A Framework for Web3

Open up Coinbase (or any other crypto exchange) and you’re immediately greeted with thousands of digital assets to purchase. Coinbase itself now offers over 8,000 unique assets. Entering the crypto web3 world can be quite intimidating if you don’t know where to start.

To simplify with family and friends, I always suggest thinking about it as bitcoin on one side, and then everything else on the other end. And while that framework is a bit oversimplified, I think that generally gets people climbing down the right rabbit hole.

Let’s face it - web3 has a lot of shiny new objects, from NFTs to DeFi, to buying land next to Snoop Dogg on the Metaverse. Meanwhile, the Bitcoin network keeps plugging along, mining a new block approximately every 10 minutes. It’s not fun, it’s not sexy, but it is incredibly important to the new world we’re creating.

Bitcoin is elegantly simple but arguably solves the most important societal issue we have today as sound money. Money serves as the foundation of society. One could make a case that most of the problems we have today (including inequality) are because the government has a monopoly on money.

But when we strip down to first principles, money is simply a vehicle to capture our energy, work, effort, time, and knowledge, so that we can transact value with others using a common denominator. It may even be fair to say that bitcoin is digital energy.

Beyond bitcoin, however, exists a world of smart contracts that eliminate the need for trusted third parties. This of course is a welcome innovation, as many centralized institutions have historically abused power at the expense of many.

But this is where many people start to get lost in their web3 journey. Below, I propose a framework for thinking about how to invest across the different opportunities in web3, including some analogies to technology you may already be familiar with.

While there are a lot of technical nuances embedded in this framework, we can think of web3 as three levels:

Layer “0” (Money) - The foundation of our digital economy is sound money that acts as a store of value, medium of exchange, and unit of account. In contrast, fiat money is a ponzi scheme, so this seems like the most logical place to innovate first. After almost 13 years, bitcoin has a resounding monopoly in this category relative to its “competitors.”

Layer 1 (Smart Contract Platforms) - The simplest way to think of smart contract platforms is as operating systems - each trying to optimize for varying levels of security, decentralization, and scalability. The same way Linux, Microsoft Windows, macOS, and Chrome OS are different, is the same way different Layer 1s compete. In the 1990’s we didn’t know which OS would win, and the same is no different today with Layer 1s in 2021. You can also think of Layer 1 protocols as the gas asset needed to execute smart contracts.

Layer 2+ (Decentralized Applications) - On top of each specific Layer 1 protocol, developers build dApps focused on different use cases. The most common ones we hear about are Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs). In addition, smart contracts also enable the creation of Decentralized Autonomous Organizations (DAOs), the equivalent of web3 LLCs. While many of these projects are still in the experimental phase, there is no doubt that decentralized protocols are reimagining how humans coordinate together

Why We’re Focused On Layer 1s

When it comes to allocating capital in web3, I have no interest in picking a specific horse. My bias is towards Bitcoin as a foundation, however when it comes to Layer 1 protocols, guessing which one will outperform over the next 1-, 5-, or 10-years is a coin-flip. We need to actively monitor development and usage.

Ultimately, the market (users) will decide what it wants. Bitcoin must be decentralized if it wants to be sound money, but I’m not so sure if absolute decentralization is necessary for Layer 1 protocols. Look at Solana for example compared to market-leader Ethereum - Solana compromised decentralization for added scalability and lower fees, which has (so far) worked to its advantage. Now, we aren’t sure if this is a sustainable move to siphon long-term market-share, or if it’s an inevitable race to greater centralization over time. Time will tell.

Meanwhile, another protocol that grabbed our attention recently is Stacks, a smart contract platform built on top of bitcoin. Stacks is introducing scalability to the bitcoin network by executing smart contracts on its own Layer 1 and then using bitcoin as the base layer for settlement using a consensus mechanism called Proof of Transfer (PoX).

While there are some ideological disagreements within the bitcoin community about introducing another “shitcoin” on top of bitcoin, the new ecosystem is already producing bitcoin-backed NFTs and is beginning to deploy some of the first bitcoin-DeFi projects in web3. Most notably, City Coins (popularized by Miami Coin and NYC Coin) is also built on top of the Stacks protocol. We’ll continue to watch how this ecosystem develops.

Regardless, we think it’s wise to have broad exposure to a basket of Layer 1 protocols that all optimize for different parts of the Blockchain Trilemma. As development continues and adoption accelerates, we will seek to recalibrate our position sizing accordingly.

Layer 1 performance over the past year has been quite explosive, and we expect competition will lead to continued growth. Since 12/17/20, here’s how Layer 1s have appreciated:

Solana (SOL): +10,985%

Avalanche (AVAX): +2,994%

Stacks (STX): +594%

Ethereum (ETH): +522%

Cosmos (ATOM): +339%

Algorand (ATOM): +306%

Bitcoin (BTC): +104% (for context)

What’s Going On With Bitcoin?

I would be remiss if I didn’t address the elephant in the room - which is that bitcoin is down nearly 30% after making all-time highs at $67,500 earlier in November. Of course, a newcomer to bitcoin may be biting their nails right now, perhaps thinking "bitcoin is dead,” but thankfully I’m here to talk you off the ledge.

When we pause, take a deep breath, and think, we come to realize that our relationship with bitcoin is a function of our time preference. There is even research showing that children who were more capable of delaying gratification had better life outcomes decades later. Therefore, we would be wise to zoom out more when thinking about bitcoin’s price fluctuations.

We have to remember where we are in history. Bitcoin halved 19 months ago, which historically has led to rapid price appreciation 12-18 months post-halving. Unfortunately it would appear we are behind schedule (most likely due to macro, more on this later). Also, consider that according to the stock-to-flow model, we should’ve been above $100,000 in August 2021. But the price is only one signal.

Microstrategy, a public company, purchased bitcoin and now is teaching other companies how to do the same. El Salvador made bitcoin legal tender and recently issued the first sovereign bitcoin bond. Bitcoin mining is stabilizing Texas’ power grid using renewable and excess energy. Cubans are having their bitcoin revolution. Bitcoin is serving as a life-raft in Palestine. And Nigerian leaders are calling for fair bitcoin regulation. The thesis is unfolding.

So, something isn’t adding up. In early November, if we looked at the on-chain data, we started to see aggregate futures open interest (OI) reach north of $25 bn (near all-time highs). When bitcoin OI is high, it generally means investors are taking out excessive leverage (debt) to buy more bitcoin, which can lead to cascading forced-selling events as investors receive margin calls. This contributed to the most recent sell-off.

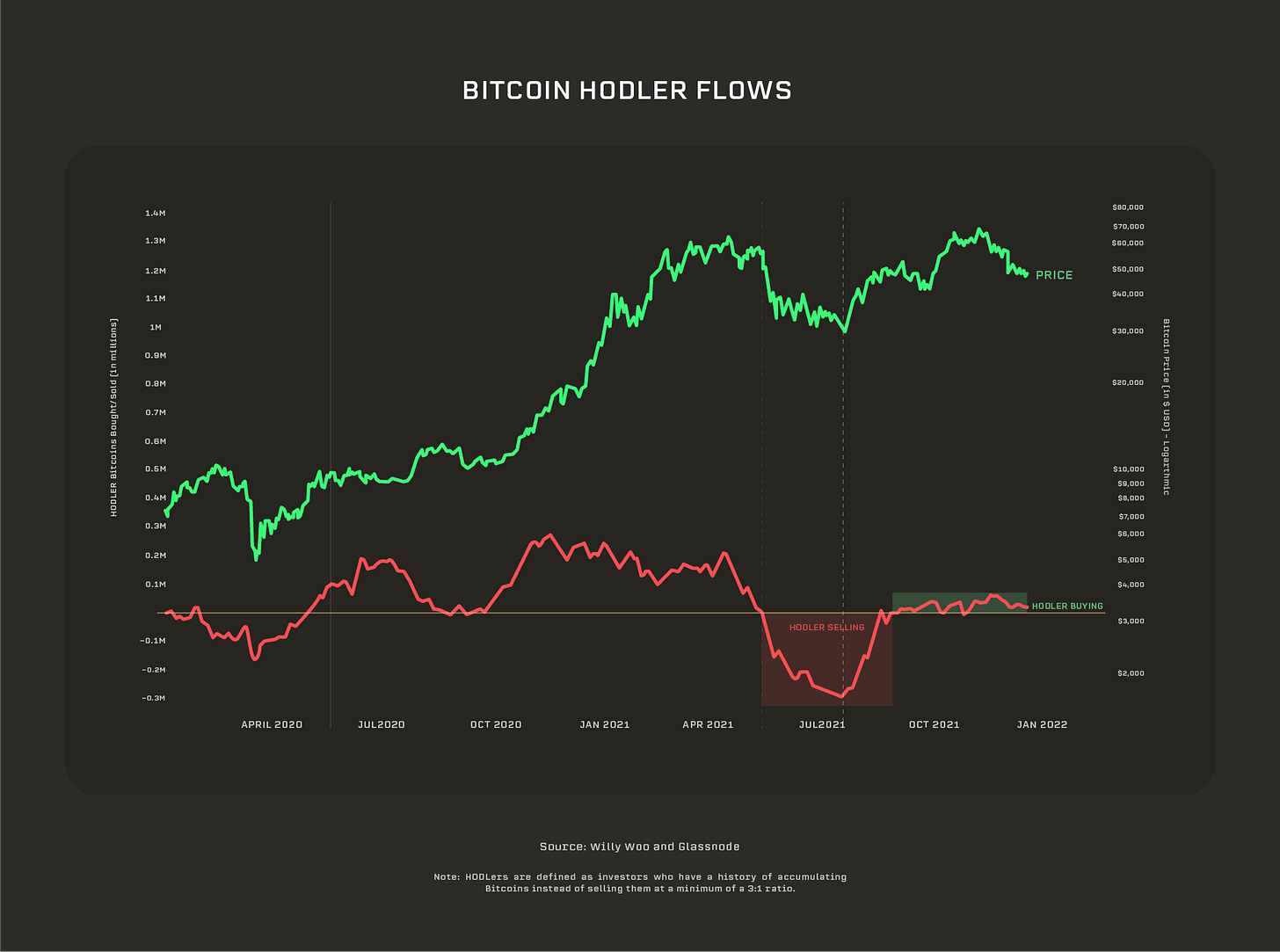

However, when we dig deeper, long-term holders (>5 months ownership) are near peak bitcoin accumulation. These types of HODLers rarely get shaken out from short-term down moves. Historically, when HODLers are at low levels of accumulation, this is a sign of a potential bear market (which is not the case right now). Furthermore, coins are now beginning to move off exchanges, why is typically good for spot demand.

Looking further at the behavior of HODLers, bitcoin has been in a steady accumulation phase since September 2021 (which trend is holding up), contrasted with the sell-off we saw between May 2021 and July 2021. Furthermore, our heatmap analysis also shows that accumulation at the $45,000 - $50,000 levels has been from bitcoin whales (wallets holding >1,000 BTC), who are generally more sophisticated buyers. It would appear we are reaching oversold territory for bitcoin and the “smart” money is beginning to step back in. Overall, we believe it is more likely that bitcoin continues on its long-term bull run, depending on the macro.

Tough Macro Outlook In 2022

I of course hedged myself by saying depending on the macro because we need to understand and respect how institutional money flows in and out of financial markets. As the ever-wise Jeremy Grantham once said:

The great key to investing is getting the big picture right. Everyone thinks the holy grail is picking stocks, but how many winners do you need in a portfolio to equal the massive secular moves between different asset classes?

It’s these movements between asset classes (ie/ equities, bonds, commodities, real estate, private equity, bitcoin, etc.) where the real money is made. Interestingly enough, the correlation between asset classes is historically unstable, however, the relationship of asset classes to varying macroeconomic environments is consistent over time.

Below I introduce the GRID Framework, which is critical in evaluating which macroeconomic environment we are currently in.

There are four Macro Regimes we are constantly monitoring:

Reflation - Growth (GDP) accelerating and Inflation (CPI) accelerating relative to expectations

Goldilocks - Growth accelerating and Inflation decelerating

Deflation - Growth decelerating and Inflation decelerating

Inflation - Growth decelerating and Inflation accelerating

Based on the most recent inflation and jobs data from the U.S. Bureau of Labor Statistics, it is likely we will stay within the INFLATION regime into mid-Q1 until YoY inflation begins to decelerate. At which point, forward-looking models are indicating the U.S. (and globally) will likely be in the DEFLATION regime for the better part of 2022. This is not great news, and we should expect higher realized volatility in risk assets (crypto, equities, commodities) if that occurs.

As such, right now is a good time to take some risk-exposure off the table until we move to a REFLATION or GOLDILOCKS regime. Historically, bitcoin (and the broader crypto/web3 space) massively outperform during those regimes, as we saw from 3Q20 through 3Q21.

In addition, I want to quickly touch upon the most recent Federal Reserve meeting, including their summarized projections. Fed Chair Powell indicated a more hawkish (tightening the money supply) tone during his remarks by quickening the pace of the quantitative easing (QE) taper. The Fed now expects to be done with QE by mid-March, at which point they are expected to raise interest rates. Currently, investors are expecting there to be 3 interest-rate hikes in 2022. An interest-rate increase would be negative for risk assets, but good for USD strength.

I view this QE taper and interest-rate increase as a potential U.S. policy blunder, though time will tell. With debt/GDP at ~125% and U.S. “true interest expense” (including entitlements, social spending, military, etc.) greater than 100% of U.S. tax receipts - the U.S. government cannot raise interest rates for any meaningful period without creating a U.S. Treasury market malfunction or a foreign currency crisis. The reality is that we cannot run the Volcker playbook again to fight inflation.

The U.S. is not in the same fiscal or geopolitical position we were in during the late 1970s and ’80s. If we want to de-lever the U.S. balance sheet, we, unfortunately, have to let inflation run hot for many years (in what Ray Dalio calls an inflationary deleveraging). In an inflationary deleveraging, we would expect real (adjusted for inflation) negative interest rates for as long as possible until the U.S. inflates its balance sheet away. This of course is not only a U.S.-centric issue, and would be great for risk assets (and terrible for cash and bondholders) over the coming decade.

I want to pause and make something abundantly clear. Since 1800, 51 of the 52 countries with debt/GDP >130% have defaulted, either through restructuring or high inflation. The only country that has not defaulted yet is Japan - which has been an economic zombie for the past few decades. Regarding the U.S. fiscal position, some pundits will claim “the U.S. will just become like Japan” if we keep incurring debt, but we think this comparison isn’t reasonable. Unlike Japan, the U.S. has a negative net international investment position (NIIP), a current account trade deficit, and an externally-funded (supported by foreign UST purchases) fiscal deficit. For a country in our position, raising real interest rates over any sustained period is NOT a realistic policy option. The Fed is effectively cornered.

So when I think about the next 12 months and contextualize where we are in history, I think risk assets will have some volatility due to tighter monetary and fiscal policy, but over the next few years (possibly even decade), risk assets should benefit greatly as monetary and fiscal policy begins to ease once again.

While the Federal Reserve has begun tightening, I fully expect them to reverse course and ease monetary policy once something in the global economy “breaks” (which could be as soon as 2022). The Federal Reserve and the U.S. Treasury are already working together to “ensure that U.S. Treasuries and money markets function.” This is a huge signpost to me that we are nearing the end of the post-1971 Petrodollar system. This is incredibly structurally inflationary over time, and undoubtedly positive for risk assets, including bitcoin.

Final Thoughts

Given this environment - we will dollar cost average into our positions over 1Q22 while maintaining a healthy stablecoin (cash-equivalent) position. While we understand that bitcoin is trading at a discount relative to our models and is being accumulated by sophisticated investors, we also recognize that macro drives institutional flows in and out of asset classes. As such, we will carefully enter positions and try to take advantage of volatility as we patiently build up our core holdings.

We remain structurally bullish on a multi-year time horizon but recognize the risks over the next 12 months due to tightening U.S. monetary and fiscal policy. Aside from that, we will continue to watch COVID-19, the currency crisis in Turkey, the energy crisis in Europe, and the supply chain disruptions/real estate bubble in China.

I hope you enjoyed this letter. My goal is to do this monthly at a minimum, or perhaps whenever there is breaking news or I have some thoughts I want to share.

I wish you all a Merry Christmas, Happy New Year, Happy Holidays, and everything in between. Wishing you all health, wealth, and happiness in 2022!

-Netizen Velez