In September, the S&P 500 broke June 2022 lows and has since retraced slightly above $3,600. The sell-off followed the August CPI print, which supported our hypothesis for sticky and stochastic inflation, as core, median, and sticky CPI all re-accelerated on a MoM annualized basis. With inflation no longer expected to linearly return to 2%, investors are finally beginning to believe the resolve of the Federal Reserve, whose monetary policy is set to be tighter for longer.

Across the pond, divergent monetary/fiscal policy and the energy war vs. Russia have led to historic government bond volatility, causing significant stress on the global financial system. This month we saw the Bank of Japan intervene to protect the Japanese Yen. We also saw the Bank of England implement “temporary” quantitative easing after several U.K. pension funds nearly failed due to rising bond yields.

With that backdrop, let’s jump into our economic and market outlook.

Outlook (TLDR)

Short Term (< 1 month)

Our top-down analysis is pricing in INFLATION (45%) and DEFLATION (36%) as the dominant market regimes, which is consistent with our view of the global economy, given slowing growth and persistent inflation. With equity markets underhedged from an options perspective and the VIX (equity volatility) over 30 and the MOVE (bond volatility) near 150, we view asset markets as particularly fragile. In addition, the non-farm payroll numbers from last Friday confirmed our view that the labor market is still overheating and a 5.5% (all-time high) employment cost index will likely continue to pressure inflation in the coming months.

Looking ahead, an upside surprise from September CPI on Thursday could be the catalyst to drive another leg lower in asset markets. On energy, oil is set up for a gamma squeeze higher following the OPEC+ production cuts, which could be disastrous for near-term inflation expectations. That said, we do not believe 3Q earnings will be as negative as some investors expect. While the continued USD strength will weigh on multi-national companies, we do not believe the near-term profits cycle is at-risk yet. We suspect an earnings recession will be a 2023 story.

We believe we have entered a window of crash risk, and investors would be wise to de-risk and/or short risk assets from here. The Fed remains intent in its fight against inflation, despite what other Central Banks are doing, which will continue to strengthen the USD and weigh on USD-denominated assets.

Medium Term (2-6 Months)

Our bottom-up analysis estimates DEFLATION (73%) and INFLATION (23%) as the dominant macro regimes over the next 6 months, which historically is a risk-off environment. It appears that good economic news is now bad for markets, as a more resilient economy gives the Federal Reserve cover to aggressively tighten monetary policy without risking an immediate actual recession.

The risk/reward on our Net Liquidity analysis is skewed to the downside, as our bear case calls for $3,200 and $12,000 on the S&P 500 and Bitcoin, respectively, by year-end. For context, we’re currently trading around our base case of $3,600 and $17,500 on the S&P 500 and Bitcoin, respectively, by year-end.

Based on the recent global bond market volatility and persistent inflation dynamics, we believe investors should prepare for higher bond yields globally, which will put pressure on risk assets as investors choose to reallocate money in favor of bonds as we move into 2023.

Long-Term (6-12 Months+)

Netizen’s investment thesis is that the fiat currency world, supported by debt and political power, will shift towards market-based money, as has always occurred at the end of empires. We believe the Great Power competition between the West (U.S., Europe, Japan, etc.) and East (China and Russia) will result in a sovereign debt crisis and usher in a multi-polar world.

We believe COVID-19 and the escalating Great Power Competition have ended an era of cheap energy, labor, and goods – which will keep inflation firmly elevated above the Fed’s 2% target in the coming decade. As long-term inflation expectations rise, we would expect global bond yields to re-rate higher which will pressure global liquidity, given bonds are the largest source of collateral in the modern financial system.

With the Bank of Japan, the European Central Bank, the People’s Bank of China, and now the Bank of England all easing monetary policy (to various degrees), the Federal Reserve is the only major Central Bank still tightening. This is putting immense upward pressure on the USD relative to other fiat currencies, which historically has led to deflationary shocks.

We believe the world is quickly inching closer to a global sovereign debt crisis, and investors are impatiently waiting for the Federal Reserve to blink. Our investment outlook hinges on the actions of the Federal Reserve. Are we watching the Volcker-led Fed of the 1970s, or are we about to witness the 1930s Fed, which stepped aside and allowed catastrophic deflation to reset the global economy? We don’t know yet, but we are watching closely.

The Fed Is Projecting An Actual Recession

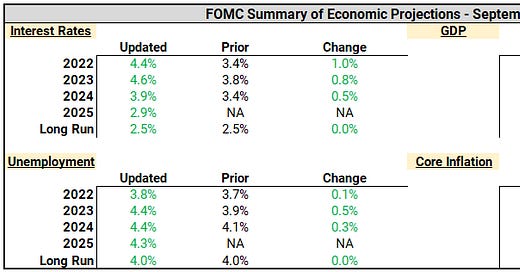

Following the hotter-than-expected August inflation print, the Fed raised interest rates by another 75 bps during their September FOMC meeting. The September meeting also included an updated summary of economic projections (SEP), which saw interest rates, unemployment, and core inflation estimates all revised higher and GDP estimates revised lower. If you’ve been following our notes all year, these revisions shouldn’t come as a surprise.

Based on the magnitude of the revisions, we have evidence the Federal Reserve is explicitly guiding toward an actual recession by the end of 2023. Specifically, when we look at historical data going back to the 1940s – we have never seen a 90-bps increase in the unemployment rate over 15 months (Sept 2022 – Dec 2023) without seeing an actual recession. Furthermore, we’ve also never seen a 180 bps decrease in core inflation without seeing an actual recession as well.

Of course, it’s important to remember the Fed’s SEP are only estimates and hardly ever line up with reality. That said, it’s alarming the Fed (which likes to proactively manage market expectations) is transparently projecting an actual recession, and we think this is a warning sign for investors to brace for the impact of a hard landing. This is consistent with our bear case scenario – people will lose jobs, growth will slow, and the cost of living will persist. Consider yourself warned.

Source: Netizen Capital & Federal Reserve

The Dollar Is King

With the Federal Reserve now projecting the Fed funds interest rate to be 4.4% by the end of 2022 and 4.6% by the end of 2023, markets are officially pricing in tighter monetary policy for longer. Traditional macroeconomics teaches us that interest rate differentials drive the value of fiat currencies, meaning, if the U.S. Fed funds interest rate is higher than the European Union, then the USD should strengthen relative to the EUR. However, there is no historical evidence for this – and in fact, we generally see the USD rise when foreign Central Banks sell U.S. Treasuries.

This is problematic because there is over $13 trillion of USD-denominated debt issued by foreign Central Banks, comprised of both bank loans and USTs. Given the global dollar shortage, foreign entities need to sell USTs to pay down debt, settle trade imbalances and prop up their currencies (ie/ Japan), which further exacerbates USD strength and pressures global liquidity.

According to the Bank of International Settlements (BIS), UST market liquidity conditions are at similar levels to the 2008 GFC. Given that was when Lehman failed, we are concerned trouble may be brewing in global investment banks, like Credit Suisse which recently saw their credit default swaps rise significantly following concerns around liquidity. In addition, the United Nations’ 2022 Trade and Development Report called out that the Federal Reserve’s monetary policy is leading the world into a period of stagflation and economic instability.

If the Fed continues to tighten monetary policy and foreign Central Banks continue selling USTs to fund dollar shortages, we expect the USD to strengthen against most foreign currencies. Its clear equity, bond, and currency markets are very volatile and fragile, and we would caution investors to be very disciplined with their risk management right now. If you are unsure what to do, hold USDs.

Source: Eurodollar University

Bank of Japan Intervenes To Protect JPY

It now appears the Fed’s fight on inflation is beginning to backfire on its allies. On September 21, the 10Y Japanese bond stopped trading for the first time since 1999, prompting the Bank of Japan to intervene to artificially prop up its currency by buying JPY. We view this as a pivotal moment in macroeconomics, as Japan has now shown its playbook to attempt to undermine the Fed’s tight monetary policy.

With the Bank of Japan owning $1.23 trillion of USTs, and having sold only $70 billion in USTs YTD, it appears the BoJ has more firepower to sell USTs to buy JPY. That said, this is a double-edged sword. If a government caps its bond yields, then the currency is the release valve. You can’t cap you’re your government bond yields and currency forever. At some point, the system breaks.

With foreign Central Banks holding $7.5 trillion of USTs in aggregate, we believe more foreign governments will begin selling USTs in the coming quarters, which will raise UST yields and ironically strengthen the USD over time. Specifically, we view the BoJ as trapped in a currency death spiral, which may eventually strain U.S.-Japanese relations.

Source: Netizen Capital

Bank of England Implements “Temporary” QE

On another episode of how foreign central banks are failing, we’d like to discuss the near collapse of several U.K. pension funds. Earlier this month, Liz Truss was announced as the new British Prime Minister. Only one week into office, she announced a foolish fiscal stimulus plan to help families and businesses with higher energy costs (due to Russia) while also aggressively cutting taxes – all while the Bank of England is trying to fight 10% inflation.

As a result, the GBP weakened considerably, and U.K. government bonds began to sell off aggressively, in anticipation of an even larger sovereign budget deficit. As a result of the currency weakness and bond sell-off, several U.K. pension funds began to get margin called as they were required to sell assets to raise cash to fund their levered bond positions. The margin calls caused a spiraling fire sale of 30Y U.K. government bonds and forced the Bank of England’s Financial Policy Committee to step in with temporary quantitative easing to prevent the pension funds from failing.

We continue to see cracks in the modern global financial system, as monetary policy (tightening) diverges from fiscal policy (easing). We are extremely concerned that U.S. monetary policy is breaking the economy of U.S. allies. We’re unsure how this plays out and note that the USD is the best currency to hold for now.

Source: Netizen Capital

ECB Continues QE As Trade Balance Worsens

Finally, I want to discuss the brewing disaster that is the European Union. The ECB has been quietly using its pandemic-era bond-buying program (QE) to shield highly indebted Eurozone countries from the Central Bank’s decision to fight inflation. Between June and July 2022, the ECB injected €17bn into Italian, Spanish, and Greek debt markets, while allowing its portfolio of German, Dutch, and French debt to fall by €18bn. Essentially, the strong Eurozone nations are subsidizing the weaker ones.

However, following Russia’s invasion of Ukraine, Europe’s trade balance (particularly due to energy markets) is weakening considerably, which has weighed on the Euro. Given Germany has long served as the economic engine of the Eurozone and is now seeing manufacturing come to a halt as energy prices rise, it begs the question of how the ECB will continue to support Italian, Spanish, and Greek debt markets.

Like Japan and the U.K., we believe the European Union is structurally compromised, as the Eurozone experiment seems to be imploding on itself. Without energy sovereignty, we find it unrealistic that Germany will be able to carry the Eurozone economy and subsidize bankrupt nations. It appears that both a hawkish Federal Reserve and the Great Power Competition vs. Russia/China are breaking the economies of U.S. allies.

Source: Netizen Capital

Physical Gold Deliveries Hit 30-Year High

With the JPY, GBP, and EUR all in free fall vs the USD, it makes us once again question the validity of fiat currencies. Of course, this is central to the thesis of Netizen Capital, however, the Russians are wise to this idea as well. Recall earlier this year Russia’s Central Bank said that due to a significant change in market conditions, it would now buy gold from commercial banks at a negotiated price. In a world where bankrupt nations back fiat currencies, Russia seems to be the only country that understands energy and commodities (the master inputs to any economy) are the only things that truly have value.

According to the commodities exchange COMEX, weekly physical gold deliveries broke a 30-year high range ceiling by nearly double! Based on estimates, the current paper gold market (futures, ETFs, etc) is 100x larger than the physical gold supply available. This means that many people who think they own gold, don’t. And when push comes to shove (ie/ when governments start fighting over a true neutral reserve asset), those with paper gold are going to be left behind, while those with physical gold in vaults are going to rewrite the rules.

It appears there is an immense bid for the analog world’s neutral reserve asset. Though we’re unsure of the buyer (central banks, commercial banks, hedge funds, high net worth individuals, etc.), it is clear there is a correlation with the problems we see in Japan, Europe, and the U.K. While gold is one way to play the collapse of fiat, we believe Bitcoin will soon emerge as the digital world’s neutral reserve asset.

Source: Luke Gromen & FFTT LLC

Bitcoin Miners Under Financial Stress

Speaking of Bitcoin, tighter monetary policy has led to less global liquidity, which as we’ve discussed before weighs on the price of all risk assets, including crypto, and Bitcoin. As miners become more efficient and competition increases, the cost of production per unit of BTC increases. BTC-denominated rewards are currently at an all-time low of 4.06 BTC per Exahash per day.

Interestingly, the log-log regression between Difficulty and BTC market cap has an exceptionally high correlation of 0.944, which gives us a basis to estimate the price at which miners come under financial stress. Currently, the estimated cost of production is at $18,300, meaning many BTC miners will likely become forced sellers if we stay under that price for too long.

A new valuation framework proposed by Glassnode analyst kuntah fits a non-linear relationship between the cost of production and the input parameters of Difficulty and Issuance. The model estimates that the bear market floor estimated cost of production is $12,140 – which interestingly aligns with our net liquidity analysis.

While this is all theory, it’s directionally helpful to put numbers around the price action of Bitcoin. Given there is an airgap in supply ownership between $12,000 and $18,000, we believe Bitcoin may be primed for a leg lower here in the coming quarter or so. We will begin to aggressively allocate towards Bitcoin if we break below $13,000.

Source: Glassnode

Bitcoin Volatility Is A Coiled Spring

Given equities and bonds were able to break through their YTD lows, we find it curious that both Bitcoin and Ethereum have held up on a relative basis. In fact, BTC volatility has been compressing to historically low levels, while equity, bond, and currency volatility continues to expand.

If history is any indicator, we believe we’re on the precipice of a large directional move in BTC and ETH in the coming quarter. BTC volatility has only been below 25 on three occasions in the past 5 years:

October 2018 (bearish) – when the Fed was tightening monetary policy

March 2019 (bullish) – when the Fed paused raising interest rates and later in the year began cutting after the Repo crisis failure

July 2020 (bullish) – when the Fed was aggressively easing monetary policy post-COVID

Given the outlook of Fed policy and the macroeconomy, we believe the next move will be lower. This is not the environment to be risk-on, even though we think Bitcoin is the antidote to failing Central Banks. We recognize the world is not yet caught up to our view on this and believe it will take a lot more pain for institutions and countries to abandon the current monetary system.

Source: Kruger Macro

Final Thoughts

If there’s one takeaway from this letter, it’s that the USD is breaking global sovereign debt markets and will likely continue to put pressure on risk assets until the Fed pivots its hawkish monetary policy. Short risk = long USD. In the post-WW2 era, a strong USD has always led to deflationary shocks in the global economy, and we don’t expect this cycle to be any different.

Source: Netizen Capital

The failure of the BoJ, BoE, and ECB are on full display for the world to see. The Federal Reserve and foreign central banks are all over-indebted with no reasonable way out. As politicians come under pressure from social angst, fiscal policy will diverge from economic reality (ie/ British PM Liz Truss proposing fiscal stimulus with 10% inflation). We maintain our view that the United States is the best house on a terrible block, which will lead to foreign policymakers capitulating before the Fed and U.S. Congress.

That said, our global fiat system is inextricably connected, and all paths lead to further monetary and fiscal stimulus to keep the mob happy. We remain convicted that Bitcoin, gold, and other commodities (including energy, food, and metals) will likely be the best investments this decade. Until then, however, tread cautiously. We believe there is more downside from here, but are ready to buy aggressively if we start sensing capitulation in markets.

- Netizen Velez