Netizen Weekly | Bitcoin Market Update #10

The Fed vs. Trump and What This Means For Your Portfolio

Fed Independence vs. Trump's Economic Agenda

After another eventful week, markets remain caught between conflicting forces: a DEFLATIONARY top-down market regime and STAGFLATIONARY bottom-up macro conditions – both historically RISK-OFF for stocks and Bitcoin. The tension between Fed Chair Powell and President Trump continues to escalate, with Trump publicly demanding rate cuts and calling Powell "TOO LATE AND WRONG" while threatening his "termination" in a scathing tweet this morning – a direct challenge to the Fed's independence that's crucial for ensuring long-term economic stability. Powell has maintained the Fed's autonomy, acknowledging yesterday that while growth is cooling and inflation progress has stalled above their 2% target, the FOMC remains "well-positioned to wait" before changing rates, prioritizing economic data over political pressure. This fundamental conflict between Trump's short-term political agenda (lower rates to stimulate growth) and Powell's long-term price stability and full employment mandate is further complicated by Trump's tariffs – which Powell described as "significantly larger than anticipated" with likely inflationary supply chain disruptions. The resulting market momentum clearly reflects this institutional tug-of-war: GOLD surging BULLISH to $3,300 ATHs as a traditional policy uncertainty hedge, Bitcoin flipping to NEUTRAL (from BEARISH) as it navigates conflicting signals, while ETH, S&P 500, and NASDAQ remain decidedly BEARISH amid fears that neither side will successfully navigate the economy toward a soft landing.

TLDR: Powell's commitment to Fed independence and data-driven policy is clashing with Trump's demands for politically-motivated rate cuts, creating an institutional power struggle that has investors seeking refuge in gold while keeping Bitcoin in a neutral holding pattern.

What This Means for Risk Assets

While markets appear to be stabilizing amidst this institutional power struggle, the fundamental tension between Powell's data-driven approach and Trump's politically-driven agenda will likely cause more volatility in risk assets. We expect equities to eventually retest recent lows once Wall Street analysts finally cut their overly optimistic sales, earnings, and GDP estimates to align with Powell's more cautious economic outlook rather than Trump's optimistic rhetoric. Bitcoin's recent resilience compared to equity markets is encouraging for the "decoupling" thesis, but it clearly hasn't achieved the same safe-haven status as gold, which has thrived amid the uncertainty created by Trump’s tariffs and de-dollarization. The Fed has made it clear that political pressure alone won't trigger rate cuts unless inflation data also supports such moves, with Powell emphasizing that tariffs deliver a "one-time price jump" that actually complicates their already challenging policy path. The recent volatility in the 10-year Treasury yield – from 3.7% up to 4.5% and now back to 4.3% – underscores how the bond market is struggling to price in both recession risks and Trump’s public pressure on Fed independence, creating an environment where traditional correlations are breaking down and asset-specific dynamics are increasingly dominant.

TLDR: Risk assets face near-term pressure but Bitcoin's neutral momentum suggests it may weather the storm better than traditional markets, though not as well as gold's bullish trend.

Where Are Bitcoin's Key Price Levels?

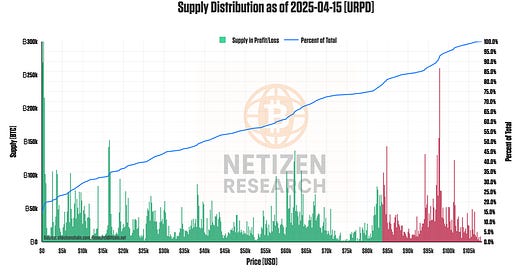

Bitcoin's supply distribution shows approximately 75% of circulating supply remains in profit despite recent volatility – a critical threshold that historically separates bull and bear market regimes, with readings above this level typically sustained during bull markets and rejections from this level confirming bear markets. The past week's consolidation has formed a new supply concentration range between $80-85K, creating a significant resistance zone as these holders may look to exit at breakeven or slight profit. The price is finding additional technical resistance at its 200-day moving average of $87.5K while remaining below the short-term holder cost basis at $92.9K – a level we believe must be reclaimed to validate any sustainable rally. A break below $80K would likely accelerate towards $70K as the air gap between $70-75K (where fewer coins changed hands) gets filled, making this current range a critical decision zone for Bitcoin's next directional move.

TLDR: Bitcoin is consolidating in the $80-85K range with key resistance at the 200DMA ($87.5K) and STH cost basis ($92.9K) overhead, while a break below $80K would likely trigger acceleration down to the $70K support zone.

Why This Isn’t The Bottom: LTHers Remain Profitable

Long-term Bitcoin holders remain in a position of near-universal profitability, with on-chain data showing virtually 0% of LTH supply underwater – a condition that historically precludes this being a bear market bottom. Bitcoin cycles typically bottom when long-term holders begin capitulating and showing significant unrealized losses on their investments, which is completely absent in the current market structure. This gives us confidence that we're experiencing either a bull market correction or potentially the early innings of a bear market, with Bitcoin consolidating in a range while awaiting clearer macro policy direction from both the Fed and Trump administration.

TLDR: The absence of long-term holder capitulation contradicts historical bear market bottom patterns, suggesting we're in either a bull market correction or the early phase of a bear market.

Is Spot Demand Strong Enough for a Sustained Rally?

Today's futures positioning indicates a "Spot Rally" quadrant, where price increases despite deleveraging in the futures market – an encouraging shift from the leverage-heavy patterns that created vulnerability to April's cascading liquidations. While this transition toward spot-driven price action is a positive development, we would need to see more consistency and substantially less leverage in the market to get behind a durable rally in Bitcoin. Until we observe stronger and more persistent spot demand across multiple trading venues, we remain cautiously neutral on Bitcoin's near-term prospects, requiring clearer evidence of institutional spot accumulation before turning constructive on the asset.

TLDR: Bitcoin's evolving market structure shows a shift toward spot-driven price action, but we need to see more consistent spot demand and reduced leverage before gaining conviction in a sustainable uptrend amid policy uncertainty.

Your Edge in Bitcoin Accumulation

Our Dynamic DCA model has historically outperformed traditional dollar-cost averaging by ~30% over multi-year periods. For just $10/month, access our premium research and rigorously back-tested accumulation strategy that adapts to market conditions using on-chain data, helping you stack Bitcoin smarter.

In the coming weeks, we will also be creating a new chart suite and investor dashboard exclusive to premium members, giving you a full recap of macro and on-chain metrics we're seeing and opportunities in the market. Your support helps fund this development! Consider subscribing.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.