In October, the S&P 500 had its second-largest bear market rally of this year (+8%) ending the month above $3,900. After a volatile start to the month, the S&P 500 bottomed at $3,500 following the September inflation data. However, markets rallied aggressively through the end of the month as core inflation was better than feared. The tug-of-war between eager bulls and hungry bears continues in 2022, leading to a choppy market environment for all investors.

Last Wednesday, we heard from Federal Reserve Chairman Jerome Powell in what might have been his most confident, direct, and hawkish FOMC meeting yet. In other news, the second largest global crypto exchange FTX recently failed due to insolvency, causing their FTT token to lose over 80% of its value in the last 5 days. With Binance (the largest exchange) backing out of its deal to acquire FTX, confidence in the crypto industry is now shaken and many funds, lending desks, and exchanges may be at-risk for forced liquidation.

With that backdrop, let’s jump into our economic and market outlook.

Outlook (TLDR)

Short Term (< 1 month)

Following the November FOMC meeting, investors did not reposition as aggressively as we expected. With VIX significantly compressed, we look ahead toward Tuesday’s U.S. midterm elections and Thursday’s October CPI release. Regardless of a divided outcome on Tuesday, historical analysis suggests markets generally rally following midterm elections. That said, we believe there is a likelihood of core CPI surprising to the upside given recent economic strength, which could catalyze downside from here. Regarding the FTX/Alameda insolvency, prepare for more downside.

Investors and companies alike get exposed in bear markets. Overzealous financing deals, Ponzi shitcoins (FTT), and degenerate use of leverage have brought the second-largest crypto exchange to its knees. Now is not the time to be a hero. Crypto sentiment may be broken for a time but use this as an opportunity to buy real assets like Bitcoin (which is backed by energy) at a historic discount, everything else only works in a bull market.

Medium Term (2-6 Months)

Updated guidance from the U.S. Treasury suggests the S&P 500 and Bitcoin are overpriced heading into year-end, but in-line as we move through 1Q23. Our model suggests the S&P 500 and Bitcoin should be at $3,500 and $15,000 respectively, by year-end. However, the revised Treasury General Account has the S&P 500 and Bitcoin back $3,700 and $21,000, respectively, by the end of 1Q23. Whether markets decide to look forward and bypass the 4Q22 treasury guidance is still unknown.

As we think about the direction of markets over the next several months, we think this is the type of market to capture dispersion between style factors. Contrary to the past decade, we now favor small caps over mega caps and value stocks instead of growth stocks. We believe long/short pair trades are the best risk-adjusted way to attack this current market. Possible ideas include long BTC + short ETH, long Russell + short Nasdaq, long energy + short S&P 500, etc.

Long-Term (6-12 Months+)

Netizen’s investment thesis is that the fiat currency world, supported by debt and political power, will shift towards market-based money, as has always occurred at the end of empires. We believe the Great Power competition between the West (U.S., Europe, Japan, etc.) and East (China and Russia) will result in a sovereign debt crisis and usher in a multi-polar world.

We believe COVID-19 and the escalating Great Power Competition have ended an era of cheap energy, labor, and goods – which will keep inflation firmly elevated above the Fed’s 2% target in the coming decade. As long-term inflation expectations rise, global bond yields will re-rate higher and pressure global liquidity, given bonds are the largest source of collateral in the modern financial system.

Our long-term view is that we are witnessing a war between western sovereign debt and energy as the true value in the global economy. Since 1971, the U.S. and its allies have bullied the global economy into accepting USDs and USTs as pristine collateral, not recognizing that the key input to any economy is energy. We view Russia’s aggression towards Europe as the first step in challenging the western Eurodollar system. We’re watching closely and remain bullish on energy, commodities, and related infrastructure.

Dovish Statement, Hawkish Press Conference

In the time leading up to the 11/2 FOMC meeting, the S&P 500 rallied a hellacious 12% in 2 weeks. Investor sentiment was a function of overly bearish options positioning in October that never came to fruition following better-than-feared (though still bad) September inflation data.

At 2pm, the FOMC released its official policy statement which got eager bulls excited about a “soft pivot.”

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Markets immediately popped higher from already overbought conditions as investors interpreted the statement above to suggest that the Fed will slow (or stop) the pace of raising interest rates in future meetings.

Then came the 230pm press conference where Fed Chair Powell delivered his most confident, direct, and hawkish Q&A yet. In particular, he dropped 3 bombs we want to dissect:

“Even so, we still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.”

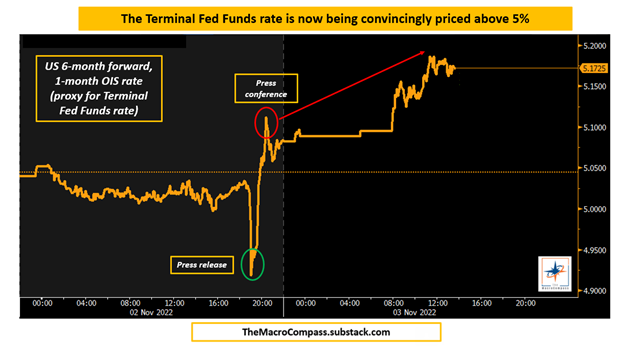

Recall, in the September FOMC meeting, the Fed released their summary of economic projections which estimated the terminal Fed Funds interest rate would be 4.6% by the end of 2023. Following these comments from Fed Chair Powell, futures markets immediately repriced the terminal Fed funds interest rate north of 5% (negative for risk assets).

He then followed up with:

“To be clear, let me say again, the question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restricted, which really will be our principal focus.”

In response to investors’ questions about whether the December FOMC meeting will see a 75 bps or 50 bps interest rate increase, Powell emphasized that the path of rate hikes is less important than the destination. And that destination is indeed much higher for longer than previously expected (negative for risk assets).

He then dropped this nuke:

“And trying to make good decisions from a risk management standpoint, remembering of course that if we were to over-tighten, we could then use our tools strongly to support the economy, whereas if we don't get inflation under control because we don't tighten enough, now we're in a situation where inflation will become entrenched and the costs, the employment costs in particular, will be much higher potentially.”

Finally. The answer to the question we’ve all been waiting for – is Powell afraid of overtightening? The answer is a resounding NO. He would rather overtighten the economy into recession than allow runaway inflation. Why? Powell believes the Fed has the “tools” (printing money) to support a depressed economy. Whereas the Fed cannot do anything to fight hyperinflation besides…you guessed it, tightening monetary policy.

So there you have it, Powell would rather cause a recession because they could always print money if things get too bad than let runaway inflation occur. Powell has read the history books because that is exactly what happened to former Fed Chair Volcker in the early 1980s.

After raising interest rates to an eye-watering 17% in 1980, Volcker prematurely cut interest rates during a recession without being certain that inflation was dead. Later that year he was forced to raise interest rates again, this time above 18%, causing a second recession in 1981-1982.

To reiterate – this is the most hawkish we’ve seen Fed Chair Powell in his 4 years in office. Our message to eager bulls awaiting a pivot is to keep dreaming. Our message to hungry bears waiting for more downside is to be patient. We came away from last week’s FOMC meeting with 3 takeaways: 1) the terminal Fed Funds interest rate will be even higher than we expected before, 2) interest rates will be kept higher for even longer than we expected before, and 3) the Fed would rather overtighten into a recession than under tighten and allow runaway inflation. All three points are negative for financial markets.

That said, Powell’s comments are just words. With the U.S. economy (particularly the labor market) so resilient, Powell hasn’t received any political pressure (yet) to pivot monetary policy. Let’s see what happens next year when the unemployment rate increases and corporate layoffs start to show in economic data (announcements have been happening all year). That will be the real test of Powell’s resolve. Until then, we must take his words at face value.

Source: Macro Alf

Net Liquidity May Support Markets In Early 2023

As we’ve discussed many times, excess monetary and fiscal liquidity creates wealth inequality, asset bubbles, and sticky inflation. To combat this, the Federal Reserve is now trying to withdraw liquidity from the global economy which has weighed on financial markets all year. Although interest rates tighten financial conditions, Powell is also reducing the size of the Federal Reserve balance sheet by implementing $95 bn/month of quantitative tightening.

Last week, the U.S Treasury announced the Treasury General Account (TGA) balance will be $700 bn by the end of 4Q22 (up from $550 bn previously), which we denote in the red line below. This would put the S&P 500 and Bitcoin at roughly $3,500 and $15,000, respectively, by year-end. That said, the U.S. Treasury is also expecting the TGA balance to go back to $500 bn by the end of 1Q23, denoted by the green line. This would put the S&P 500 and Bitcoin at roughly $3,700 and $21,000, respectively, by the end of 1Q23.

Given Net liquidity is such a powerful driver of financial markets, we would be wise to respect the updated guidance from the U.S. Treasury department. Since markets are forward-looking, it’s possible investors may look right through 4Q22 and begin to price in future liquidity into markets. As such, we think right now is a good time to capture dispersion in markets through thoughtful long/short pair trades, rather than sit naked long or short in either direction. (ie/ long BTC + short ETH, long Russell + short Nasdaq, etc.).

Source: 42 Macro

Historic Treasury Market Volatility

While the FOMC meeting was the main event last week, an underappreciated piece of news came from the Treasury Department’s announcement that they have “not made any decision whether or how to implement a buyback program.” This is a reg flag in our view for financial markets, given how illiquid the treasury market has been year-to-date, as indicated by the MOVE index (treasury volatility) hovering above 150 – which according to the creator of the MOVE index Harley Bassman means “the Fed has lost control.”

Without a Treasury buyback in 4Q22, the next opportunity would be 3 months from now in February 2023. Recall, government agencies prefer to be reactive and come in to save the day during a crisis, rather than admit there is a problem and be proactive. Our initial take is that there will be more Treasury market illiquidity (and volatility) in the coming months, which historically weighs negatively on financial markets.

Source: Convexity Maven

Why Own Risk When You Can Buy T-Bills

Investing is all about opportunity cost. By investing in one asset, you are deciding not to invest in another. Even staying in cash is an investment decision. Over the past decade of near 0% interest rates, investors were disincentivized to save (because rates were so low) and instead could only earn a return by speculating on riskier investments. However, with the Federal Reserve raising interest rates aggressively, USTs are finally becoming an attractive place to park your cash and earn a “risk-free” return.

Given the macro outlook, we would argue that it’s now better to own T-Bills instead of the S&P 500. T-Bills are short-dated USTs (maturing in 1-year or less). Currently, a 1Y UST is yielding 4.75% (the chart shows 4.51%), whereas the S&P 500 dividend yield is 1.76%. As the price of the S&P 500 continues to decline and dividends paid out stay the same or decrease (as companies need to save cash), the dividend yield will also decrease, making equities less attractive relative to T-Bills.

By raising interest rates aggressively, the Federal Reserve is trying to disincentivize speculation in equities, crypto, real estate, and alternatives, and push investors into the UST market. And although UST yields are still lower than the prevailing rate of inflation, it’s still better than holding cash or taking market risk in this macro environment. As interest rates continue to rise we would expect institutional investors to start rotating out of risk assets (which have been over-owned for the past decade) and into USTs.

Source: 42 Macro

The U.S. Economy Is Still Booming

Although we entered a technical recession earlier this summer, 3Q22 GDP grew 2.6% supporting our call that an actual recession was premature. And while leading indicators suggest the U.S. economy is showing signs of a slowdown, the U.S. and Asian economies are outperforming their European counterparts, which may be temporarily supportive of U.S. asset prices.

The U.S. labor market continues to outperform the pre-COVID (2015-2019) trend. Specifically, private sector aggregate labor income most recently grew 6.6% on a 3-month SAAR (down from +7.8% last month), 50% higher than the 4.4% pre-COVID trend. While we have seen many big tech companies announce hiring freezes and layoffs, it’s unlikely jobless claims will appear in the economic data until next year. Until then, the U.S. job market remains resilient and continues to surprise the upside.

That said, one observation we want to call out is that YTD GDP is roughly flat while monthly job growth in 2022 has averaged +400,000, implying that productivity must be down significantly. Is working from home less productive? My real-life observations bias me to say “yes,”, especially in white-collar jobs where 80% of the work is likely done by 20% of the employees. As corporate layoffs accelerate, we would expect to see passive buying into 401ks slowdown and be less supportive of financial markets.

While we saw the 10Y3M UST Yield Curve invert temporarily invert for a week, we’re not convinced that the #actualrecession countdown has officially begun. As we’ve discussed before, households and businesses are sitting on historic levels of checkable cash in bank accounts and can likely weather some economic pain. We don’t think the Federal Reserve will flinch towards pivoting unless an unforeseen crisis appears. For now, rates will be higher for longer.

Source: Netizen Capital

Bitcoin Miners Declaring Insolvency

As discussed in our last letter, Bitcoin miners have recently become under stress, as competition grows (network hash rate is at all-time highs) and the price of Bitcoin meanders near cycle lows. As shown in the image below, we are officially in the Inventory Flush phase of the Bitcoin mining cycle, where overzealous mining companies will soon run out of cash (as profitability compresses) and need to liquidate either their Bitcoin held in treasury or their Bitcoin mining machines, to stay afloat.

Over the past several weeks we’ve heard from four major players in the Bitcoin mining industry come under pressure:

Computer North – Filed Chapter 11 Bankruptcy

Texas-based private Bitcoin miner Compute North filed Chapter 11 Bankruptcy after it failed to pay unsecured creditors due to rising electricity prices and falling Bitcoin prices. The company is estimated to have $100 million - $500 million in both liabilities and assets

Core Scientific (CORZ) – Cash Negative By End of 2022

Public Bitcoin Miner CORZ was down 90% in the past month after it was revealed in an SEC filing that the company’s cash balances would be negative by year-end. The company only has 24 BTC left on its balance sheet after it sold off most of its Bitcoin treasury in June 2022. It claims the financial pressure was due to rising network hash rates, rising electricity prices, and falling Bitcoin prices.

Argo Blockchain (ARBK) – Facing Negative Cash Flow

Public Bitcoin Miner ARBK was down 76% in the past month after a $27 million financing deal with a strategic investor failed to go through and the company announced they will be facing negative cash flow soon and will need to curtail operations

IRIS Energy (IREN) – May Default on Financed Bitcoin Miners

Public Bitcoin Miner IREN was down 30% in the past month after news came out that the company may default on $103 million worth of Bitcoin miner financing. Due to the higher network hash rate and lower Bitcoin price, the company is only generating $2 million in monthly profit vs. the $7 million in monthly financing costs it owes. If the company cannot refinance the debt it will need to default and begin liquidating assets

We believe the Bitcoin mining industry will be one of the most important energy industries in the world in the future – however, overzealous expansion plans from the previous bull market have led to unsustainable financing for many companies. While there are better-capitalized Bitcoin mining companies like CleanSpark (CLSK), Riot Blockchain (RIOT), Marathon Digital (MARA), and BitFarms (BITF), we do not yet feel comfortable allocating to any company yet. That said, we are watching closely. Capitulation events are generally asymmetric investment opportunities, though we are not convinced there won’t be more pain to come.

Source: Anicca Research

Final Macro Thoughts

We assess that we’re in the eye of the bear market storm. While the narrative consensus now believes that a U.S. recession is imminent, we disagree. The strength of the U.S. labor market and the cash balances of U.S. households and businesses suggest that the U.S. will be an outperformer relative to the global economy. While leading economic indicators are showing a slowdown, we think the actual recession is more likely to be a late 2023/early 2024 event.

As it relates to the direction of markets, we’re unsure. Future macro catalysts and options positioning will likely drive market action from here on out. With markets neither overbought nor oversold, we have no directional bias here. That said, we continue to see cracks in the bond, crypto, and energy markets which gives us cause for concern. We continue to believe the bottom in risk assets is not yet here, though would not be leaning aggressively short right now.

Thoughts on FTX/Crypto

Separately, I want to address the FTX/Alameda insolvency. I wrote up a very big piece on it over the weekend, but the story unfolded so quickly over the past several days that I had to delete it. The recent FTX insolvency is a huge black eye for crypto. While it’s unfortunate that many people are losing money in crypto right now, the industry has way too much hubris from the 2020-stimulus-driven bull market that needs to be corrected.

The question you need to be asking now, is “who else is in trouble?” FTX was a darling of the crypto industry. It was run by 30-year-old crypto-billionaire Sam Bankman-Fried. He looked like the stereotypical crypto genius. Forbes even compared him to Warren Buffett. I’m going to say this until I’m blue in the face. Everyone is a genius during bull markets. If Sam (supposedly the smartest guy in the room) was swimming naked, who else is secretly broke? My hunch is that over the next several days, weeks, and months, more over-leveraged hedge funds and crypto companies will be forced to liquidate their assets in the open market. While it’s painful for those already invested, it’s healthy, and much needed for the industry. Think of this as your opportunity. The decisions you make in the next few months will set you up for success for the rest of the decade.

Bad things happen during bear markets. Let’s be ready.

- Netizen Velez