Netizen Dynamic DCA Whitepaper

Stack 30% More Bitcoin Than Traditional Dollar-Cost Averaging Using On-Chain Data

Our Mission

Our mission is to provide Bitcoin investors with a systematic, data-driven approach to long-term accumulation. By leveraging on-chain metrics and advanced analytics, we help investors own more BTC over time while navigating market volatility with discipline and emotional detachment.

Executive Summary

Our dynamic dollar-cost averaging (DCA) strategy has consistently outperformed traditional DCA by an average of 30.7% across 12,000+ back tests. Through extensive analysis of Bitcoin's on-chain data and price action, we've developed a unique approach that automatically adjusts purchase amounts based on market conditions, helping investors systematically accumulate more Bitcoin over time. Our on-chain analytics identify optimal periods of undervaluation and positive momentum, removing emotion from the investment process while maintaining strict risk management principles.

The strategy is built on two foundational metrics derived from Bitcoin's blockchain:

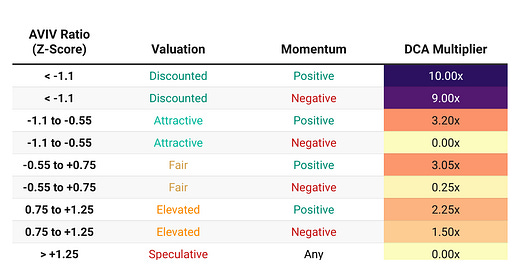

Active Value/Investor Value (AVIV) Ratio (Z-Score): This valuation metric established by Glassnode’s Cointime Economic framework, measures Bitcoin's relative valuation by comparing active market behavior to long-term holder patterns. We've identified specific Z-score valuation thresholds through machine learning: Discounted (Z < -1.1), Attractive (-1.1 to -0.55), Fair (-0.55 to 0.75), Elevated (0.75 to 1.25), and Speculative (Z > 1.25).

Active Value/Investor Value (AVIV) Gradient Oscillator: This momentum indicator tracks the rate of change between market valuation and realized valuation. Positive readings suggest an uptrend has momentum to continue, while negative values indicate potential trend exhaustion.

Figure 1 illustrates this framework in action. The top panel shows Bitcoin's price history since 2015, with colored shading indicating our dynamic multipliers ranging from 0x to 10x the base investment amount. Below, the AVIV Valuation and AVIV Momentum demonstrate how the strategy identifies optimal entry points. During periods when Bitcoin is Discounted (Z-Score < -1.1) combined with positive momentum, the model signals aggressive accumulation—up to 10x the base investment amount. When the market is in Attractive or Fair territory, the strategy adjusts dynamically based on momentum, ranging from 0x to 3.2x the base amount. During Elevated or Speculative periods, the strategy becomes more conservative, reducing exposure or sitting out of the market entirely, particularly when momentum is negative.

Our extensive backtesting, using out-of-sample data from 2015 to 2024, demonstrates remarkable outperformance:

Outperforms Traditional DCA: Our strategy accumulated an average 30.7% more Bitcoin across 12,000+ back tests when compared to a traditional DCA strategy investing with hindsight

Consistent Across Time: Dynamic DCA accumulated more Bitcoin than traditional DCA 99.0% of the time, showing a flawless win-rate in all tested annual timeframes except the 7-year window (88.5%)

Asymmetric Risk/Reward: Our maximum drawdown was limited to just -2.3% versus traditional DCA, while maintaining significant upside potential of up to 101.5%

Using machine learning, we've refined our strategy to be robust across different market cycles while removing emotion from the investment process. This systematic approach has proven effective in both bull and bear markets, helping investors accumulate more Bitcoin while maintaining strict risk management principles.

Want to DCA smarter and stack 30% more BTC for only $10/month? Sign up for our Premium membership below!

Model Strategy & Approach

Avoiding Overfitting & Ensuring Robustness

In algorithmic trading, it's easy to create models that look impressive in hindsight but fail in real-world conditions. To ensure our strategy delivers consistent results, we implemented a rigorous three-phase optimization process with extensive out-of-sample testing.

Our testing framework focuses on the modern era of Bitcoin (post-2015), which represents a more mature market characterized by:

Higher liquidity and trading volume

Multiple complete bull-bear market cycles

Increased institutional participation

More sophisticated price discovery mechanisms

We test across multiple timeframes to ensure robustness:

Test windows ranging from 2 to 8 years

Purposefully excluding 1-year windows due to multi-year investment horizon

Rolling forward through time to create overlapping samples

Evaluating performance across different market and macro cycles

Three-Phase Optimization Process

Our methodology progresses through three increasingly precise phases, each designed to balance computational efficiency with accuracy:

1. Preliminary Testing (Monthly Steps)

In our initial phase, we conducted over 1,000 trials using monthly intervals between test windows. This efficient approach allowed us to explore a wide range of possibilities, generating 427 distinct out-of-sample windows and identifying the most promising parameter ranges for further study.

2. Focused Optimization (5-Day Steps)

With promising parameter ranges identified, we increased our precision by moving to 5-day intervals. This phase involved:

250 focused optimization trials using Optuna machine learning

Over 600,000 individual back tests

More granular analysis of market entries

Validation across various market conditions

Identification of our top 10 parameter candidates

3. Final Audit (Daily Steps)

Our most rigorous phase analyzed the top 10 parameter candidates using daily intervals. This means testing every possible market entry point—12,792 distinct windows for each candidate. For each window length (2-8 years), we evaluated:

Mean and median performance

Maximum potential upside

Worst-case scenarios

Performance consistency (20th/80th percentiles, and standard deviation)

Success rates and asymmetry ratios

Objective Function

Our DCA strategy was optimized around an objective function that balances multiple performance criteria to ensure our strategy delivers consistent results:

Objective = mean outperformance + K × (success rate - 90) - λ × max(0, -max drawdown - 10)

This function combines three key elements:

Outperformance: More BTC accumulated vs our Retroactive DCA benchmark

Consistency: A penalty when success rates fall below 90%

Risk Management: Drawdown protection beyond 10% threshold

Through extensive testing, we found optimal results with:

K = 2 (prioritizing consistent win-rate)

λ = 0.5 (allowing reasonable drawdown tolerance)

This balance favors strategies that maintain high success rates while preserving upside potential during strong market conditions.

Dynamic Multiplier Rules

Our optimization process yielded clear rules for adjusting the base $100 weekly investment. These multipliers consider both market valuation (AVIV Z-Score) and momentum state:

Key features of our multiplier strategy:

Maximum aggression (9x-10x) during discounted periods regardless of momentum

Moderate buying (2.25x-3.2x) during attractive and fair valuations with positive momentum

Reduced exposure (0x-1.5x) during elevated valuations or negative momentum

Sitting out of the market during speculative periods

This framework systematically maximizes Bitcoin accumulation during favorable conditions while maintaining strict risk management during less optimal periods. The rules are clear and unambiguous, removing emotional decision-making from the investment process.

Key Observations & Rationale

Valuation Dominates When AVIV Ratio (Z-Score) < -1.1

The biggest alpha comes from buying aggressively when Bitcoin is discounted

Our strategy ensures maximum capital deployment when Z-Score < 0

Bullish Phases = Overvaluation

In strong bull markets, Bitcoin tends to remain "overvalued" according to our on-chain metrics

Our momentum indicators guide intelligent buying during these phases:

Positive Momentum + Overvaluation: Careful participation to capture continued upside

Negative Momentum + Overvaluation: Strategic pause to avoid chasing overheated prices turning over

Bitcoin is a Trending Asset

Bitcoin's momentum shifts often signal sustained directional moves

Our strategy rides the positive momentum up but steps aside when negative

We Bias Towards Success Rate Over Drawdown

Our model prioritizes consistent outperformance over minimal drawdowns

Example: We prefer 95% success rate with a rare -20% drawdown over 85% success rate with -10% drawdown

This preference is reflected in our objective function constants (K = 2, λ = 0.5)

Control Groups: Retroactive DCA vs. Base DCA

To properly evaluate our strategy's effectiveness, we compare it against two distinct benchmarks. This dual comparison ensures thorough validation of our approach.

Retroactive Static DCA

What is it? For any given back test period, we calculate the total amount our Dynamic DCA invested, then distribute that same capital evenly over the same timeframe.

Advantages:

Fair Comparison: Both strategies invest identical total capital

Isolates Timing Effect: Performance differences reflect better timing and cost-basis

Limitations:

Unrealistic Hindsight: No investor knows their total investment amount in advance

Optimistic Benchmark: Sets an artificially high performance bar that can’t be replicated in practice

Base Static DCA

What is it? A simple real-world approach: investing a fixed $100 each week throughout the period.

Advantages:

Matches Reality: Reflects typical investor behavior

Simple Benchmark: Clear, consistent weekly investment

Limitations:

Different Capital Deployed: Total investment varies from Dynamic DCA

Performance Gap: May overstate or understate relative performance

Our Approach to Benchmarking

We use Retroactive Static DCA as our primary benchmark for cost basis comparison—it's the most challenging target to beat since it assumes perfect hindsight. The Base Static DCA provides a secondary benchmark that reflects common real-world behavior.

By outperforming both benchmarks consistently, our strategy demonstrates its effectiveness across different comparison frameworks.

Historical Performance Analysis

Our strategy's effectiveness is validated through comprehensive testing across 12,792 distinct rolling windows between January 2015 and December 2024. The results demonstrate consistent outperformance against both benchmarks:

vs Retroactive DCA:

2-3 year windows: +32-33% average outperformance with high consistency

4-5 year windows: +29% stable outperformance across both periods

6-8 year windows: +25-33% sustained performance, even in longest timeframes

vs Base DCA:

2-3 year windows: +232-243% dramatic outperformance in shorter timeframes

4-6 year windows: +224-235% maintained strong advantage in medium-term

7-8 year windows: +222-236% consistent edge even over longest periods

The strategy's outperformance remains remarkably robust across different timeframes, with an overall average of +30.7% versus Retroactive DCA and +231.5% versus Base DCA. This consistency across large sample sizes suggests our approach captures fundamental market behavior rather than temporary anomalies.

In managing risk, understanding worst-case scenarios is crucial. Our extensive testing demonstrates exceptional resilience across all timeframes:

vs Retroactive DCA:

Short-term (2-3 years): Maintained positive outperformance (+11%, +5%)

Mid-term (4-6 years): Consistent positive floors (+3%, +4%, +1%)

Long-term (7-8 years): Minimal drawdown (-2%) with recovery to break-even

vs Base DCA:

Outperformance strengthens with longer timeframes

Minimum gains range from +51% (2-year) to +145% (8-year)

Note: Different total capital deployment affects comparison

This resilience against our most challenging benchmark—Retroactive DCA with perfect hindsight—demonstrates our strategy's edge comes from superior capital deployment rather than simply investing more money.

Our strategy shows remarkable potential for outperformance across all timeframes:

vs Retroactive DCA:

Short-term (2-3 years): Strong peaks of +80-85%

Mid-term (4-6 years): Consistent peaks of +70-83%

Long-term (7-8 years): Maximum peaks of +83-101%

vs Base DCA:

Short-term (2 years): Extraordinary peaks of +518%

Mid-term (3-5 years): Exceptional peaks of +472-481%

Long-term (6-8 years): Sustained peaks of +464-466%

This performance profile demonstrates powerful asymmetry: strong protection against drawdowns combined with substantial upside potential in optimal market conditions.

Perhaps most impressively, our strategy shows remarkable consistency in outperforming traditional approaches:

vs Retroactive DCA:

100% success rate across 2-6 year windows

Brief dip to 88.5% in 7-year windows

Returns to 100% in 8-year periods

99% overall success rate across all 12,792 windows

vs Base DCA:

100% success rate across all timeframes

Zero instances of underperformance

Perfect track record across 12,792 scenarios

This consistency reflects a fundamental truth about Bitcoin markets: within any 2+ year window, the AVIV Z-Score inevitably identifies periods of undervaluation, presenting opportunities for aggressive accumulation. Our strategy capitalizes on these moments through disciplined execution, systematically avoiding FOMO buying during overvalued periods while concentrating capital deployment when conditions are most favorable.

Understanding Bitcoin's Market States

Our analysis of Bitcoin's market states from 2015 to 2024 reveals a systematic pattern that underpins our entire strategy. The market cycles through distinct conditions with remarkable regularity:

Fair Value Conditions (47% of time)

Market's natural equilibrium state

Dominated by positive momentum (33%)

Negative momentum less common (14%)

Presents steady accumulation opportunities

Elevated & Speculative Markets (26% of time)

Elevated periods (14%): Rising valuations with strong momentum

Speculative phases (12%): Market euphoria requiring disciplined restraint

Almost exclusively positive momentum

Critical periods for maintaining investment discipline

Discounted & Attractive Opportunities (26% of time)

Discounted periods (16%)

Balance between positive (4%) and negative (12%) momentum

Prime accumulation windows

Often coincide with market fear

Attractive periods (10%)

Weighted toward negative momentum (6% vs 4% positive)

Strategic entry points for long-term positions

This distribution reflects Bitcoin's fundamental market dynamics. During bull markets, prices often remain elevated for extended periods, testing investor discipline. Bear markets, while psychologically challenging, present the most attractive entry points for long-term accumulation.

Our strategy exploits this predictable cyclicality by removing emotion from the equation. The data shows that significant value opportunities occur in approximately 25% of all trading periods—typically during times of market stress when most investors are psychologically least prepared to buy. By systematically increasing exposure during value opportunities and reducing it during speculative periods, we help investors accumulate more Bitcoin while avoiding emotional decision-making.

Why On-Chain Analysis Matters

Traditional financial markets operate as black boxes, where investor behavior must be inferred from limited data. Bitcoin fundamentally transforms this paradigm by providing a complete, transparent ledger of all market activity.

This transparency enables analysis across multiple dimensions:

1. Supply Dynamics

Track realized vs. unrealized value flows

Monitor net unrealized profit and loss (NUPL)

Analyze spent output profit ratio (SOPR)

Map short-term vs. long-term holder supply distribution

Track accumulation and distribution patterns by cohort size and age

2. Holder Behavior

Analyze wallet size cohorts

Track holding duration patterns

Monitor cost basis by holder segment

Identify smart money movements

Map accumulation/distribution patterns across different investor types

3. Network Activity

Measure exchange flows and balance changes

Monitor miner behavior and capitulation signals

Track hash rate and mining difficulty adjustments

Analyze miner reserve changes and selling pressure

Identify institutional movement patterns

4. Market Structure

Monitor derivatives market data

Track open interest across major exchanges

Analyze funding rates and market leverage

Calculate cost basis by cohort

Identify key profit/loss thresholds

Track market structure shifts and breaks

5. Cohort Analysis

Segment holders by size (whales, institutions, retail)

Track behavior patterns by holding duration

Monitor cost basis distribution by cohort

Analyze accumulation trends across different groups

Identify strategic shifts in holder behavior

The ability to analyze Bitcoin through these multiple lenses provides insights impossible in traditional markets. Where stock analysts might see only price and volume, Bitcoin researchers can dissect every transaction's age, size, and relationship to market cycles. This rich data allows us to build more sophisticated and reliable investment strategies.

The AVIV metrics represent just two carefully chosen signals from this vast analytical landscape. While these metrics have proven highly effective in capturing market transitions between accumulation and distribution phases, they're just the tip of the iceberg. The Cointime Economic framework developed by Glassnode opens up countless possibilities for leveraging on-chain data to enhance investment decisions.

Looking ahead, we see tremendous potential for expanding this analytical framework.

Implementation & Investment Considerations

The Essential Long-Term Mindset

Our model is explicitly designed around multi-year Bitcoin cycles. A minimum 2-year investment horizon isn't just recommended—it's essential. This is precisely why we exclude 1-year windows from our analysis. The strategy's core purpose is removing human psychology—both fear and greed—from the equation. When our model signals reduced buying, those funds should be deliberately saved for future opportunities.

Building Your War Chest

Significant buying opportunities (Z-Score < -1.1) appear roughly once every 3-4 years. These Discounted windows require substantial capital to fully capitalize on the opportunity. We recommend:

Maintaining disciplined saving during reduced buying periods

Building reserves specifically for aggressive deployment during optimal conditions

Keeping additional capital ready for extreme opportunities

Navigating Market Extremes

Two extreme scenarios warrant special attention:

1. Capitulation ("Nuke Zones")

When Z-Score drops below -1.5

These rare moments of deep fear and undervaluation warrant deploying more capital than our standard 10x multiplier

Often coincide with major market events or crises

Historically provide exceptional entry points

2. Peak Euphoria (“FOMO”)

When Z-Score exceeds 1.5

Stay patient and resist the temptation to chase higher prices

FOMO buying near local tops typically leads to poor long-term outcomes

Use this time to potentially de-risk (sell Bitcoin at a profit) and build reserves for future opportunities

Understanding Signal Changes

Our historical analysis spanning January 2015 to December 2024 (3,653 days) reveals the strategy's practical rhythm:

Signal Frequency: 272 total changes, averaging 2-3 shifts per month

Average Signal Duration: 13.4 days in each state

Median Signal Duration: 4 days

Range: 1 to 212 days

This pattern reveals an important truth: while Bitcoin markets can be noisy day-to-day, meaningful regime changes tend to persist. Our approach filters this noise to capture significant market movements while avoiding overreaction to temporary fluctuations.

Smart Bitcoin Investing, Made Simple

Your Personal Bitcoin Strategy Engine

We've built a powerful investment tool that helps everyday investors buy Bitcoin more strategically. No complex crypto knowledge required—just smart, data-driven insights that work for you.

What Makes This Different:

Intelligent DCA strategy leveraging on-chain data

Tested across multiple bull/bear cycles

Easy to understand and implement

Historically has improved cost basis and returns

Real Insights, Real Results

Every week, you'll get a complete picture of Bitcoin's market health. We break down complex data into clear, actionable information that helps you make smarter investment choices.

What You'll Discover:

Macroeconomic trends that move asset markets

Bitcoin supply and demand dynamics

Investor behavior insights

Miner market health

Invest Like A Pro

Most investors are just guessing. Our approach uses machine learning and on-chain analysis to give you an edge. We've analyzed over 12,000 market windows since 2015 to build a strategy that adapts to market changes.

Our Dynamic DCA strategy helps investors navigate Bitcoin's notoriously volatile market cycles. By providing data-driven insights, we transform emotional investing into a systematic approach that:

Reduces panic selling during bear markets

Prevents FOMO-driven buying at market peaks

Maintains consistent accumulation across various market conditions

Helps investors stay emotionally detached from short-term price swings

The chart demonstrates how our method potentially generates 30% more Bitcoin by intelligently timing purchases, turning market volatility from a challenge into an opportunity.

Try Premium Risk-Free For 7 Days :)

Try our full premium subscription free for 7 days. See how data-driven investing can transform your Bitcoin strategy.

Thanks for reading and making it this far!