Netizen Weekly | Bitcoin Market Update #4

Navigating Trump Volatility, Liquidity, and Bitcoin's Supply Void

Bitcoin ping ponged between $78K and $94K following President Trump's Strategic Shitcoin Reserve announcement (read our thoughts here). What initially appeared bullish quickly became a "sell-the-news" event, with Bitcoin tumbling -28% from cycle highs while Ethereum and Solana collapsed by more than -50%. This violent price action exposed a critical supply gap between $70K-$90K formed during November's rally. Despite the extreme volatility, Bitcoin's current correction remains shallower than previous bull market drawdowns (-30% to -71%), suggesting stronger institutional support in this cycle.

Economic Tug-of-War: Liquidity Dynamics & USD Strength

Global liquidity is tightening primarily due to a strengthening US Dollar, creating headwinds for Bitcoin and risk assets. When the dollar strengthens, foreign entities must sell assets to obtain more dollars for debt payments, reducing money available for investments. Recent events have amplified this dynamic: $136 billion in Treasury settlements (largest since May) drained cash from the system, while President Trump's 20% China tariffs further boost dollar demand. We've seen this movie before—during 2018-2019 trade tensions, China devalued its currency by 13% against the USD to maintain export competitiveness, triggering similar devaluations worldwide and ultimately leading to a 20% crash in equities. With America's international debt burden doubling to $20 trillion since 2018, even more global capital is vulnerable to this dollar-strengthening cycle.

On the positive side, several factors point to improving liquidity ahead. The Treasury is actively reducing its cash balance (from $850B to $537B), effectively pumping money back into the financial system. Markets now expect three Fed rate cuts in 2025, and the Fed is likely to end Quantitative Tightening (QT) in the first half of 2025 as economic growth slows. This potential triple boost—Treasury cash injections, rate cuts, and the end of balance sheet reduction—would significantly expand money supply. Money market conditions are already showing early signs of this shift, with investors choosing private lending over Fed facilities. Historically, this transition from tightening to easing liquidity conditions creates an environment where Bitcoin outperforms substantially.

TLDR: Near-term liquidity remains tight (USD strength), but outlook improves with expected rate cuts, end of QT, and potential Fed pivot if growth slows.

Supply Clusters: Trapped Between $84K and $98K

All wallet cohorts by size have distributed heavily in recent weeks, with realized losses peaking at $818M/day—second only to August 2024's yen-carry-trade unwind ($1.34B). SOPR registered its first period of loss dominance since October 2024, though its swift return to equilibrium suggests investors are defending their cost-basis—typical bull market behavior. Short-Term Holders recorded their second-largest negative SOPR print of the cycle, indicating substantial capitulation from newer investors to experienced participants.

The UTXO data reveals key supply clusters that will determine Bitcoin's next significant move. Recent price action exposed the $70K-$90K region where minimal coins had previously changed hands, explaining the rapid descent. We're not convinced of a sustained breakout in either direction unless Bitcoin breaks below $84K where there is a supply cluster of 154K BTC, OR gets above $98K where a massive supply cluster of 646K BTC sits (just below the psychological $100K level). If we break below $84K, another supply "air gap" appears, potentially taking prices as low as $70K before finding meaningful support.

TLDR: Watch key supply clusters at $84K (154K BTC) and $98K (646K BTC) as these will likely determine Bitcoin's next significant directional move.

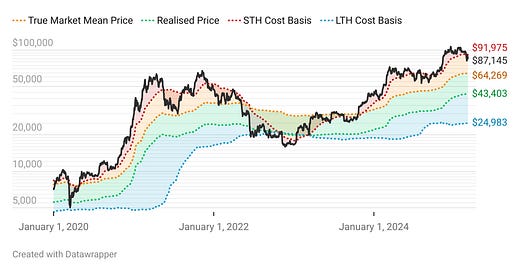

Strategic Support Zones: On-Chain Cost Basis Analysis

Current Bitcoin Price ($91,234) relative to major cost basis levels:

0.9% below STH Cost Basis ($92,035)

41.8% above True Market Mean Price ($64,350)

110.0% above Realized Price ($43,452)

265.1% above LTH Cost Basis ($24,990)

The Short-Term Holder cost basis provides a critical market reference level at $92K. Bitcoin's position at this level indicates we're in a decisive zone—reclaiming $92K confirms bull market continuation, and breaking below can be a sign of more trouble. The $70K region represents exceptionally strong support with multiple factors converging: the Active Realized Price at $70K, significant supply accumulation, and previous cycle highs from both 2021 and early 2024 (high $60Ks). It would take a severe capitulation or major macro shock to break below $70K for any significant period in our opinion.

TLDR: We view $70K as the lower bound for meaningful market support—a confluence of Active Realized Price, previous cycle highs, and significant supply clusters all converge at this level, making it an ideal zone for strategic accumulation.

Leverage Washout: Waiting for Genuine Spot Demand

The Bitcoin futures market has undergone substantial deleveraging, with Open Interest declining ~12% while prices whipsawed violently. The 7-day data ending March 6th showed OI down -11.72% with price up +7.59%—confirming leveraged positions are being flushed out over the past week. We won't be convinced of a sustainable rally until we see real spot buying emerge to replace speculative leverage. Recent volatility has been extraordinary—with 1-week and 2-week rolling realized volatility recording some of the highest values of the entire cycle, exceeding 80%. This extreme volatility typically coincides with excessive leverage, as speculative traders get washed out in both directions.

TLDR: We need to see genuine spot buying and reduced market volatility to become constructive on Bitcoin's short-term outlook—excessive leverage continues to create whipsaw price action in both directions.

Your Edge in Bitcoin Accumulation

Our Dynamic DCA model has historically outperformed traditional dollar-cost averaging by ~30% over multi-year periods. For just $10/month, access our premium research and rigorously back-tested accumulation strategy that adapts to market conditions using on-chain data, helping you stack Bitcoin smarter.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.