Last month’s newsletter was aptly titled Don’t Fight The Fed, as many investors over the past decade have been conditioned to blindly buy the dip, naively assuming the Fed will always have their back. This of course was true for the past 14 years, as the Fed’s quantitative easing never yielded real-world inflation. However, following over $4 trillion of fiscal and monetary stimulus post-COVID, the Fed is now contending with the highest inflation we’ve seen since the 1980s. As a result, the new Fed regime has pivoted towards fighting inflation at all costs, even if it means causing a recession.

With the Fed now quickly reversing its hyper-accommodative monetary policy and Democrats and Republicans in fiscal gridlock until the mid-term elections, we can confidently say help is not on the way. With US stocks, US bonds, and crypto all down over 10% over the past month, we have officially solidified ourselves in a structural bear market. If there is any bit of advice we could offer you, it’s to preserve your assets at all costs. Despite inflation being so high, cash is ironically your friend right now, and we would be waiting for more pain before we buy the dip.

With that context, let’s jump into our economic and market outlook.

Outlook (TLDR)

Short Term (< 1 month)

With the S&P 500 and Nasdaq having broken below the year’s lows, we believe the following month will continue to be challenging for risk assets. Based on our dispersion analysis, many hedge funds/institutional investors covered their short positions ahead of the May FOMC meeting (including ourselves), suggesting the risk for an incremental short squeeze from here is unlikely. Furthermore, our crowding analysis in options markets shows that the S&P 500 and Nasdaq are still at risk of a further downside correction despite the recent carnage in markets. In short – there is still a downside risk from current levels.

On Wednesday, we’ll be watching for April’s Consumer Price Index (est. +8.1%). If April inflation surprises to the downside, it’s possible there may be a slight reprieve in markets, however, given the latest hawkish commentary out of the Federal Reserve and European Central Bank, we don’t think a lower-than-expected inflation print would be enough to catalyze a durable bottom in risk assets. Looking ahead, we would also flag that monthly options expire on Friday, May 20, which on occasion has led to bear market rallies as investors unwind their hedges.

We would be taking profits and selling/shorting any strength in risk assets. If shorting is not a strategy you want/can employ, we would be raising cash positions materially (as high as 50% of your portfolio).

Medium Term (2-6 months)

Last week we heard from Fed Chairmen Jerome Powell at the May FOMC meeting, where he announced several major updates regarding their monetary tightening agenda. As expected, Powell announced an increase in the Fed funds rate by 50 bps to 0.75%-1%, in line with market expectations. In addition, the Fed also finally announced details around their quantitative tightening program to reduce the Fed’s egregious balance sheet.

Specifically, the Fed expects to roll off no more than $30 bn of Treasury securities and $17.5 bn of mortgage-backed securities in June, July, and August, and then expects to increase the pace of balance sheet reduction to $60 bn of Treasury securities and $35 bn of MBS beginning in September. This will amount to roughly $1 trillion of Fed balance sheet reduction over the next 12 months. For some perspective, the Fed’s current balance sheet is $8.9 trillion, more than double what it was back in March 2020 ($4.2 trillion). So while a $1 trillion reduction isn’t going to get us back to pre-COVID levels, there is a direct relationship between the Fed balance sheet and the stock market, which all investors must be aware of. Therefore, we would expect markets to continue weakening as the Fed removes liquidity.

While markets briefly rallied after the FOMC meeting following Powell’s comments that a 75 bps hike was off the table, we believe the real news was that the Fed expects to take interest rates past the neutral rate to fight inflation. For some context, the neutral rate is a conceptual interest rate that neither pushes economic activity higher nor slows it down. Currently, Fed Presidents estimate the U.S. neutral interest rate is between 2% and 3%. So a Fed funds rate past the neutral rate of 2%-3% would indeed slow down economic activity enough to destroy demand and curb inflation. We interpret this as incrementally more hawkish and negative for financial markets.

It's our belief the Fed is losing the battle vs. inflation. We continue to believe the Fed is cornered and must cause a recession (ie/ reduce consumption and growth) to meaningful curb inflation. However, we do not believe the right time to buy the dip is when there is blood on the street, but rather when we begin to hear the Federal Reserve sirens going off that the money printers will be turned back on. While we are skeptical of trying to predict the future, we believe the Fed may pivot dovish between August and November 2022, and as such keep our fingers on the trigger to buy risk assets hand over fist when that time comes.

Long Term (6-12+ months)

If the Fed pivots dovish in the next 6 months (which is becoming increasingly likely) the next 12 months will be exceedingly bullish for risk assets, in particular Bitcoin, commodities, equities, etc. (ie/ real “things”). In a world where money is infinite, scarce assets have infinite value.

Given current sovereign debt levels are so unsustainably high, it does make us fear what the next 12 months look like geopolitically. If the Fed does indeed pivot dovish and turn the money printers back on, presumably so will the European Central Bank and central banks globally. Fiat money will likely devalue as governments pay back their debt with printed money, and we will likely experience another inflation spike. This is what many macroeconomists call “the end game” for fiat money – a self-reinforcing inflation cycle that ends with a re-ordering of the global monetary system. Of course, these things take time to unfold, and while I don’t want to make a call that this re-ordering will happen in the next 12 months, I do think the next monetary easing cycle may be the last one we know that has the USD as the global reserve currency. I expect over the next several years that the global monetary system will be reworked to revolve around either a neutral global reserve asset backed by Bitcoin, gold, or commodities.

My general philosophy towards the global monetary end-game is that as investors we want to own real things that have tangible value, as they will hyperinflate in price as fiat money devalues. It’s why I am so bullish on Bitcoin, energy, agriculture, base metals, etc. Energy is the master commodity input in any economy. Bitcoin is a store of value preserved by proof of work (in the form of computational power). Oil, gas, coal, uranium, and electricity, are all key inputs into building pretty much anything. And agricultural goods are necessary for a functioning society and are consumable energy for humans and animals.

Getting The Big Picture Right

I’m going to spend the rest of this newsletter going through my overall assessment of the macroeconomic landscape and how it relates to financial markets.

Reflationary monetary policies over the past two years have produced massive injections of money and credit into global economies, driving high nominal growth and self-reinforcing inflation. As a result, Central Banks are now tightening monetary policy. Given where we are in the business and policy cycle, stagflation (low growth, high inflation) is now a big risk, and the war in Ukraine has added to that.

With the S&P 500 down 14% YTD, risk assets have been under pressure as investors begin to price in the withdrawal of fiscal stimulus and tighter monetary policy. Leading economic indicators are confirming the start of a global growth slowdown, however, on a reported backward-looking basis, growth is still fine for now. Meanwhile, we’re also beginning to see cracks in the global financial system, as evidenced by recent currency volatility, unhinged inflation, and weakness in government bonds.

The Bank of Japan Is Trapped

While global Central Banks are tightening monetary policy, the Bank of Japan is the only major Central Bank still easing. In April, the BOJ reaffirmed its yield curve control policy to peg their 10-year government bonds at 0.25%. To maintain the 10-year JGB at 0.25%, the BOJ is printing unlimited Japanese Yen to buy their debt, causing the Yen to sharply devalue vs. the USD.

With Japanese debt/GDP greater than 250%, the BOJ cannot afford to allow the 10-year JGB to rise above 0.25%, or else they will default and suffer a debt crisis. As the third-largest global economy by GDP, a Japanese sovereign debt crisis would cause a dangerous domino effect on the global economy.

A Weaker Yen Means Higher UST Yields

A weaker Japanese Yen is particularly troubling for the UST market because it becomes more costly for Japanese investors to swap dollar assets back to their local currency, making it uneconomic to purchase USTs.

Given Japan is the largest foreign holder of USTs ($1.3 trillion), and one of the largest marginal foreign buyers of USTs, it begs the question “who is going to finance the U.S. government without the Fed or Japan buying USTs?” (Spoiler alert – it’s not China).

In short – as the BOJ continues to print Japanese Yen to prevent JGB yields from rising (to prevent bankruptcy), the Yen will devalue, and 10-year USTs yields will rise. Given US debt and deficit levels, a rising 10-year UST will over time threaten US government tax receipts, funding costs, and therefore US government solvency.

A Weaker Yen Also Means Larger Japanese Trade Deficits

If rising UST yields weren’t bad enough, the weaker Japanese Yen is also worsening Japan’s trade deficit due to soaring costs for imported oil, food, and other necessities.

It’s important to recall that Japan has historically run trade surpluses, and over the decades has accumulated a war chest Net International Investment Position (ie/ foreign savings) of $3.7 trillion, including $1.3 trillion in USTs.

As the Japanese Yen continues to weaken due to BOJ yield curve control, Japan will soon face a balance of payments crisis and need to begin selling assets from its foreign savings, including USTs and US stocks to finance domestic energy and commodity trade.

Effectively – the BOJ and Japanese Ministry of Finance are backed into a corner and must either default (unlikely) or print Yen to cap government yields and sell USD assets to finance their economy.

Meanwhile, Europe Is In A Self-Imposed Energy Crisis

It’s important to recognize that European natural gas prices spiked to be 15x higher than in the US during late 2021, before any war. This was a function of ignorant EU policy mistakes over the past decade, choosing to shut down nuclear power plants and not diversifying their natural gas import mix.

Fast forward to 2022 and Russia’s war on Ukraine and breakdown in geopolitical relations led to further higher prices. As Europe’s largest energy trading partner, Russia has demanded European companies pay for natural gas in rubles. While many European nations initially refused, several large European energy providers are now opening up Russian bank accounts out of necessity.

Now at the mercy of Russia, Europe must build a significant amount of natural gas capacity and pipelines (which takes years) if it wants to become energy independent. And given the European Central Bank's indebtedness, it makes us wonder, “who will finance the ECB if they too are about to start tightening monetary policy?” Given these dynamics, we believe Europe has very little strategic leverage and will soon need to choose between capitulating to Russia’s energy demands or falling into an energy-led recession.

USD Strength Is A Problem For Our Allies

While it’s easy to look at the strength of the Dollar Index (DXY) and think it’s a sign of U.S. strength vs. Russia/China, the DXY measures the USD against mostly our allies (57% Euro, 13% Japanese Yen, 12% Pound sterling).

If currency weakness continues in Europe and Japan, they may soon ask the US Treasury Exchange Stabilization Fund (ESF) of the Federal Reserve to begin buying Japanese and European sovereign debt. This would effectively be the US Treasury and/or Fed selling USDs to buy Japanese Yen and European Euros.

While the White House and media would have you believe the U.S. and Western powers are winning the Great Power Competition vs. Russia/China, ironically the recent geopolitical moves have weakened our strongest allies (Europe and Japan) considerably and may force us to eventually bail them out.

USD Strength Is Also Bad For Corporate Profits

Aside from the international implications, a stronger USD also hurts U.S. multinational corporate profits, as overseas revenue translates into fewer dollars due to unfavorable exchange rate comparisons. A stronger USD can also put pressure on emerging markets, given so many have high levels of USD-denominated debt, which can soften global growth and weaken US export volumes.

This dynamic was evident in Amazon’s 1Q earnings where results from the company’s core online retail business and advertising unit came in below expectations. As the world’s largest retailer, Amazon’s 2Q guidance was particularly concerning – citing lower than expected sales due to unfavorable currency exchange rates and a potential operating income loss due to inflation (fuel and transportation costs) and the war in Ukraine.

We have been saying for months that we are likely going to see earnings estimates revise down as companies begin to issue slower than expected guidance. We believe Amazon’s weak earnings guidance was a harbinger of slower growth to come, and we expect there to be more earnings revisions lower in 2Q, especially as real consumer disposable income continues to deteriorate.

The U.S. Is Already Halfway to a Recession

While I’ve been calling for months that we are in a 12-18 month recession-risk window, I was surprised to see Q1 GDP down 1.4% QoQ. While the headline indicates we are technically halfway to a recession, most of the underperformance was driven by a widening US trade deficit and a higher-than-expected GDP deflator.

That said, Q2 GDP will likely also be under pressure as we contend with a full quarter of Russia/Ukraine and further trade disruptions due to China’s draconian COVID lockdowns.

While two negative quarterly GDP prints fit the textbook definition of a recession, I would caution investors not to read too much into the Q1 print. Real consumer spending in Q1 grew 1.8% (entirely driven by services consumption), the fastest we’ve seen since 2Q21, suggesting consumer demand is still hanging in there for now.

US Housing Market Showing Signs of Weakness

With the Fed raising interest rates, 30-year mortgage rates have recently risen above 5% (nearly a 3 sigma move), which will put pressure on new home buying demand, consequently weighing on existing home prices.

If you bought a house over the past two years and locked in a 30-year mortgage below 3% you should pat yourself on the back. With mortgage rates now above 5%, that same house you bought would require nearly double your monthly payment. We’re also starting to see weekly mortgage applications drop 65%, a clear sign of weaker housing demand.

The real underlying problem is that over the last 18 months, we saw ~$850 billion in direct stimulus checks, $400 billion in cash-out refinances, $1+ trillion in forgivable loans, and another $4 trillion in QE. The question we should be asking is “what recapitalizes the consumer?” Higher wages aren’t keeping up with consumer price inflation and as housing prices inevitably come under pressure, consumers will begin to feel the negative wealth effect and subsequently consume less (ie/ less growth).

Stocks or Bonds, There’s Nowhere To Hide

Popularized by Ray Dalio, the 60/40 portfolio (aka Risk Parity) is an investment strategy that has been parroted for decades by investment advisors as the Holy Grail of passive investing. The idea is that a portfolio of 60% equities and 40% bonds are diversified enough to weather any economic and market environment. This is because equities and bonds are historically inversely correlated.

There are two main problems with risk parity, however:

It’s estimated almost $400 billion are invested in passive risk-parity strategies due to their perceived level of safety (meaning there is a lot of sleepy money over-invested in this strategy)

Equity and bond inverse correlations break down when inflation is greater than 5%

As such, Risk Parity is already showing severe stress, declining YTD nearly as much as it did back in the March 2020 COVID crisis, and not too far off from the 2008 Global Financial Crisis. If you’ve been watching the market over the past few months, you may have noticed the days where stocks are down big, bonds have also sold off as well – resulting in true wealth destruction, as there is nowhere to hide besides cash (or being short the market).

In addition, the MOVE Index (which measures UST volatility) is approaching March 2020 levels, which you may recall forced the Fed to step in and print money to add liquidity to the UST market. While we think the Fed is firmly committed to tightening monetary policy, we do believe that the breakdown in Risk Parity is a function of a global sovereign debt crisis, as USTs are no longer seen as a safe-haven asset by investors, and that the Fed will eventually need to step in to avoid a liquidity crisis.

Market Internals Signaling Significant Risk-Off

In case you were wondering if the recent weakness was an indicator to buy the dip, I want to discuss a few market internals that we look at to validate our macroeconomic outlook. Specifically, we look at 4 internal market ratios to determine what type of environment we are in:

VVIX/VIX - Volatility

High Beta/Low Beta

Small-Cap/Mega Cap

Value/Growth

Currently, the volatility-adjusted fractal momentum of the VVIX/VIX, High Beta/Low Beta, and Small Cap/Mega Cap ratios are bearish, signaling to us that it is NOT the time to be buying the dip and is indeed a market-wide risk-off environment.

Furthermore, the following individual assets are signaling risk-off as well:

USD – Bullish (a stronger dollar is negative for risk assets)

10-Year UST – Bullish (higher UST yields tighten financial conditions, negative for risk assets)

High Yield Credit Spreads – Bullish (widening credit spreads signal distress in credit markets, negative for risk assets)

S&P 500 – Bearish

Nasdaq 100 - Bearish

Russell 2000 - Bearish

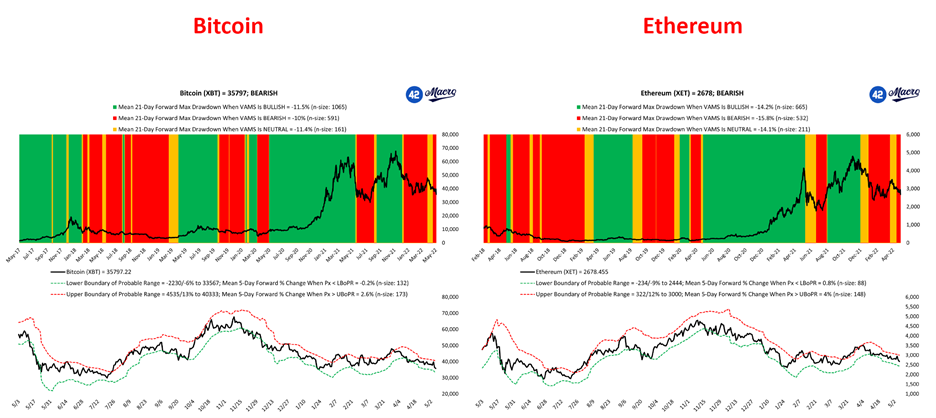

Bitcoin – Bearish

Ethereum – Bearish

When you layer the market analysis on top of our macroeconomic view, my main takeaway is that right now is not the time to be buying the dip. In fact, we believe right now is the time to be at max defense in your investment portfolio, meaning 50% cash, 25% long commodities (energy and agriculture), and 25% short risk assets (if possible).

Final Thoughts

Now is not the time to buy the dip, as we are clearly in a structural bear market with no end in sight (yet). The past two years of excess money and credit in the global economy are finally unwinding, and as a result, so must asset valuations. Although we’re contending with the highest inflation we’ve seen in decades, I would argue right now is one of the rare circumstances where it pays to hold cash in your portfolio instead of being long risk assets.

While economic data on a reported backward-looking basis is still fine, leading indicators continue to paint a challenging outlook for the global economy and markets. What’s concerning is that historically when risk assets sell off, investors typically rotate into government bonds for safety. However, the recent few months have seen accelerating selling in equities, bonds, currencies (ex-USD), and crypto. Currently, the safest asset classes to be in are the USD and commodities.

We reiterate our stance that now is not the time to be buying the dip, and we would use any strength to sell your assets to reduce risk exposure, and/or short risk assets. We would also caution all investors to beware of bear market rallies. Here are two data points for you:

After 2000, the Nasdaq had 16 bear market rallies greater than 10% (averaging 22.7%) before bottoming down 78%

After 1929, the Dow had 10 bear market rallies greater than 10% (averaging 22.8%) before bottoming down 89%.

Don’t be fooled by narratives. Now is the time to max defensive in your investment portfolio. Owning tech, crypto, and meme stocks is a death sentence in these markets. Just look at Cathie Wood’s ARKK (down 53% YTD). In our view, the best asset classes to own are the USD and commodities (energy and agriculture). And while we do eventually expect Central Banks to pivot monetary policy and turn the money printers back on, we think they need to see a lot more pain before they step in again.

P.S. As it relates to Bitcoin specifically, we think right now is a good time to accelerate your dollar-cost averaging strategy to accumulate Bitcoin sub-$40k, however, we would also be setting aside extra cash in case Bitcoin drops below $30k. We view Bitcoin in the $25k-$30k range as prices where investors should be ready to go all-in. We believe rotating a significant part of your net worth into Bitcoin sub-$30k will be a generational buying opportunity that could change the trajectory of your family forever.

Keep your head on a swivel, and good luck.

- Netizen Velez