The Fed Will Wait-and-See…

Yesterday the Federal Reserve held rates steady at 4.25-4.50%, with Powell maintaining a wait-and-see approach as Trump's tariffs threaten to weaken the global economy. We believe the Fed is now trapped within their dual-mandate: interest rates are too low to bring inflation back to 2%, and the Fed can't hike rates without risking a rise in unemployment. The Fed will eventually need to pick between the US economy or the US dollar, meaning either saving the labor market or fighting inflation. We expect the Fed to eventually sacrifice its 2% inflation target IF Trump’s tariffs lead to an actual recession, which we won’t see in the hard economic data for at least several months. With US Treasury auctions already struggling under the weight of record deficits, we suspect the Fed will eventually have to intervene with QE or yield curve control.

TLDR: The Fed's policy flexibility is severely constrained, setting the stage for a potential adjustment to its inflation target if economic conditions deteriorate.

Is Bitcoin Front-Running Lower Interest Rates?

We suspect smart money is already positioning in case the Fed surrenders and raises its inflation target, despite Powell's repeated commitment to their 2% goal. Consumer confidence declined for a fifth consecutive month in April, falling to levels not seen since the onset of the COVID pandemic, while corporate earnings face twin pressures from tariff-driven input costs and weakening consumer spending. Gold's recent breakout may confirm what Bitcoin's price action has been signaling for months: that the Fed is trapped between their maximum employment and stable price mandate. Bitcoin's strength in the after-hours of the FOMC meeting, nearly touching $100K, may speak to markets looking through Powell's cautious comments and front-running future interest rate cuts. When tariff headwinds eventually hit the labor market, we suspect the Fed's 2% inflation mandate will likely collide with political realities, potentially unleashing a wave of monetary easing to “stabilize” the economy.

TLDR: Bitcoin's post-FOMC price resilience suggests the market may already be pricing in the Fed's eventual policy shift.

Is On-Chain Momentum Signaling Another Major Rally?

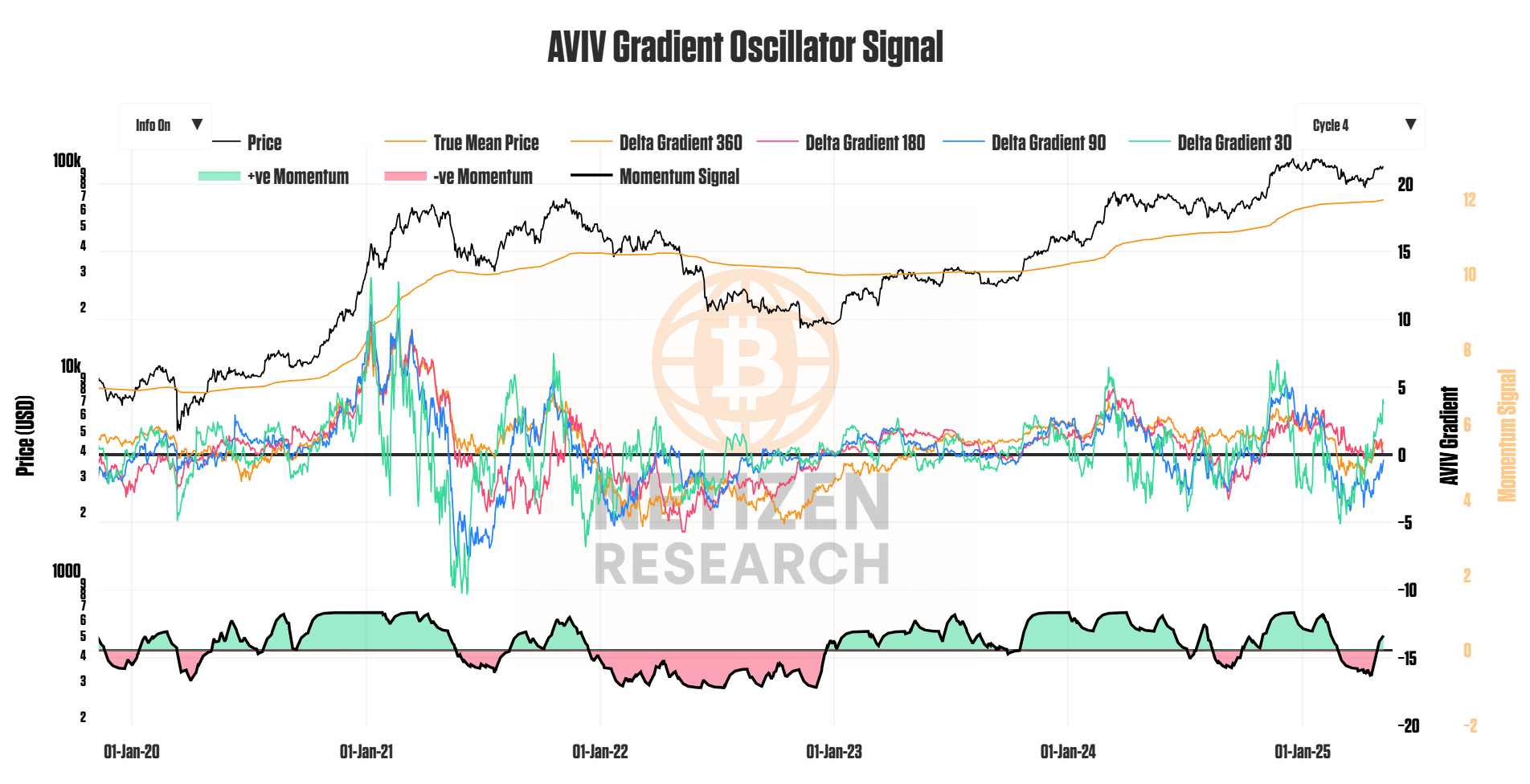

The AVIV Gradient Oscillator turned positive on April 26th, registering a current reading of +0.40 on a scale of -1 to +1, signaling increased bullish momentum. Historical data indicates that momentum inflections of this nature typically precede sustained Bitcoin rallies, providing a technical foundation for further upside. With an AVIV Ratio Z-Score of 0.745, Bitcoin's current price action sits at the upper bound of what our Dynamic DCA Model considers "fair value," but during times of positive on-chain momentum, our backtesting has found that the valuation of Bitcoin matters less. As a trending asset, it is not uncommon to see Bitcoin hit elevated and even speculative levels of valuation if on-chain momentum is persistently positive, and with momentum only at 0.4, we see continued upside from here and are less focused on the valuation currently.

TLDR: The positive turn in the AVIV Gradient Oscillator suggests Bitcoin may be entering a period of sustained upward momentum, potentially targeting the $100K-120K range if the pattern follows historical precedent.

Supply Walls: Clear Path To All-Time Highs

At the $100K price level, approximately 85% of short-term holders and 100% of long-term holders are in profit, representing roughly 95% of all Bitcoin in circulation. The substantial supply wall that existed between $93K-$100K has been largely absorbed through recent trading activity, with noticeably lighter resistance appearing above $102K. A decisive break above $100K would likely coincide with markets more aggressively pricing in the Fed's eventual policy pivot, potentially accelerating the upward move as resistance thins. While macro headwinds from tariff implementation remain valid concerns, evolving liquidity expectations appear to be offsetting near-term economic drag in market positioning.

TLDR: The supply distribution heat map suggests that once Bitcoin decisively clears $100K, reduced overhead resistance could enable more rapid price appreciation towards all-time highs.

Bull Market Behavior: HODLers Taking Profit

Bitcoin HODLers have flipped to net selling alongside the recent momentum turn, distributing approximately 20K BTC daily compared to the December 2024 peak of 117K BTC. This measured distribution pattern is consistent with long-term holder behavior during periods of rapid price appreciation, as they typically reduce exposure to manage risk and secure profits. Current distribution levels do not yet signal excessive selling pressure but rather represent a healthy rotation from strong to newer hands that often accompanies bull market phases. The selling pattern resembles the behavior observed during the post-election rally that drove Bitcoin from $70K to $100K, suggesting a similar market structure may be developing.

TLDR: HODLer distribution remains within normal parameters for a bull market phase, indicating potential for continued upward price movement before distribution reaches concerning levels.

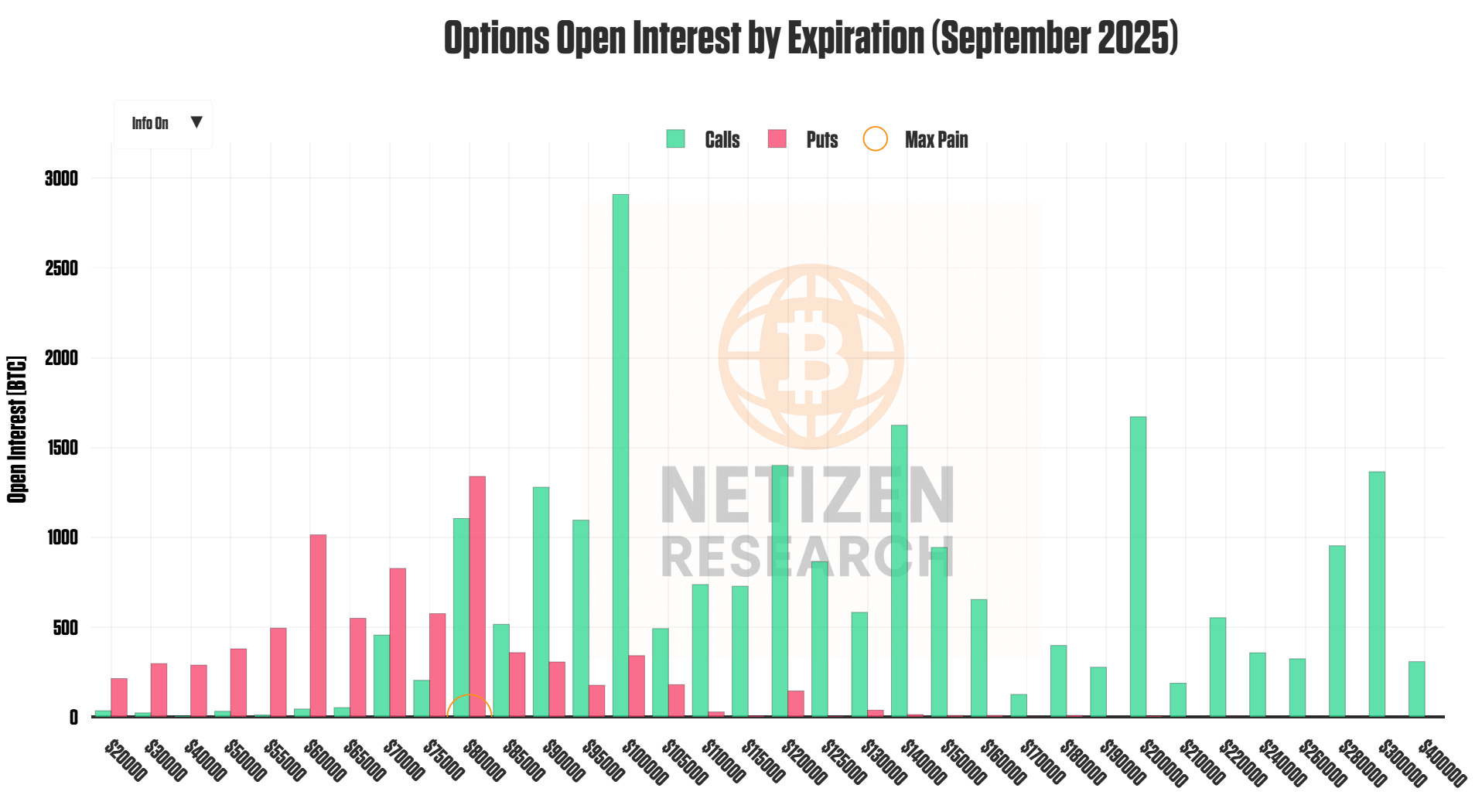

Options Markets Betting on a Fed Pivot

The September 2025 expiry options chain shows highest open interest concentrated at the $100K strike, with growing call volume emerging at higher strike prices including $120K, $140K, $200K, and even $300K. The put/call ratio skews heavily toward calls, while the options max pain price sits at $80K, suggesting market participants are positioned for upside above current levels. Professional traders appear to be positioning for liquidity-driven upside once lagging economic data weakens sufficiently to force a Fed policy response. The September expiration strategically captures the timeframe in which tariff impacts could materialize in economic data, potentially triggering the Fed policy pivot that Bitcoin appears to be anticipating.

TLDR: Options positioning reveals institutional conviction in higher Bitcoin prices over the medium term, with significant speculative interest in price targets well above current levels.

Your Edge in Bitcoin Accumulation

Our Dynamic DCA model has historically outperformed traditional dollar-cost averaging by ~30% over multi-year periods. For just $10/month, access our premium research and rigorously back-tested accumulation strategy that adapts to market conditions using on-chain data, helping you stack Bitcoin smarter.

In the coming weeks, we will also be creating a new chart suite and investor dashboard exclusive to premium members, giving you a full recap of macro and on-chain metrics we're seeing and opportunities in the market. Your support helps fund this development! Consider subscribing.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.