In November, Bitcoin had its worst month (-16.2%) since June 2022, falling to as low as $15,500, brought down by the collapse of the third largest crypto exchange FTX and its subsequent contagion. In addition, higher network hash rate, higher energy costs, and lower Bitcoin prices have led to accelerated selling pressure from distressed Bitcoin miners. While Bitcoin stabilized around $17,000, we’re still concerned about further insolvencies in the Bitcoin and broader crypto industry in the coming months. As such we do not think this is the cycle bottom in Bitcoin. That said, with the short-term holder costs basis below Bitcoin’s realized price, BTC is historically oversold.

Meanwhile, the S&P 500 had another strong month (+5.4%) in what we suspect is yet another bear market rally. With the S&P 500 bouncing off its 200-day moving average ($4,100) with volatility and the dollar oversold, we believe TradFi investors are FOMOing into market year-end praying for a Fed pivot. Like August 2022, we believe investors are misinterpreting October’s better-than-expected inflation number as a bullish signal. Given the magnitude of deceleration in October inflation, it’s statistically likely that November’s inflation print surprises to the upside and catalyzes an increase in cross-asset volatility, higher terminal Fed Funds rate, and risk-off behavior.

With that backdrop, let’s jump into our key takeaways.

Outlook (TLDR)

Tactical View (< 6 months)

Near-term, our research indicates November inflation is statistically likely to surprise to the upside, which may cause Fed Chair Jerome Powell at the 12/14 FOMC meeting to triple-down (quadruple-down?) on hawkish rhetoric. We’ll receive an updated Fed summary of economic projections, which will give us more insight into the path of interest rates, as well as their expectations on growth and unemployment. With the Atlanta Fed tracking 4Q GDP at 3.2% (after +2.9% in 3Q), it’s obvious the U.S. economy is booming on a lagging and coincident basis. While leading indicators, such as the 10Y3M yield (-80 bps inverted!) are giving us serious concern, our study of history suggests the 2023 recession may be a second-half story and is not an imminent threat.

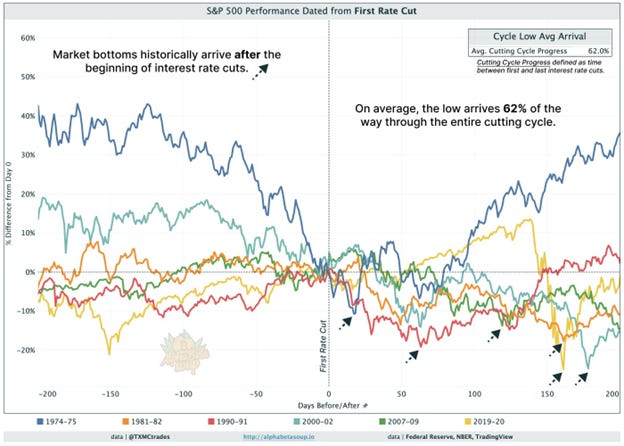

With risk assets (besides Bitcoin and crypto) overbought, we suspect net liquidity and negative macro data will take markets lower in the coming month or two. Without credit risk though, it’s unlikely this will be the ultimate bottom, and we’re likely to see a recovery in risk assets (to lower highs) during 1H23. However, we would not expect a true bottom until after the Fed pivots (pause or cut), which is currently being priced for June 2023. This lines up with our views that an actual recession is unlikely to begin until 2H23, which is when we would expect to see risk assets (including Bitcoin and crypto) finally bottom. The key takeaway here is that markets don’t move in straight lines, and we’ll likely see another bear market rally before an actual recession brings the ultimate market bottom in 2H23.

Secular Views (> 1 year)

We say this every month but it’s worth repeating. Our investment thesis is that the fiat currency world, supported by debt and political power, will shift towards market-based money, as has always occurred at the end of empires. And although gold worked in an analog world, we believe this new market-based money will be a Bitcoin standard, and we try to think of all our investments priced in BTC. While Bitcoin is unfortunately perceived as a risk asset, it’s the truest proxy of global liquidity, and in our view is the risk-free asset of the future. Historically, Bitcoin appreciates when net liquidity expands and conversely declines when net liquidity contracts. Liquidity of course is influenced by both monetary (the Federal Reserve) and fiscal policy (Congress). Given persistently high inflation, the Fed and Congress are trying to aggressively contract liquidity without putting the global Eurodollar system at risk. This is an incredibly difficult challenge to balance and one we think will ultimately fail.

If we look at history, every fiat currency that has ever existed has devalued to zero vs. real assets, as sovereign debt becomes unsustainable and money printing is the only solution to prevent cascading defaults and societal collapse. We believe the USD is not immune to this fate, and Bitcoin will eventually replace fiat money as a neutral global reserve asset (like how gold was a neutral global reserve asset in centuries past). With Bitcoin's short-term holder cost basis below its realized price, Bitcoin is historically oversold, and potentially offers asymmetric returns on time horizons longer than 1 year. While we believe there is more tactical downside ahead, long-term HODLers would do well to buy at current levels.

Insitutions Are Capitulating Bitcoin

Institutional crypto investors have endured catastrophic pain in the 2022 bear market. While the Terra/LUNA collapse and subsequent Three Arrows Capital failure saw the total crypto market shed $807 bn of total market cap in May and June combined, other crypto companies were quietly insolvent. Six months later the third largest crypto exchange by volume, FTX (along with its sister hedge fund Alameda), also failed, leading to another $150 bn of crypto market cap destruction in November.

As such, we’ve seen forced liquidations from institutions across all digital assets, including Bitcoin. Remember, when crypto companies face a liquidity crisis, they must sell whatever assets they hold on their balance sheet, including BTC, ETH, etc. Pivoting specifically to Bitcoin, when we look at the rate of BTC accumulation/selling by investor cohort, we notice that while much of the selling during the FTX crash came from whales (BTC wallets holding more than 10,000 BTC), it was smaller-sized accounts that were aggressively buying the dip. The irony here is that most institutions buy BTC thinking they’re long-term HODLers, but when push comes to shove it’s the smaller investors who have true conviction. This behavior suggests most institutions view Bitcoin as an investment, while real Bitcoiners are ideologically driven.

Source: Glassnode (Checkmate)

Bitcoin Is Redistributing to Netizens

The Bitcoin bull case in 2020/2021 was centered around money printing and institutional/nation-state adoption. Institutional adoption is a double-edged sword. While on one hand, it’s incredible to see the Bitcoin grassroots effort begin to be taken seriously, it can also lead to the consolidation of power and wealth by the world’s elite – the exact opposite of what Bitcoiners want.

Bitcoin is a silent protest against the centralized government's monopoly of money. At a recent Bitcoin conference in Africa, Jack Dorsey said the following regarding Bitcoin:

“The goal <of Bitcoin> is to help the internet realize a native currency, an open money we can all see, we can all trust, that’s not controlled by a government or corporation.”

The recent FTX crash was a positive event for the world, as Bitcoin is now being redistributed to netizens all over the world. In November, wallet addresses holding less than 1 BTC (ie/ regular people) accumulated the most BTC ever in any given month (+96.2k) and now collectively hold over 1.2 million BTC, equivalent to 6.3% of the circulating supply. This behavior suggests that there is a passive bid from regular everyday Bitcoiners who believe in an open, transparent, and fair monetary system.

Source: Glassnode (Checkmate)

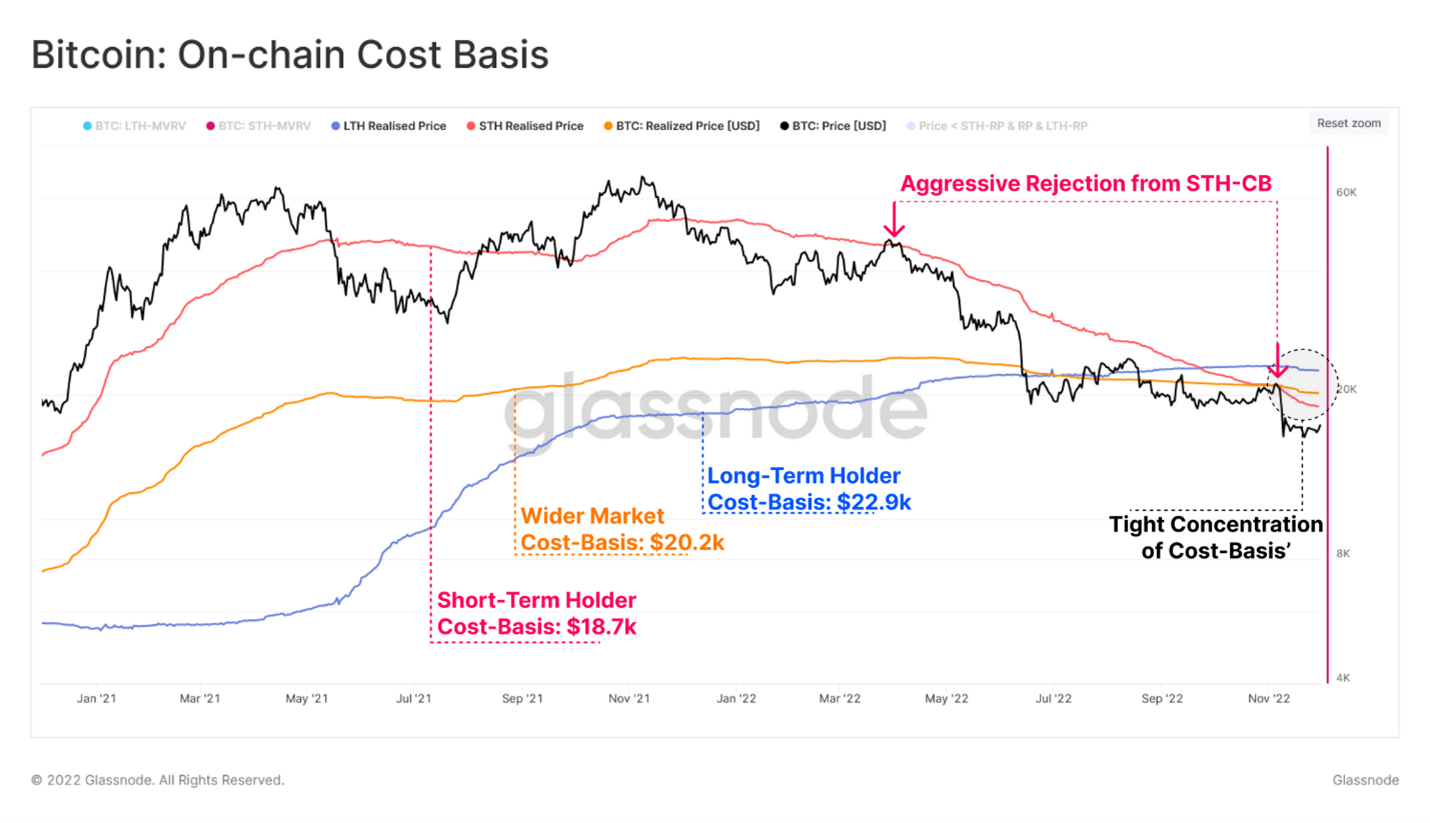

Bitcoin In Search Of A Bottom

With Bitcoin’s price below both the short-term holder (STH) cost basis and realized price (aggregate cost basis), we’re officially in the Floor Discovery phase (shaded red). Historically, the STH cost basis acts as a floor during bull markets and a ceiling during bear markets. During the early stages of a bear market, the price of Bitcoin falls below the STH cost basis but remains above the realized price, in what’s known as the Pre-Bottom Discovery phase (shaded green). However, after an extended bearish trend, the price of Bitcoin falls below the realized price, known as the Bottom Discovery phase (shaded yellow).

Looking back at previous cycles, the Floor Discovery phase can last anywhere from 2-10 months. Based on previous cycles, purchasing Bitcoin when the price is both below the STH cost basis and realized price yields asymmetric returns on any time horizon longer than 1 year. Therefore, if you are not a tactical investor, we highly encourage you to increase your dollar-cost averaging to take advantage of this historic window.

That said, with the FTX contagion unknown and macroeconomic headwinds still ahead of us, prices may continue to go lower from here. It’s important to acknowledge Bitcoin has never experienced a global liquidity contraction of this magnitude, so tactical investors would be wise to remain cautious while slowly building up a position.

Source: Glassnode (Checkmate)

BTC Overhead Resistance At ~$20K

For Bitcoin to exit its bearish trend, we would need to see BTC spot price > realized price (20.2k). During bear markets, investors who are in an unrealized loss on their investment usually try to get out at their cost-basis, creating a natural ceiling in markets. If the STH cost basis breaks below the realized price, it means long-term holders are capitulating and new short-term holders are acquiring BTC at lower prices. Given the concentration of the STH/LTH cost basis and realized price we suspect the $18.7k - $22.9k range will serve as strong overhead resistance.

Source: Glassnode (Checkmate)

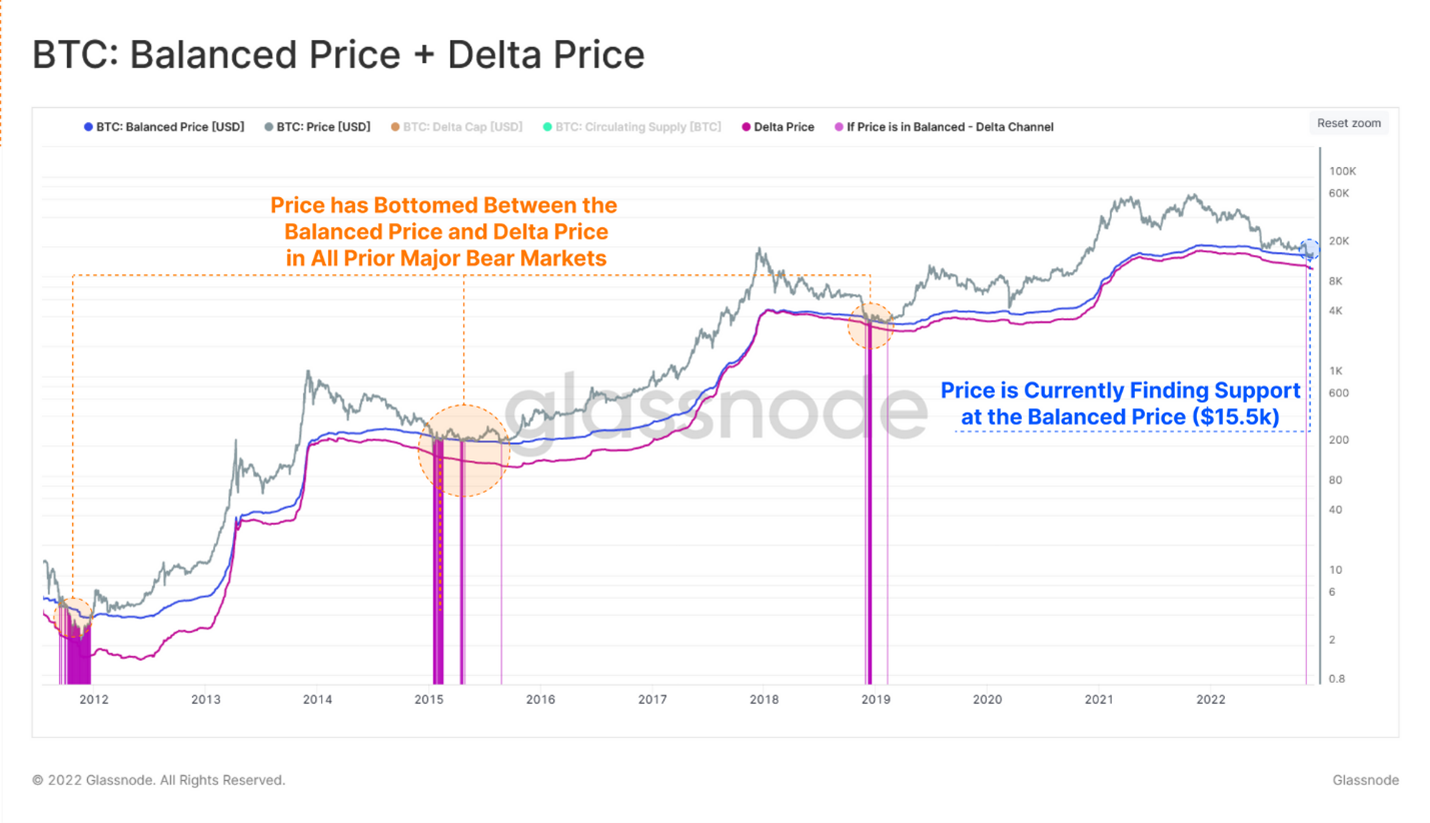

BTC Floor May Be Closer To ~$12K

Although Bitcoin is objectively undervalued, the network cost basis model shows that Bitcoin can reach as low as its delta price (12k). In all prior bear markets, Bitcoin’s price has traded between the balance price and delta price, with only 3% of trading days occurring within this range. The delta price is defined as realized cap – average cap / circulating supply. While this is an experimental pricing model that has worked with a sample size of n = 3, we believe the FTX contagion and macro headwinds may be the right catalyst to fuel further downside to this lower level. For those who don’t recall, Bitcoin’s price distribution has an air gap between $12k and now $15k (then $17.5k). This is not to say we must trade to $12k, but we think investors should be aware of the downside risk.

Source: Glassnode (Checkmate)

FTX Contagion Is Still Spreading

Over the past month, more cracks have begun to emerge in crypto, exposing the shaky foundation the entire industry was built on. Following the FTX collapse, Genesis Lending (a subsidiary of crypto conglomerate Digital Currency Group) is now exploring restructuring or bankruptcy after suspending withdrawals citing liquidity issues. This could have catastrophic implications on DCG’s crown jewel, Grayscale Bitcoin Trust, which is the largest publicly traded crypto fund. A week later, the $3 billion crypto lending platform BlockFi filed for bankruptcy. The FTX web is far-reaching, and we believe that many more dead bodies (companies) will float to the shore in the coming months. If there are further institutional crypto bankruptcies, we expect all digital assets (including BTC) held on balance sheets to be force liquidated in the open market. So, while Bitcoin is indeed objectively a BUY, we suggest mentally preparing for further downside.

Source: The Information Reporting

The Fed Remains Market Enemy #1

Despite FTX, the real enemy of financial markets continues to be the U.S. Federal Reserve, whose intent on tightening monetary policy to fight inflation has still not been enough to slow down the booming U.S. economy. With the labor market extremely tight (1.7 job openings for every unemployed worker), private sector labor income has been growing nearly 2x the pre-COVID trend. This acceleration in wage growth, along with the trillions of dollars of COVID stimulus has led to one of the strongest aggregate household balance sheets in history. While economic classes are getting hit by inflation differently, the reality is that U.S. households have over $7.6 trillion in checkable cash in bank accounts (up $3.6 trillion since 2020). As a result, consumption remains resilient and debt burdens remain manageable for the total economy.

Given the strength of the U.S. economy, it’s unlikely we’re anywhere close to seeing core services CPI ex-shelter decline from its current 5.7% 3-month SAAR pace to the Fed’s 2% average inflation target. As we’ve discussed before in previous letters, while a recession is not imminent, it is inevitable in 2023, and in fact, the Fed is implicitly projecting an actual recession next year. As it relates to financial markets, however, markets have historically bottomed after a Fed pivot. To be clear, a Fed pivot is not a deceleration in tightening (75 bps to 50 bps) – it’s a pause or outright cut – which at the earliest is being priced in for June 2023. Therefore, we wouldn’t expect the bear market to hit its ultimate bottom until at least 2H23 – plan accordingly.

Source: Alpha Beta Soup (TXMC)

November Inflation May Surprise Markets

Last month October inflation came in cooler than expected, once again exciting investors that inflation is on its way back to 2%, meaning the Fed will pivot soon. Specifically, MoM core CPI increased 0.3% (lower than expectations) causing markets to rally in expectation of a 50 bps interest rate increase instead of 75 bps in the upcoming 12/14 FOMC meeting. Recall, however, the same thing happened in August of this year. July core inflation missed to the downside and markets rallied, foolishly expecting the disinflation process to be accelerated and autocorrelated. The opposite happened, as the August inflation print was hotter than expected, causing markets to sharply reverse. Even Fed Chair Powell admits he and his army of economic PhDs at the Fed don’t fully understand inflation.

As we called back in September, the disinflation process is sticky and stochastic. There will be ups and downs, but it is by no means a linear process. Once again, the magnitude of disinflation from the October inflation print has historically led to a reacceleration in inflation in subsequent months. As such, we expect the November inflation print on 12/13 to surprise the upside, which may catalyze a sell-off in risk assets. With the S&P 500 near 4,000, VIX near 20, and the DXY under 105 - we have all the makings of a bear market rally that is losing steam.

Source: 42 Macro (Darius Dale)

Final Thoughts - BTC Is The Risk-Free Asset

While we spend a lot of time discussing and risk-managing the macroeconomic environment, our investment philosophy is focused on the collapse of fiat money and the re-ordering of our monetary system around a Bitcoin standard. With the price of BTC now below both the STH cost basis and realized price, we believe it is a sin to not buy Bitcoin right now. Although we see the potential for more downside due to the FTX contagion and inevitable global recession, Bitcoin is a great long-term buy at current prices.

Over the past year, we’ve seen many crypto protocols and companies implode resulting in cascading bankruptcies and liquidations. The crypto industry (re: not Bitcoin) has been largely built on a house of cards, fueled by speculation, overleverage, and excess liquidity courtesy of the Federal Reserve. Despite all the disruption, Bitcoin remains unphased. No matter how many Ponzi crypto projects are uncovered in the coming months, one thing is for sure – 1 BTC will be mined every 10 minutes (until the next halving of course)

Bitcoin remains a fringe asset. Many investors are wary of Bitcoin, ignorantly associating it with other crypto protocols like ETH, SOL, DOGE, etc. (all of which are technically unregistered securities by the way). But Bitcoin stands on its own. There will be a day in the future when Central Banks begin to own Bitcoin on their balance sheets. In fact, Russian President Vladimir Putin recently called for the creation of an independent blockchain-based settlement network to combat the global financial payments system currently monopolized by Western banks. Meanwhile, Harvard PhDs are writing papers on how Central Banks could use Bitcoin to avoid international sanctions, which is the exact problem President Putin is complaining about. This is in stark contrast to the European Central Bank which recently put out an opinion piece on how Bitcoin is on “the road to irrelevance,” in a piece titled Bitcoin’s last stand.

So, whose assessment of Bitcoin is correct? The oppressed or the oppressor? I’ll let you think about that. My point is that the bull case for Bitcoin is playing out in real time despite the underlying price. Our view is that eventually, society (both individuals and institutions) will come to respect the value and utility of a sovereign monetary system. The choice is yours if you want to participate in the Bitcoin network or remain plugged into the fiat system that has done nothing but siphon wealth from the people it swears to protect for generations.

- Netizen Velez