now in bearish VAMS, while oil looks like it will soon break down from bullish VAMS to neutral VAMS.

We believe commodities are acting as a leading indicator of the coming deflationary recession – which is surprising, given how supply-constrained fossil fuels and agricultural commodities are due to the conflict between Russia and Ukraine. Although recent commodity weakness may help energy and food inflation broadly, we suspect these markets will remain supply-constrained if geopolitical tension persists in Eurasia.

Given our long-term view that fiat currency will eventually transition back to market-based money, we suspect commodities are a good investment, but only AFTER a deflationary recession. As such, we are no longer recommending buying commodities here, in anticipation of global demand destruction.

Source: Netizen Capital

Equity Markets Have Been in A Controlled Demolition

Despite the weakness in financial markets, we have not yet seen a spike in volatility associated with peak capitulation that would signal a durable bottom in markets. In fact, over the last 12 months, the highest we’ve seen the VIX reach is 39 on January 24. Even the Russian invasion of Ukraine on February 24 only got the VIX up to 38, which is nowhere near the March 2020 highs of 85 VIX. For perspective, in October 2008, we saw VIX approach 90.

With VIX ranging between 25-35, equity markets have been under a controlled demolition, suggesting investors are complacent and not ready for a large move in markets. By the time this structural bear market is over, we would expect to see a spike in VIX, which may help signal a bottom.

Source: 42 Macro

Final Thoughts

The question is no longer “if” or “when” we’re headed for a recession but rather “how bad” will it be. While we’re already likely in a technical recession due to the back-to-back negative GDP prints in 1Q and 2Q, we believe 2Q and 3Q earnings will clarify the magnitude of the downside from here. Furthermore, although inflation continues to build momentum, we believe the markets are already sniffing out a deflationary recession which would crush prices quickly as the Fed enters a liquidity crisis.

In particular, the steep Eurodollar futures curve inversion, the strong USD, and weak commodity prices have us on high alert. Beyond an earnings recession, we believe a run on global collateral could cause immeasurable pain to the economy and financial markets. Within the crypto space, we’ve already seen several high-profile crypto companies collapse in recent months due to collateral issues. As of now, the entire crypto market seems completely hated by investors.

If there is one piece of advice we could give to all our crypto friends, it’s to take all your digital assets off exchanges or borrowing/lending CeFi companies and move them to cold storage. When companies and banks have collateral issues, it’s usually the depositors who lose money. Almost all digital assets on crypto exchanges and with CeFi companies are not FDIC-insured, which means if they have a liquidity crunch, your assets now belong to them. Please be smart – send your assets into cold storage with a hardware wallet (I recommend Ledger). Furthermore, given the economic and market outlook, the only crypto I recommend owning in a bear market is Bitcoin (due to ideological reasons), everything else will get taken to the woodshed during a capitulatory sell-off (including Bitcoin, though it will hold up better).

Before I finish, I want to give tangible price levels to look for and revise our downside targets for equity markets and crypto. Specifically, based on positioning, business cycle, and valuation analysis (which we’ve discussed in Don’t Fight The Fed), we believe the S&P 500 could bottom at the following levels:

Top Range: $3,400 on S&P 500 or $16,750 on BTC (on a correlation basis)

Middle Range: $3,200 on S&P 500 or $15,000 on BTC

Bottom Range: $2,900 on S&P 500 or $12,500 on BTC

Now, of course, it’s possible the Fed pivots before we reach these levels, rendering these estimates useless, but I think directionally it gives equity and crypto investors some ideas on where some prices may fall before this is all said and done. The reality is that equity and crypto correlations have been very tight for the past 7 months, and we would expect that trend to continue as liquidity is removed from markets. As long as equity markets have more downside, crypto will not form a durable bottom.

Right now is not the time to be a hero, nor is it time to buy the dip. Be patient, build cash, and you will be rewarded with a generational buying opportunity at unbelievably cheap prices once the deflationary recession is fully priced in and once the Federal Reserve pivots monetary policy and turns the printers back on. Don’t Fight the Fed!

-Netizen Velez