In my last letter, I spoke about the secular and cyclical forces of growth and inflation as well as the Great Power Competition, specifically the West (the U.S. and Europe) vs. East (China and Russia). While I didn’t expect things to devolve so quickly, fast forward one month and now we’re all talking about a potential WWIII.

I started Netizen because I believe we’re living through history and wanted to create an investment vehicle to take advantage of the changing world order. By now I hope that’s evident and you’re paying attention. My thoughts and prayers go out to all my friends who have family members on both sides of the Russia/Ukraine conflict. Regardless of how the conflict is resolved, the reality is that there will be no winners.

With that, let’s jump into the macroeconomic and financial market implications of the recent geopolitical events.

Outlook (TLDR)

Short Term (< 1 month)

The U.S. economy still looks fine for now – however, that will soon be stress-tested in the coming weeks as we continue to see incremental inflation, employment, consumer spending, and confidence data. Now that the Omicron variant is largely behind us, recent manufacturing data has shown a re-acceleration in the global economy. However, given the uncertainty of further geopolitical escalation, it seems the market is largely shrugging off the positive data. This past week we also began to see hedge funds and institutional investors begin to lower their exposure to equity markets and rotate into defensive sectors (ie/ staples, utilities, healthcare, etc.). Smart money is beginning to question the growth outlook, in-line with our medium-term view. We would be selling/shorting any strength. Now is not the time to be positioned bullishly.

Medium Term (1-3 quarters)

As it relates to our Macro regime analysis, once we head into April, May, June, and beyond – the U.S. and global economy will be squarely in the DEFLATION regime, with YoY growth and inflation decelerating. Historically, this regime is disastrous for risk-assets (including pro-cyclical equities, high-beta equities, emerging markets, commodities, and crypto) and positive for risk-off assets (including consumer staples, healthcare, utilities, fixed income, gold, and the USD).

Based on backtesting, Bitcoin (-25.7%) and Ethereum (-71.4%) post by far the worst annualized expected returns when we see the following macroeconomic environment:

YoY Growth decelerates 2 std. deviations,

YoY Inflation decelerates 1 std. deviation,

Interest rates rise,

Fed balance sheet tightens, and

Fiscal stimulus tightens

This past week, Fed Chair Jerome Powell reiterated his commitment to do what it takes to slow down inflation (despite inflation being supply-side driven). When asked by Sen. Richard Shelby (AL-R) if the Fed was prepared to “pull a Volcker” and do what it takes – Powell responded that Volcker was the “greatest economic public servant of the era,” and that “I hope history will record that the answer to your question is yes.”

This is a clear signpost to us that the Fed’s priority is inflation, NOT growth. While Powell stressed his belief the Fed can bring down inflation without triggering a recession, we respectfully disagree – especially given the recent developments in Russia/Ukraine and the increased likelihood of persistent energy and food inflation globally. At its core, inflation is a supply-demand mismatch. We believe the Fed must cause a recession (ie/ reduce consumption/growth) by tightening monetary policy to meaningfully curb inflation and would not risk easing monetary policy while inflation is running 7%+ unless it were a matter of national security.

Long Term (1-2 years out)

While the Fed may be willing to do “what it takes” to curb inflation, the majority of Wall St. and policymakers are ignoring the U.S. debt and fiscal position, which we would argue is a matter of national security. Unfortunately, our enemies in Russia (and China) understand the U.S. cannot taper a Ponzi (more on this later).

Currently, U.S. net interest expense on debt, baby boomer entitlement programs, and defense spending are funded by U.S. tax receipts – we can think of all three as U.S. “true” interest expenses. The U.S. will never default on USTs or baby boomer entitlements, and never cut defense spending in the face of a potential WWIII.

In 2021, U.S. true interest expense as a % of U.S. tax receipts was nearly 110%. If the Fed tightens monetary policy into a recession to curb inflation, consumption will fall, weighing significantly on U.S. tax receipts, while existing U.S. net interest expense will rise. This dynamic would force the Fed and Congress to pivot back to accommodating monetary and fiscal support of the U.S. economy or risk “default.”

This is all to say that the U.S. is cornered. Although I have the timelines above, this whole scenario could potentially play out this year. I have no idea. What I do know, however, is that sequencing is important. In a scenario where the Fed and Congress are forced to “print or default,” they will choose the former and significantly devalue the USD. While we are currently positioned bearishly in anticipation of a recession, our finger is on the trigger to pivot back to bullish if the Fed and Congress are forced to provide monetary and fiscal support due to the risk of “default.”

The Perfect Setup For A Recession

I’ll be the first to admit I can’t predict the future. All I’m trying to do is look at the data and think about the outcomes that are probabilistically likely to occur. I don’t know if we are necessarily headed for a recession, but I do believe the data suggests the setup is here and we need to be aware of what is unfolding. Below I will unpack in more detail some key drivers of a potential recession.

USD OIS Forward Swap Spreads Pricing in Recession in 18 Months

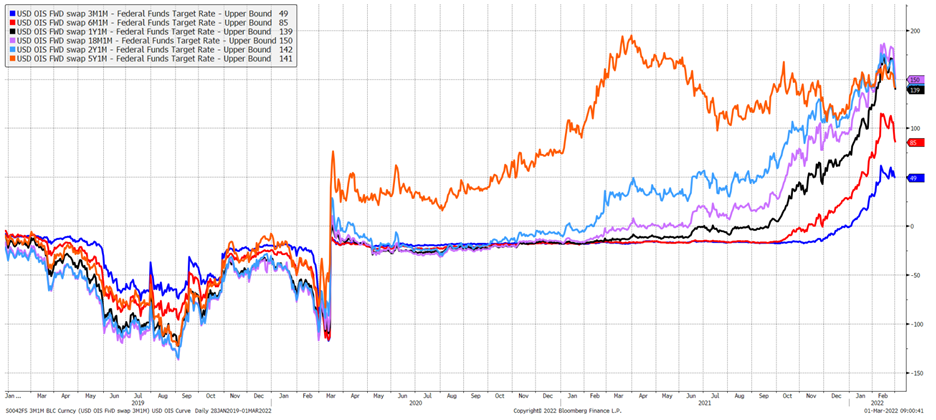

Without boring my less technical readers, the USD Overnight Index Swap Forward Swap Spread measures the forward expected Federal Funds rate (interest rate) of the U.S. economy.

The chart below shows the OIS FWD swaps for 3M, 6M, 1Y, 18M, 2Y, and 5Y. Curiously, the market is pricing a ceiling of 150 bps, or 1.5% Fed Funds rate in 18 months. After 18 months, the 2Y forward swap spread is pricing in a Fed Funds rate of 142 bps, or 1.42%, indicating a reversal in monetary policy back to easing.

The only reason the Fed would pivot from tightening to easing within 18-24 months is in response to a recession aka bond markets are expecting a recession in 18-24 months.

Fed Balance Sheet Reduction Will Weigh on Markets

The Fed’s tools of interest rates and quantitating easing/tightening affect Wall St. and Main St. differently. When we raise interest rates, this affects the real economy by slowing credit growth and tightening real financial conditions. Meanwhile, when we initiate quantitative tightening, this lowers risk premia in markets, causing financial asset prices to decline.

While the focus has been on interest rate hikes, we believe the real risk to financial markets is the pace of quantitative tightening in the Fed balance sheet. Experts believe the Fed will reduce its balance sheet by $1 trillion over the next 12 months beginning with $50 bn in July and accelerating from there.

As we see the Fed balance sheet contract in the coming year, we believe there is a material risk to financial markets which can reflexively decelerate real economy growth via a negative wealth effect.

Biden’s Third Stimmy Was a Mistake

President Biden’s unnecessary $1.9 trillion COVID relief bill in March 2021 pulled forward consumption in 2021 (particularly in goods, not services), which caused U.S. Real GDP to grow +5.7% in 2021 (vs. -3.4% in 2020).

While the Biden Administration would have you believe they helped save the U.S. economy, we believe this was a policy mistake, as evidenced by high inflation. As such, there is no remaining political willpower to pass the $1.75 trillion Build Back Better plan. With no further prospect for fiscal stimulus, we believe the U.S. economy will see a growth hangover in 2022.

U.S. disposable personal income per capita contracting at a -3% seasonally adjusted annualized rate is a recessionary number. Mathematically, U.S. consumers cannot continue growing the U.S. economy when disposable income is negative absent incremental fiscal support.

U.S. Growth Expectations Are Too Optimistic

Bloomberg consensus has 2022 GDP Growth at 3.7%, nearly 1.7% above the 5-year trend of 2% GDP growth ending in 2019. Given the persistent inflation, lack of fiscal stimulus, and contracting real income, we think these estimates are incredibly optimistic and are not adequately reflecting reality.

Growing U.S. GDP by 3.7% after a record 5.7% growth (fueled by easy money) with no more stimulus and persistent inflation would require a herculean effort by the U.S. consumer.

As such, we expect significant downside estimate revisions in U.S. growth as we continue to move throughout the year which will significantly weigh on financial markets, and reflexively the U.S. economy via degradation of the wealth effect.

Inflation Will Remain More Persistent Than Expected

While the news cycle is typically focused on headline inflation, we believe the Federal Reserve Bank of Cleveland’s median CPI reading is more reflective of the underlying trends of inflation.

Unfortunately, January’s median CPI of +7.1% on a seasonally adjusted annualized basis is the fastest median inflation we’ve seen in recorded years going back to 1983. This would suggest that the U.S. inflation dynamics are more broad-based and stickier.

As we think about the already struggling consumer balance sheets (contracting real income), any incremental inflation shocks from food and energy prices (Russia/Ukraine) will weigh materially on U.S. growth and by extension financial markets.

Furthermore, the U.N.’s world food index is already at all-time highs in February 2022, which does not include the likely inflationary shock we will see from the Russia/Ukraine conflict and sanctions in the coming quarters.

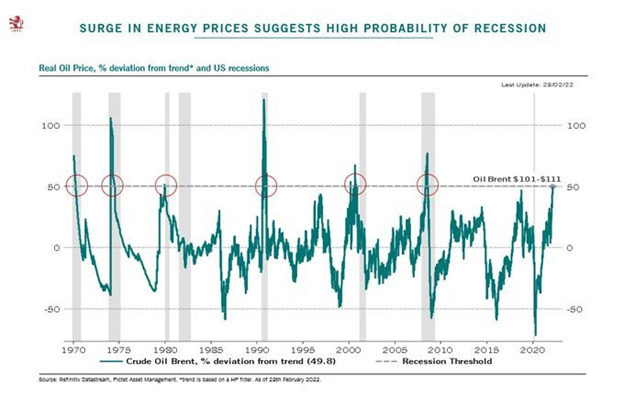

Finally to drive this point home, the last six times we saw crude oil priced above $100/barrel going back to 1970 we experienced a recession shortly thereafter. As of writing this, crude oil futures are priced at $115/barrel, which should continue to rise, absent a resolution of Russia/Ukraine.

Putin Is Playing Chess, Not Checkers

The Great Power Competition between the West (the U.S. and Europe) and East (Russia and China) has been ongoing for decades, though it didn’t hit mainstream media until Russia invaded Ukraine in February 2022. While I don’t want to minimize the humanitarian crisis occurring in Ukraine, I do not believe Ukraine is the story here. Writing off President Vladimir Putin as an unhinged psychopath akin to Adolf Hitler is not only intellectually lazy but misses the forest for the trees. There is a mountain of evidence over the years showing Putin has been strategizing to challenge the post-1971 USD hegemony and he now sees an opportunity.

Russia’s invasion of Ukraine comes at a particularly risky time for the global economy. While we were likely already headed for an economic recession, conflict with Russia will be inflationary for global energy and food prices. Europe depends on oil and gas from Russia. As a result, Russia has leverage on the West and understands the global energy balance doesn’t work without their participation. Putin sees the spread between 40-year high inflation and low government treasury yields and realizes driving energy prices higher via an invasion will catalyze a Western depression and force the Fed/Congress to devalue the dollar.

Energy is the master commodity, and any fiat reserve currency nation needs to have energy independence to defend its currency. The post-1971 U.S. petrodollar worked because the USD was connected to oil, vis-à-vis our protectionist relationship with Saudi Arabia. In 2018, Saudi Arabia broke the petrodollar by selling oil in Chinese yuan. Now that China is the largest global oil importer, Saudi Arabia doesn’t need the U.S.

Russia and China have aligned incentives to escape the USD system. As the combined largest net energy exporter and goods manufacturer, they now have enough leverage to challenge the West. It’s important to recognize NATO was formed post-WWII as a peacetime military alliance against the USSR, and further expansion of NATO territory is seen as a threat to Putin. He understands that by invading Ukraine, NATO will be forced to react with sanctions, which he was prepared for as evidenced by Russia’s net purchases of gold over the past decade.

While many Western nations were supportive of banning Russia from the SWIFT system (the international bank messaging system), this act poses significant risks to the U.S. reserve currency status as illustrated by President Obama’s comments in 2015:

We cannot dictate the foreign, economic, and energy policies of every major power in the world. In order to even try to do that, we would have to sanction, for example, some of the world’s largest banks. We’d have to cut off countries like China from the American financial system.

And since they happen to be major purchasers of our debt, such actions could trigger severe disruptions in our own economy, and, by the way, raise questions internationally about the dollar’s role as the world’s reserve currency. That’s part of the reason why many of the previous unilateral sanctions were waived.

While SWIFT was largely seen as the “U.S. going nuclear” against Russia, the U.S. and E.U. Central Banks more importantly recently sterilized Russia’s FX reserves, effectively confiscating years of aggregated surpluses from Russia’s trade. This has tremendous implications for the USD’s reserve currency status, and we believe this is the beginning of the end of the USD hegemony.

By rendering Russia’s FX reserves valueless, the U.S. and E.U. effectively weaponized their debt. As China and other non-Western nations watch closely, it begs the question of who may be next. For years net exporting nations have accumulated their trade surpluses in the form of U.S. and E.U. debt, and over the past month we found out that if you’re politically on the wrong side of the West, you can be stripped of your wealth.

While I won’t speculate on what will happen next, the Russia/Ukraine invasion seems to be part of a larger play to destabilize the Western economy and shake up the existing world order. This of course has been core to my thesis on why Bitcoin is the most important asset to own in the coming decade. The post-WWII monetary system was built around the gold-backed USD. However, when we defaulted on gold in 1971, we established the petrodollar backed by foreign oil.

Eastern powers recognize the pain points of the global economy and the Eurodollar monetary system. While the media would have you believe that Russia is haphazardly invading Ukraine, it’s hard to believe that a geopolitical master strategist like Putin would attempt such a move without approval from China’s President Xi Jinping. We believe Western media is underestimating how much leverage Russia (and China) have over the U.S. and Europe.

Some countries think in generations, while others think in election cycles. It’s evident that U.S. short-sightedness has brought us to this point, and my hope is that our leaders will be bold enough to do what is necessary to protect U.S. interests. If we continue going down this path, I expect we will soon transition off the USD into a neutral global reserve asset – like Bitcoin, gold, or an energy-related currency, though time will tell.

- Netizen Velez