Bitcoin's Defiance in a Risk-Off World

The current Bitcoin rally exists within a clearly deflationary market regime - typically a RISK-OFF environment - yet risk assets demonstrate surprising resilience against this backdrop. Bitcoin momentum remains decisively BULLISH alongside gold's strong positive trend, while S&P 500 momentum has recently shifted from bearish to NEUTRAL - creating a noteworthy divergence from the prevailing risk-off conditions. Markets appear to be looking through Trump's tariff rhetoric flip-flopping and implementation walk-backs, despite the hawkish Federal Reserve stance and the unknown but likely negative economic impact where tariffs will slow growth and cause earnings to re-rate lower. This forward-looking behavior reflects how markets trade on changes in expectations rather than current conditions, creating a fundamental tension between today's data and anticipated future policy shifts. With such uncertainty ahead, prudent investors should consider building cash reserves to capitalize on potential dislocations while maintaining core positions in assets that hedge policy risks.

TLDR: Markets may be treating Bitcoin as an effective hedge against policy uncertainty and financial volatility despite the broader deflationary backdrop.

Can Bitcoin’s Rally Survive Without Liquidity?

The sustainability of Bitcoin's current rally depends largely on global liquidity conditions, which outweigh most individual technical or fundamental factors in importance. While many retail investors on Twitter/X track M2 money supply as a Bitcoin price indicator, current liquidity conditions present a more complex picture that requires nuanced analysis beyond simplistic correlations. The substantial reduction in excess reserves - evidenced by reverse repo balances plummeting from $2.5 trillion to approximately $100 billion - indicates significantly reduced monetary "fuel" compared to previous market cycles. Potential offsetting support may emerge from the People's Bank of China implementing its own easing measures, while both domestic and international credit expansion remains in positive territory despite tighter conditions. The anticipated slowdown in global trade flows expected to materialize in several months threatens to constrict dollar recycling mechanisms that typically benefit Bitcoin and US markets, creating a potential liquidity headwind that may challenge momentum. For this rally to prove sustainable beyond the near term, Bitcoin requires consistent expansion from multiple sources - a scenario that remains possible but faces meaningful headwinds in the current environment.

TLDR: Limited global liquidity sources suggest Bitcoin's current rally faces sustainability challenges unless additional central bank easing materializes.

Positive Momentum Points to Historic Rally Pattern

AVIV Momentum has just flipped positive to +0.21 on April 28th after sitting at -0.68 just ten days prior, marking a technical reversal that deserves attention despite Jerome Powell's persistently hawkish stance at the Federal Reserve. This rapid oscillator shift from below -0.50 to positive territory within a two-week window mirrors previous patterns that preceded significant Bitcoin rallies, including the December 2022 (post-FTX collapse) shift that ultimately led to the 16K to 110K run we recently witnessed. Similar momentum pattern flips occurred during the post-China mining ban rebound of July 2021, the post-COVID QE surge of April 2020, and the February 2019 Fed dovish pivot, all of which triggered substantial upward price action even during periods of macroeconomic uncertainty. While this momentum shift signals potential continuation of the rally, investors should remain cautious as the impact of Trump's policy flip-flopping could create volatility that temporarily disrupts these technical patterns.

TLDR: Historical momentum patterns signal potential for continued upside despite Fed hawkishness and Trump policy flip-flopping.

Supply Distribution Creates Strong Support Structure

Approximately 90% of Bitcoin's total supply is now in profit at current 95K price levels, creating a remarkable distribution profile that strengthens Bitcoin's fundamental position even as growth may be slowing with inflation persistently above the Fed's 2% target. Short-term holders (STH) have established a visible and significant supply wall in the 92K-94K range, with 61% of their holdings currently in profit, suggesting potential support should price retrace to those levels amid global de-dollarization trends. Long-term holder (LTH) supply demonstrates even greater conviction, with 98% in profit and significant coin aging occurring in the 80K-90K price bands, indicating these hodlers remain unphased by macro uncertainties and are unlikely to distribute their coins during minor pullbacks. The combination of a resilient LTH base alongside the emerging STH cost-basis wall creates stronger support structures than the overhead resistance, providing a foundation for price to potentially withstand economic headwinds as markets adjust to potential stagflationary scenarios.

TLDR: Bitcoin's support structure demonstrates remarkable holder conviction that appears unshaken by macroeconomic headwinds and policy flip-flopping.

Futures vs. Spot: A Healthier Market Structure Emerges

The Bitcoin Futures Open Interest versus Price Change chart reveals a crucial shift in market dynamics, as the rally has transitioned from a leverage-led advance two weeks ago (driven by short liquidations) to a more sustainable spot-led advance over the past week despite policy uncertainty. ETF inflows reached $764 million net last week—the largest since March 21st—demonstrating continued institutional and retail appetite even at elevated price levels and suggesting investment managers may be viewing Bitcoin as a hedge against Trump's unpredictable trade policies. The normalization of leverage metrics while spot demand continues building points to a healthier market structure than what we typically observe during speculative blow-off tops or liquidation cascades, though this resilience has yet to be tested by a genuine liquidity crisis. Despite this positive structural shift, the hawkish Federal Reserve stance and potential for economic slowdown highlighted in our macro section will still govern Bitcoin's medium-term trajectory, as global monetary conditions remain the primary determinant of capital availability for risk assets.

TLDR: The transition from leverage-driven to spot-driven price action suggests a healthier market structure despite persistent economic growth concerns and inflation above target.

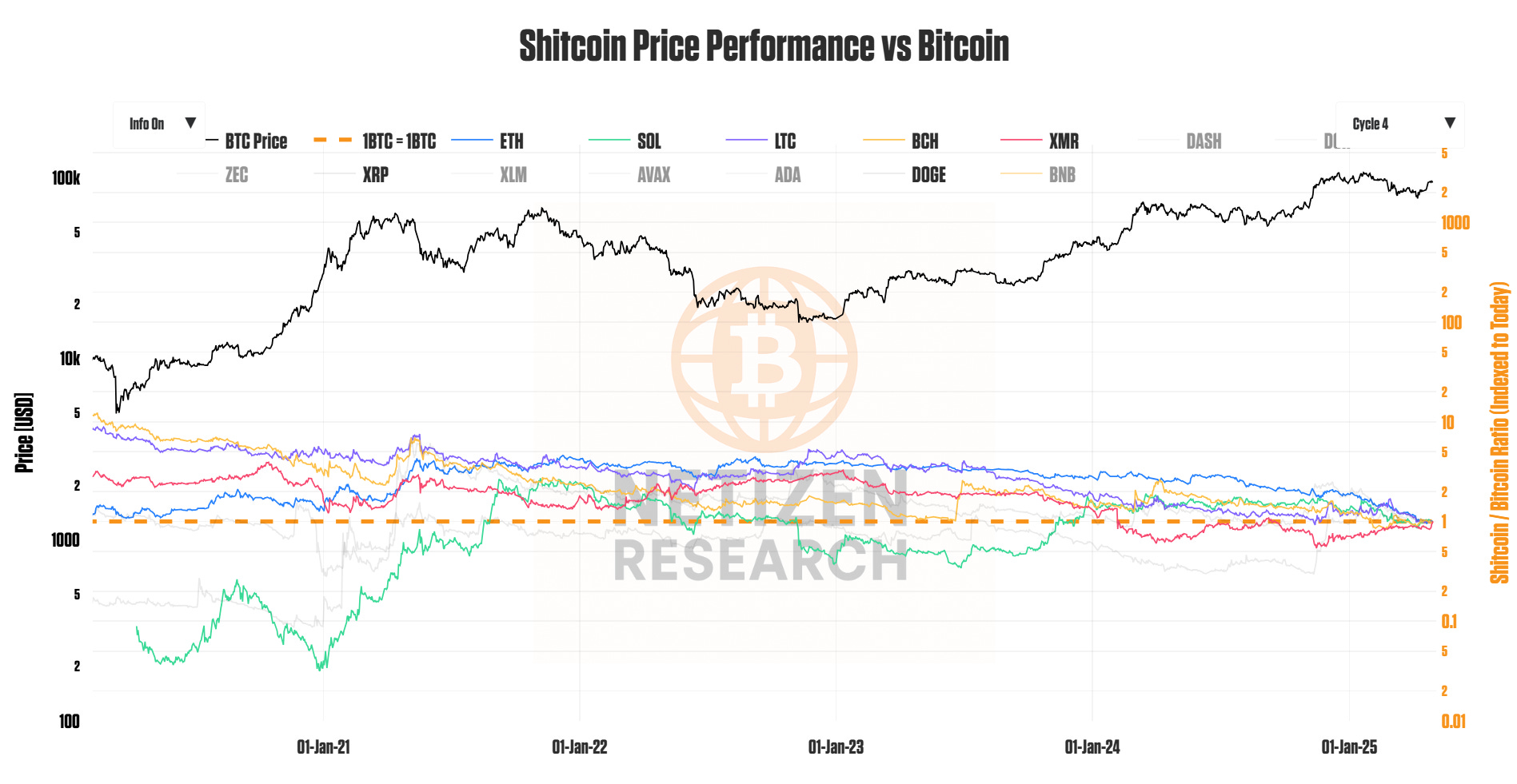

Bitcoin's Dominance Confirms Hard Money Narrative

The "Shitcoin Price Performance vs Bitcoin" chart provides compelling evidence of Bitcoin's fundamental value proposition as each alternative cryptocurrency demonstrates the same pattern: brief outperformance during easy-money windows followed by persistent underperformance against Bitcoin over full market cycles, regardless of prevailing macro conditions. Major cryptocurrencies including Ethereum, Solana, Ripple, DOGE, and others have all trended downward when priced in Bitcoin terms since 2020, reinforcing Bitcoin's rising dominance alongside increasing institutional adoption and the strengthening "hard-money" narrative that has particular appeal during times of policy uncertainty and potential de-dollarization. This perspective becomes particularly evident when viewing traditional investments like housing denominated in Bitcoin terms, revealing Bitcoin's persistent outperformance against nearly all asset classes through successive market cycles despite periods of economic turbulence. The structural divergence between Bitcoin and other cryptocurrencies suggests that institutional capital inflows are increasingly discerning about digital asset allocation, favoring Bitcoin's monetary properties over speculative alternatives as a hedge against both inflation risks and growth concerns in a challenging policy environment.

TLDR: Bitcoin's consistent outperformance against alternative cryptocurrencies (and all asset classes for that matter) reinforces its unique value proposition as a hedge against fiat money.

Your Edge in Bitcoin Accumulation

Our Dynamic DCA model has historically outperformed traditional dollar-cost averaging by ~30% over multi-year periods. For just $10/month, access our premium research and rigorously back-tested accumulation strategy that adapts to market conditions using on-chain data, helping you stack Bitcoin smarter.

In the coming weeks, we will also be creating a new chart suite and investor dashboard exclusive to premium members, giving you a full recap of macro and on-chain metrics we're seeing and opportunities in the market. Your support helps fund this development! Consider subscribing.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.