War Fears Fade, Risk Assets Surge

The Middle East ceasefire has removed the biggest geopolitical tail risk hanging over markets, with the S&P 500 climbing to $6,100 and oil retreating from crisis highs this week. What was supposed to be a market-crushing "12-day war" barely registered as a speed bump, proving that investors are not only under-invested, but looking forward to future macro catalysts. In our view, the failed war shock actually strengthens the case for a continued RISK-ON regime, as stagflation risks recede and the GOLDILOCKS market stays intact. With crude oil currently oversold, we may have just witnessed a peak in energy-driven inflation pressure for now. While there's no guarantee this ceasefire holds, markets clearly aren't fearful, as evidenced by the VIX down 20% in just five days.

TLDR: Geopolitical risk premium evaporating supports Bitcoin's rebound from last weekend's lows to $108,000.

Trump Demands Rate Cuts, Markets Listen

If war fears can't derail this bull market, we suspect Trump's Fed pressure campaign is about to supercharge it instead. His latest Truth Social blast demanding "two to three points lower" rates and calling Powell "incompetent" isn't just political theater, it's economic policy signaling that markets are taking seriously. USD money markets now price a 25 basis point Fed cut for September, with the US dollar softening as investors position for easier monetary policy ahead of Powell's likely dovish replacement next year. Trump's plan to reduce US govt debt is grounded in classic real estate economics: when you have too much debt, grow the equity faster than the debt grows through fiscal spending and cheap money. The combination of his One Big Beautiful Bill Act plus a more dovish Fed chair creates the perfect recipe for a structural melt-up in asset prices, a considerably weaker dollar, and Bitcoin benefiting as the ultimate dollar hedge.

TLDR: Fiscal stimulus plus dovish Fed replacement sets up structural US dollar weakness and asset price melt-up.

Bitcoin Rallies 10% on Ceasefire

Bitcoin's weekend dip to $98k wasn't panic, it was precision. The price tagged our predicted support zone where three critical levels converge: Short-Term Holder cost basis at $98.3k, the 200-day moving average at $96k, and Long-Term Holder supply peak at $97.7k with 325k BTC sitting there. We flagged $96-98k as major support last week, and the post-ceasefire relief rally delivered a quick 10%+ surge to $108k that caught leveraged shorts off-guard. With Bitcoin able to withstand the sell-off down to $98K and GOLDILOCKS risk-on conditions intact, we believe all-time highs are back in play.

TLDR: Bitcoin's bounce from $98k support confluence signals a path back to all-time highs is reasonable.

Momentum Positively Inflects After 1-Month Slide

The AVIV Gradient Oscillator shows momentum turning a corner after weeks of deceleration. After peaking at 0.57 on May 25th (right near Bitcoin's cycle highs), it steadily decelerated to 0.10 on June 24th while remaining in positive territory throughout the decline. On a scale of -1 to 1, we're now at 0.15 and climbing, marking just two days of positive inflection after that month-long deceleration phase. While it's still early to determine if this turn proves durable, this positive inflection powers our Bitcoin investment strategy and represents the first encouraging momentum signal we've seen in weeks.

TLDR: Just two days of positive momentum inflection after a month-long slide is encouraging but still early to call a durable turn.

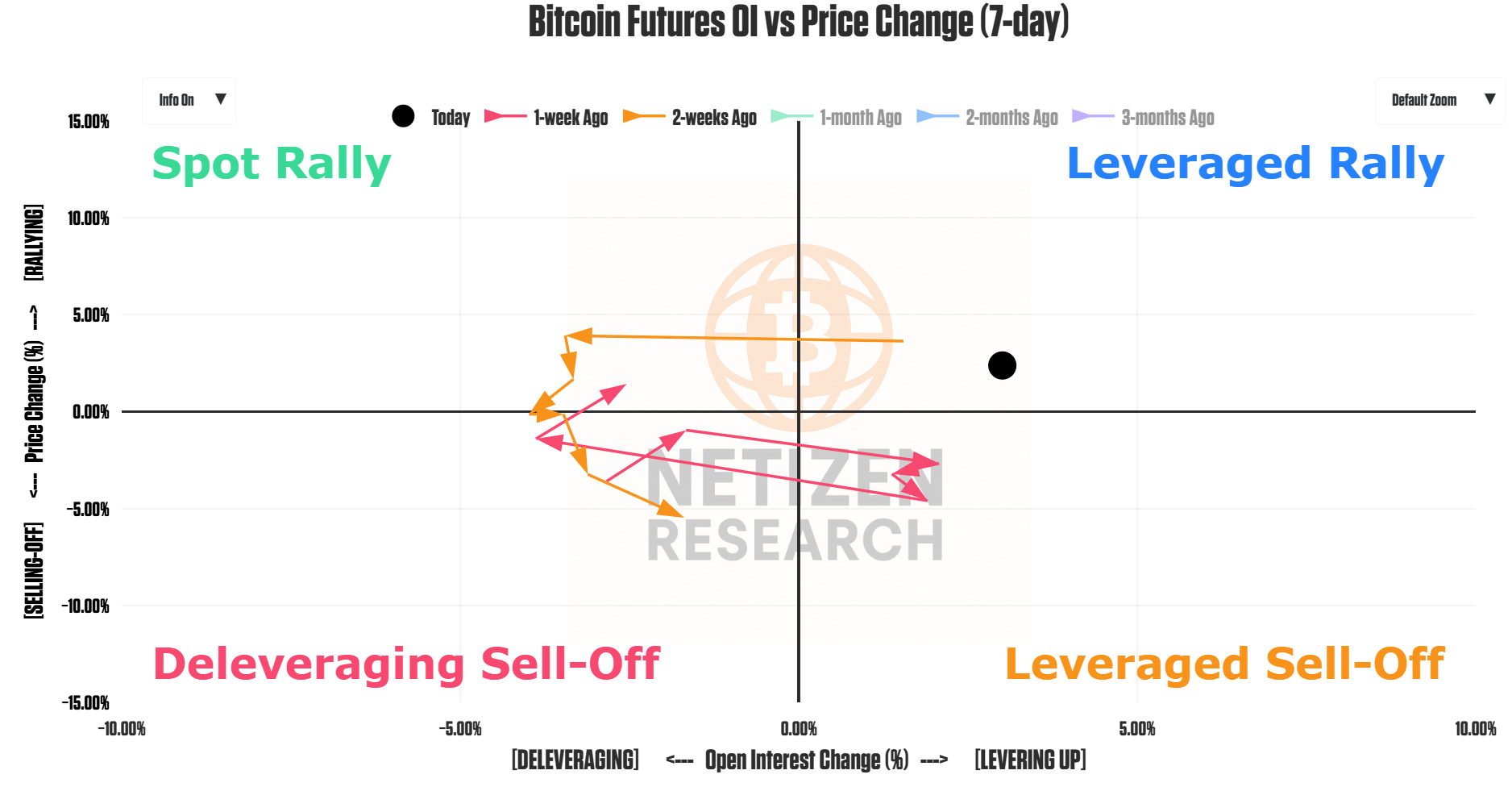

Leverage Returns With Spot Backing

After two weeks of oscillating between leveraged rallies and deleveraging sell-offs, Bitcoin leverage is starting to grow as price increases. A clear underlying bid from ETFs and Bitcoin Treasury companies provides structural support, with ETF inflows hitting $1.4B in the week ending June 15th, $1.0B the following week, and $0.94B in just the partial week ending June 25th. Sharks (100-1k BTC holders) have added 68k BTC over the last 30 days while Fish (10-100 BTC) grabbed another 18k BTC, confirming this smart money accumulation pattern. While short-term traders employing leverage will likely dominate near-term price moves, this underlying bid continues to support Bitcoin's long-term trajectory and reduces the risk of major liquidation cascades.

TLDR: Strong ETF demand and Shark/Fish accumulation provide a solid foundation that reduces leverage-driven downside risk.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.