Hello fellow Netizen,

Bitcoin's 25% correction from recent highs is signaling broader trouble ahead for risk assets. The macro backdrop has turned increasingly hostile as markets grapple with stagflation and an unprecedented sovereign debt refinancing cycle. What started as crypto-specific volatility has evolved into a clear warning sign for global liquidity conditions.

TLDR: Bitcoin's sharp correction is a leading indicator of deteriorating global liquidity conditions, with broader market stress likely ahead.

Stagflation, Risk-Off Markets, and the $5T Refinancing Wall

Last week's DEFLATION headfake transitioned quickly into an INFLATION top-down market regime, with core PCE expected to inflect higher by summer and headline CPI continuing to surprise consensus to the upside. The stagflationary environment is evidenced by contrasting economic indicators: while private sector labor income accelerated to 8.4% and employment remains resilient at 4.3% growth (three-month annualized), we're simultaneously seeing business investment contract 3% in Q4 and significant slowdowns in housing and auto sales. This aligns with our bottom-up macro regime analysis showing DEFLATION dominating the next 3-6 months before transitioning to INFLATION over the 6-12 month horizon.

The global refinancing air pocket looms as 2025's primary market risk, with approximately $5 trillion of sovereign debt needing refinancing this year amid heightened market uncertainty. Adding complexity is the emerging theory that the Trump administration may be strategically engineering economic weakness to force the Fed's hand on rate cuts – a thesis supported by recent comments from Treasury Secretary Scott Besson about "necessary detox periods" and "economic restructuring." While this could eventually boost market liquidity through renewed Quantitative Easing (aka money printer go Brrr), the near-term path likely involves significant market volatility as this high-stakes game of chicken plays out between fiscal and monetary authorities.

TLDR: Bitcoin faces near-term headwinds as liquidity conditions tighten, but potential Fed capitulation in 2H 2025 could spark a significant recovery.

Bull Market On Pause: Prepare for Choppy Consolidation

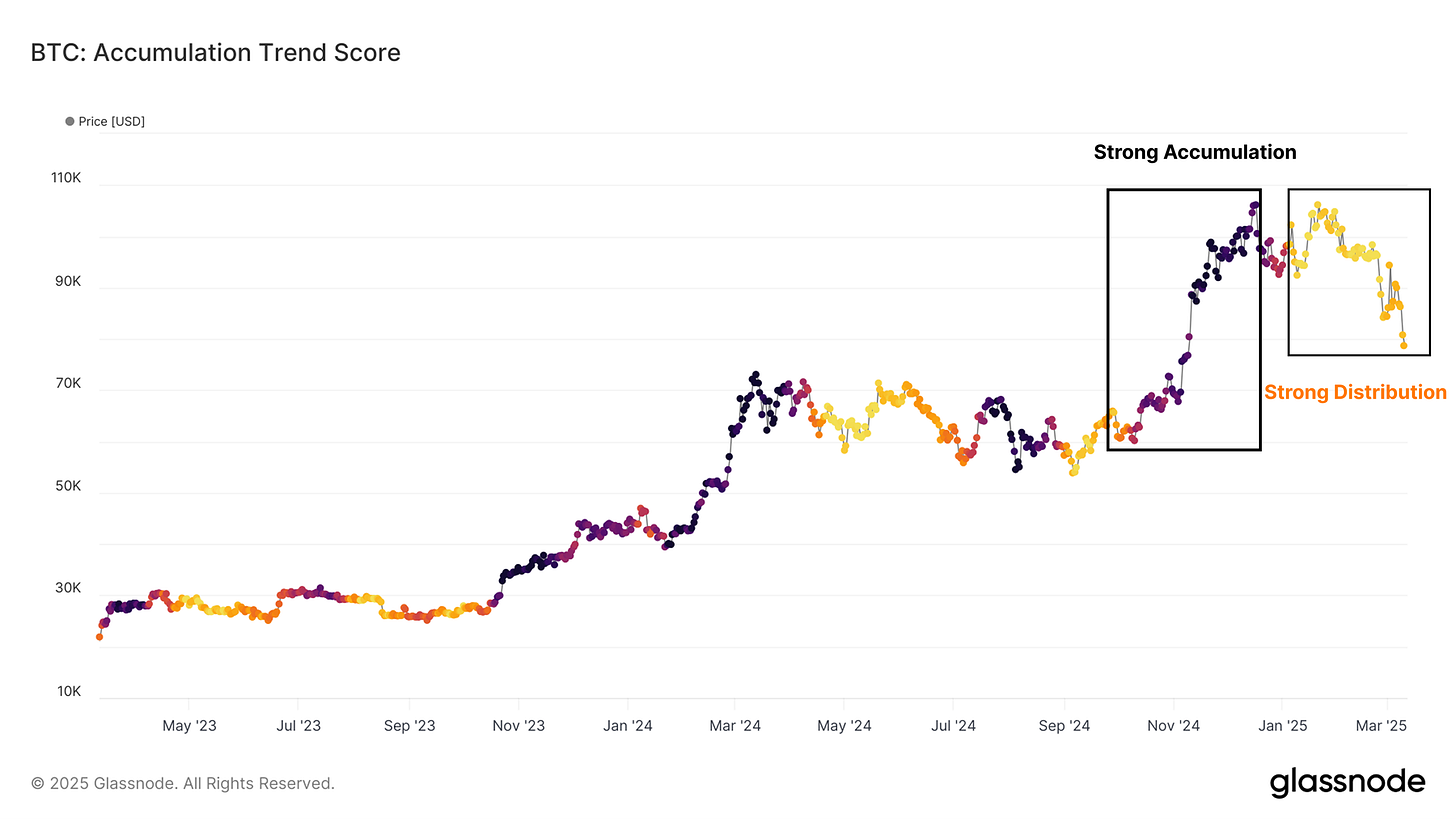

Glassnode's Accumulation Trend Score has plummeted below 0.1, revealing an intense distribution phase that began in early January 2025. This marks a dramatic shift from Q4 2024's strong accumulation patterns, with sell-side pressure now dominating market flows. The Cost Basis Distribution heatmap illustrates this evolution clearly – while investors actively accumulated during mid-December to late February pullbacks (particularly in the $95k-$98k range), this dip-buying conviction has evaporated, with minimal response to prices dropping below $92k.

Demand momentum shows similar deterioration in the short-term holder cohorts. Most tellingly, the 1-week to 1-month holder cost basis ($91k) has dipped below the 1-month to 3-month holder cost basis ($99k) for the first time this cycle, indicating new investors are no longer willing to pay premiums for exposure. This pattern has historically signaled waning capital inflows and typically precedes extended periods of price weakness, though current institutional infrastructure should help cushion against a deeper structural breakdown.

TLDR: On-chain metrics suggest we're in a distribution phase that could lead to a prolonged consolidation, rather than the start of a secular bear market.

$70K Support Level Likely to be Tested as Supply Gap Creates Vulnerability

Bitcoin's on-chain supply distribution exposes a concerning supply gap between $82K and $70K, creating a low-resistance pathway for continued downside price action in the current risk-off INFLATION regime. This structural vulnerability is particularly noteworthy given the massive concentration of short-term holder supply above $90K, indicating potential capitulation risk from these newer market participants as losses mount. However, robust support emerges at the $67K range, where a significant 202K BTC concentration (140K from long-term holders and 62K from short-term holders) aligns perfectly with the 2021 cycle highs, establishing both technical and on-chain support that should prove resilient even amid broader equity market weakness.

TLDR: Consider building cash for potential accumulation opportunities near $70K, where significant holder density and the 2021 cycle high converge to form a strong support level.

Underwater STH Analysis: Risk Levels and Capitulation Thresholds

Current Bitcoin Price ($83,673) relative to major cost basis levels:

9.4% below STH Cost Basis ($92,310)

30.0% above True Market Mean Price ($64,428)

92.3% above Realized Price ($43,515)

231.6% above LTH Cost Basis ($25,235)

Since breaking below the STH cost basis in late February, approximately 80% of short-term holders are now underwater, creating significant potential sell pressure if price slips further into the supply gap below $82K. This vulnerability is particularly concerning amid the current inflation-driven risk-off environment and tightening global liquidity. Our analysis points to $70K as the next major support level, where True Market Mean Price, previous cycle highs, and significant long-term holder accumulation converge to create structural support that would likely require a severe macro shock to breach.

TLDR: Our cost basis distribution analysis confirms $70K as the critical support floor—where True Market Mean Price, 2021 cycle highs, and major supply clusters converge, creating an optimal accumulation zone even amid STH capitulation.

Derivative Gridlock: Bulls and Bears Neutralize Each Other Into Q2

The Bitcoin derivatives landscape reveals a clear battle between bulls and bears, evidenced by the sharp transition from spot-driven rallies (March 6-8) to four consecutive days of leveraged sell-offs where rising open interest accompanies falling prices. This pattern typically indicates aggressive short positioning rather than mere long liquidations, while the significant cross-directional liquidations over recent days underscores the market's indecision. Options positioning reinforces this conflicted outlook, with max pain levels gradually declining from March ($75K) to June ($70K), suggesting institutional traders are pricing in continued range-bound activity with slight downward pressure through Q2 before any meaningful recovery can take hold.

TLDR: Expect choppy $70K-$80K consolidation through Q2 as derivatives positioning shows neither side has conviction for a breakout until macro conditions improve in 2H 2025.

Your Edge in Bitcoin Accumulation

Our Dynamic DCA model has historically outperformed traditional dollar-cost averaging by ~30% over multi-year periods. For just $10/month, access our premium research and rigorously back-tested accumulation strategy that adapts to market conditions using on-chain data, helping you stack Bitcoin smarter.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.