Since 2008 there has been a mantra many investors have followed in markets - don’t fight the Fed. For the past 14 years, investors have been taught to always buy the dip, knowing the Fed’s quantitative easing program would have their back. You see, the Fed was OK with financial asset inflation, as long as there wasn’t consumer price inflation. But the dual monetary and fiscal stimulus from COVID-19 has brought us the highest inflation we’ve seen in decades.

As a result, the Fed is now trying to walk back its hyper-accommodative monetary policy. The Fed has explicitly stated that they want to tighten financial conditions and weaken financial markets to cause a reverse wealth effect. We believe that over a decade's worth of quantitative easing has left many equity investors complacent to the new Fed regime, which prioritizes inflation instead of growth.

With that context, let’s jump into the macroeconomic and financial market implications of the recent geopolitical events.

Outlook (TLDR)

Short Term (< 1 month)

Risk assets rallied aggressively following the Federal Reserve’s March meeting – with the S&P 500 and Bitcoin getting above 4,600 and $48,000, respectively. With the March Fed meeting behind us, investors began covering overly bearish options positioning causing financial markets to squeeze higher, which compressed volatility significantly. As we look forward, we view risk assets as mispriced and devoid of rally fuel.

Fed minutes and commentary out this week confirmed our view that the new Fed regime will prioritize fighting inflation at the expense of growth. The U.S. Treasury market is confirming this view, given the temporary inversions of the 2y10y and 5y30y spreads. In addition, recent institutional fund flows indicate an aggressive rotation into defensive assets, reinforcing our conviction that this most recent rally was a bear market bounce.

Looking ahead, we expect March inflation data to come ahead of consensus expectations (+8.4%), which will make the Fed incrementally more hawkish. Over the next several weeks we’ll be paying attention to the Q1 earnings season with a focus on negative forward guidance. In May, we expect the Federal Reserve to raise interest rates by 50 bps and will be looking for more details on quantitative tightening (estimated to be $95 bn per month). Although we didn’t expect the gamma squeeze to be so vicious, we would be taking profits and selling/shorting any strength in risk assets.

Medium Term (1-3 quarters)

The Russia/Ukraine energy shock will likely keep us in the INFLATION (YoY growth decelerating, YoY inflation accelerating) regime longer than expected. However, we expect YoY inflation to peak by May (driven by difficult YoY compares) as we head into the DEFLATION regime in the summer. Historically, DEFLATION is a negative environment for risk assets (including pro-cyclical equities, high-beta equities, emerging markets, commodities, and crypto) and positive for risk-off assets (including consumer staples, healthcare, utilities, fixed income, gold, and the USD).

Based on back-testing, Bitcoin (-37.2%) and Ethereum (-119.8%) post horrific annualized expected returns when we enter the following macroeconomic environment (likely by the end of Q2):

YoY Growth decelerates 2 std. deviations,

YoY Inflation decelerates 0 std. deviation,

Interest rates rise,

Fed balance sheet tightens, and

Fiscal stimulus tightens

This past week we heard from Fed Presidents Brainard and Bullard and received the Federal Reserve minutes from the March meeting – all of which confirmed a material regime shift in the Fed’s priorities. To combat inflation, the Fed is signaling they may now raise interest rates by 50 bps at consecutive meetings and pull forward quantitative tightening by as early as May. As consumer confidence, real income per capita, and manufacturing/inventories data continue to deteriorate, our view is that we are still in the middle innings of a bear market.

In addition, the recent weakness in U.S. Treasury markets is concerning. With the 10-year UST breaking out of a multi-decade trend above 2.7%, risk assets will soon need to re-rate to lower valuations to compensate for a higher risk-free rate. With no more QE from the Fed and less foreign UST demand, we are on high alert for any UST liquidity issues in the coming quarters. We continue to believe the Fed is cornered and must cause a recession (ie/ reduce consumption/growth) by tightening monetary policy to meaningfully curb inflation, however, we also acknowledge that enough “pain” in the economy/markets will eventually cause a dovish pivot back to stimulus and easing.

Long-Term (1-2 Years)

While the Fed may be willing to do “what it takes” to curb inflation, the U.S. debt, and fiscal position mathematically limit the Fed’s ability to tighten without breaking the UST market. As the conflict in Europe continues, the likelihood of stagflation rises – arguably the worst economic environment, where growth slows and inflation remains persistently high. Deglobalization continues to accelerate as nations hoard commodities and become more protectionist, further exacerbating food and energy shortages. Looking overseas, protests over food shortages in emerging markets and the recent COVID lockdowns in China are creating social instability. We believe we are still in the early innings of a global food and energy crisis and expect commodity prices to remain elevated over the next few years. With Central Bankers tightening monetary conditions into a global economic slowdown, we remain decidedly bearish, however, our finger is on the trigger to pivot back to bullish when global Central Banks collectively capitulate by easing monetary policy to “save the economy.”

Recession Watch (Key Charts)

As investors, we need to think in probabilities, and while I’m not outright calling for a recession, data from each passing month continues to highlight we’re at risk of a material slowdown in the coming quarters. Below we will discuss several markets and economic indicators on our radar that are causing us to position so negatively.

The Most Hawkish Fed in Recent Memory

Currently, financial markets are in disbelief at the Fed’s regime change towards prioritizing inflation instead of growth. Investors who only know the post-2008 Fed have been lulled into complacency by a decade worth of quantitative easing. However, the Fed is signaling its most hawkish stance in recent memory and Fed futures are now pricing in the following interest rate hikes:

81% chance of a 50 bps hike on May 4

87% chance of a 50 bps hike on June 15

65% chance of a 50 bps hike on July 27

We believe the Fed’s change in priority to tame inflation at the expense of growth is not respected enough by investors (particularly those in high growth equities and crypto), and in the coming months risk assets will need to re-rate to lower valuations to account for a slower growth outlook.

The Bond Market Gets It

Equity markets are hardly shaken by the Fed’s hawkishness and geopolitical instability. The S&P 500 and NASDAQ are currently 7% and 16% off all-time highs, respectively, however, the bond market is telling a different story. The Bloomberg Global Bond Aggregate index is down 7.7% YTD, which is the worst drawdown through early April, and would be the largest drawdown in any year. Meanwhile, the Bloomberg U.S. Bond Aggregate index is down 7.2% YTD, the worst of most investors’ lifetime. It’s important to understand that a 7% move in bonds is incredibly large relative to a 7% move in equities given their respective volatilities. We view the recent carnage in global and U.S. bonds as a harbinger for more pain to come in the broader economy and financial markets.

The Labor Market Will Support The Fed’s Hawkishness

With U.S. unemployment at 3.6% (near all-time lows), the Fed believes they have enough cover to tighten financial conditions (ie/ raise interest rates and reduce the Fed balance sheet) without disrupting the real economy. Despite persistent inflation, the Fed has cited lower labor participation rates as a key driver for strong wage inflation, which is now at 20-year highs. There are now 1.8 jobs available for each unemployed worker, which suggests employees have more wage negotiating power than usual. The Fed’s view is that as long as the labor market remains robust (ie/ tight), they can continue to tighten financial conditions to fight inflation without risking recession, which we respectfully disagree with.

Rampant Inflation Is Hurting Real Incomes

Although the labor market is tight, wage inflation is not enough to contend with the higher cost of living Americans are facing. Real income per capita is now -3.4% on an annualized basis, a historically recessionary number. Inflation momentum continues to build up as well, as sticky CPI is now growing 6.1% on an annualized 3-month basis, vs. 4.5% on an annualized 12-month basis. This build-up in inflation is also beginning to weigh on consumer confidence, with current financial conditions, expected change in financial situation, and expected change in prices, all at multi-year lows. While backward-looking data still looks positive for now, leading indicators continue to deteriorate, suggesting we are headed for a material slowdown in the next few quarters.

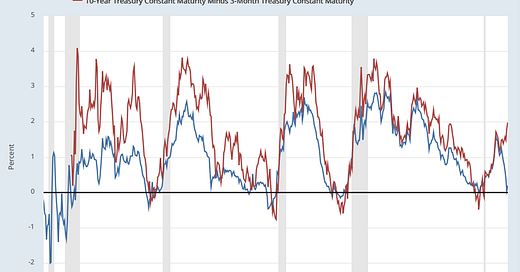

Yield Curve Inversions Are a Warning Sign

An inverted yield curve is an important recession signal because it prices in investors’ expectations for future interest rates, economic growth, and inflation. When long-dated bonds yield less than a shorter-dated bond, it suggests to investors that there is recession risk on the horizon and it’s better to be a short-term investor than a long-term investor, all things equal. We briefly saw the 2y10y UST spread invert at the end of the month, which has historically been a reliable predictor for a recession within 2 years. However, the 3m10y UST spread is still steep, indicating this is not yet a near-term risk. This is because the UST market has not yet priced in the Fed fund futures (see above). Our view is that within the next 18-24 months, there is a high probability of a global recession, although that risk has not yet been priced into financial markets.

Risk Assets Have Material Downside

Stocks and bonds are typically inversely correlated, hence the 60/40 portfolio many financial advisors promote. Stocks historically do well during risk-on environments, while bonds do well during risk-off. However, when inflation is above 5%, the two asset classes are highly correlated. The last time we saw this was the late 70s/early 80s and we now find ourselves in a similar situation. While bonds have had their worst year to date, we would expect equities to continue to deteriorate as inflation remains persistent. As we think about possible downside scenarios, we want to flag the following data analysis:

Positioning – U.S. Household Equity ownership is above all-time highs and beginning to roll over. We have seen 19 cycle peaks since the mid-1940s with a median S&P 500 drawdown of -22%

Business Cycle – Consumer conference labor differential is near all-time highs and beginning to roll over. We have seen 8 cycle peaks since the mid-1960s with a median S&P 500 drawdown of -35%

Valuation – Real S&P 500 earnings yields (S&P 500 earnings minus inflation) are the most negative we have ever seen in history. We have seen this metric invert 6 times since the early 1960s with a median S&P 500 drawdown of -41%

COVID-19 has led to record corporate profits with S&P 500 operating margins now at 16%, 200 bps ahead of the previous record high operating margin of 14%. As inflation continues to erode consumer balance sheets, we expect sell-side analyst estimates to be revised materially lower as we move through the second half of the year. As we think about the potential downside scenario for risk assets, we think another 30%+ drawdown from these levels is reasonable given the existing setup.

Bitcoin is a Solution to a Multi-Currency World

I want to spend the remaining part of this letter recapping my time at Bitcoin Miami 2022 and tie it into the recent geopolitical news out of Russia and Europe.

At its core, Bitcoin’s genesis comes from a breakdown of trust. It’s a bet against emerging populism and the inevitable currency debasement that always follows. This of course is a function of the massive wealth gaps that have been caused by Central Bank monetary policy and short-sighted international trade policy (President Clinton advocating China into the WTO). This has led to the gutting of our middle class/manufacturing industry over the last several decades.

The post-COVID era has only reinforced my view that Bitcoin is an apolitical insurance policy against fiat money. However, the common retort is that “Bitcoin will never replace the USD.” As westerners, we need to recognize our bias. At the conference, I heard from panelists all over the world, many of whom were from emerging economies where double-digit inflation is simply part of life. When money is broken, society cannot function. And many individuals in Latin America, Africa, and Asia cannot trust their local currencies to preserve their wealth.

One facet of Bitcoin that stood out to me during the conference was the importance of mining. While many alarmist narratives are floating around criticizing the Bitcoin network for consuming energy, we must realize energy consumption is not evil and is indeed necessary for us to keep progressing as a civilization. The transition from an agricultural to industrial society required more energy consumption, but it also raised living standards and improved the quality of life for billions of people around the world.

The incentive structure of Bitcoin mining is also such that miners gravitate towards the cheapest cost of energy, prioritizing renewables over fossil fuels. And many Bitcoin miners are already using existing excess energy capacity on our grids to secure the network. While many public companies like to virtue signal to the ESG crowd by purchasing carbon credits to say they’re carbon-neutral, many Bitcoin miners are pushing the envelope to be carbon-free. At the end of the day, Bitcoin mining is a commodity production business, not dissimilar from the data centers providing cloud storage. The debate around whether that energy use is “good” or “bad” is a function of whether you think the service provided is valuable or not. Cloud data is a net positive for society, but I would argue sound money is far more important. To further drive this point, Christmas lights consume more energy than Bitcoin mining but we don’t see ESG activists calling for the death of Santa Claus – think about that.

I also had the pleasure of attending Industry Day, which was geared toward financial institutions looking to allocate capital to the Bitcoin ecosystem. Some of the largest global financial firms were represented at the conference. Outside of exchanges and miners, the majority of Bitcoin today is owned by retail investors, high net worth individuals, and hedge funds. However, traditional financial institutions and sovereign wealth funds are not far behind. As regulatory policies and compliance protocols are clarified, we will begin to see trillions (yes, trillions) of institutional dollars begin to flow into Bitcoin, driving the price up significantly.

In my view, the recent geopolitical events in Europe have only further strengthened the case for “why Bitcoin?” Last week, President Putin signed an executive order declaring that they would only trade Russian natural gas with unfriendly states (ie/ the West) in Russian rubles. He said the following:

I would like to stress once again that in a situation where the financial system of Western countries is used as a weapon when companies from these states refuse to fulfill contracts with Russian banks, enterprises, individuals, when assets in dollars and euros are frozen, it makes no sense to use the currencies of these countries.

In fact, what’s going on, what’s already happened? We supplied European consumers with our resources, in this case, gas, and they received it and paid us in euros, which they then froze themselves. In this regard, there is every reason to believe that we have supplied part of the gas supplied to Europe virtually free of charge.

Following the announcement, Russia’s Central Bank resumed its gold purchases at a fixed price of 5,000 RUB ($52) per gram, below the market value of $68/gram. Effectively, Russia is creating the conditions for a short squeeze higher in their currency as other nations will now have to sell their local currencies and buy RUB to engage in Russian trade. In addition, President Putin has also tied the price of RUB to gold such that a spike in RUB will likely drive an increase in the price of gold, which would offset the FX reserves that the U.S. and Europe froze (ie/ stole).

The Kremlin also came out recently saying they would be open to trading Russian oil & gas with other countries in exchange for commodities (food, energy, metals, etc.) and even Bitcoin. There has been a clear breach of trust within the fiat system across multiple nations. The distrust in fiat currency between countries is of concern and is only further moving us towards a multi-commodity currency system. However, using commodities for trade is unsustainable and is a step in the wrong direction. If global Central Banks do not trust each other to engage in currency trade, then the case for a neutral digital global reserve asset like Bitcoin only becomes stronger.

In our view, Bitcoin is the world’s future safe-haven asset. Unfortunately, financial markets still consider Bitcoin to be a risk-on asset, with a correlation of nearly 0.9 vs. the NASDAQ. As distrust between global Central Banks continues, and questions around “what is money” emerge, we believe the world will continue to adopt Bitcoin – gradually, and then suddenly. Unlike government-issued currencies, Bitcoin is not bound by a nation-state. It’s a network state, made up of miners, users, and developers all over the world supporting the network, in hopes of creating sovereign, incorruptible, private digital money. While idealistic, the Bitcoin network has shown its resiliency and trustworthiness over the last 13 years, in a world where fragility and distrust are rampant. While we expect risk markets to be weak over the next several quarters (and Bitcoin by extension), we believe we will be gifted with a generational buying opportunity and hope you are all prepared for when that time comes.

- Netizen Velez