Bull-Bear Market Psychology

The recent market has caught many investors off-guard – myself included at the beginning of the year. But hindsight is 20-20. The period from March 2020 to November 2021 was characterized by euphoria and excess. Since then, significant problems have developed inside the economy (inflation) and geopolitically (Russia/Ukraine), leading to the S&P 500 and Nasdaq both down 14% and 24% YTD, respectively.

As investors desperately try to cling onto the last vestiges of the 2020/2021 bull market, the most common question I’ve heard over the past month was “is this the bottom?” While textbooks try to describe a bull or bear market in numerical terms (ie/ down 20%), I define it by market psychology. The transformation from bull to bear market cannot be reduced to a single number, but rather the transitioning psyche of investors as we each individually move through the seven stages of grief.

The reductionist view on markets is that asset prices only move on fundamentals, but that’s only half the picture. The price of an asset is based on fundamentals and how investors feel about those fundamentals. On one hand, company fundamentals are subject to analysis and can be predicted to some extent. But attitudes regarding fundamentals are far more psychological and emotional, not subject to prediction, and highly volatile. The latter of course is cyclical and leaves the market particularly vulnerable to excesses and corrections.

When investors turn highly bullish, they tend to conclude that everything goes up forever, and regardless of what they pay for an asset, a greater fool will come along and buy it from them for more. These high levels of optimism cause stock prices to rise faster than company profits, soaring well above fair value (excess). Eventually, the market or economic conditions can no longer support the irrational prices and they fall back towards fair value and then through it (correction). As prices decline, pessimism spreads like a weed, further pressuring prices to the downside, and eventually, bargain-hunter investors come around to buy the asset at discounted prices.

Raging bull markets are examples of mass hysteria, supported by investors racing to invest in what’s “hot” or “the future.” The rapid rise of tech stocks, meme stocks, SPACs, and crypto over the past two years made investors increasingly optimistic, fortifying a reflexive move towards higher prices until everyone has FOMO. While this euphoria leads to excesses, there is generally some grain of truth underlying the high-performing assets. The best example of this was the Dot Com bubble two decades ago. Sure, many internet companies from that era no longer exist, but the ones that survived changed the world.

Do I expect more downside from here? Yes.

Do I think the crypto asset class will be down more than 75% when this bear market is over (currently down 58%)? Yes.

Do I think crypto will change the world? Yes.

It’s OK to have conflicting views about the same asset across different time horizons. As investors, we can’t control how the market feels, but if we understand the cyclicality of investor psychology and use it as a guiding lens, we can avoid losing money during bear markets and make more money during bull markets. The key is, don’t be in denial.

With that, let’s get into our outlook.

Outlook (TLDR)

Short Term (< 1 month)

May was a particularly volatile month for the S&P 500 despite closing the month nearly unchanged. April weakness (-8.8%) persisted into May with the S&P down as low as $3,810 (-7.7%) before rallying in the second half of the month. In our view, the rally back above $4,000 was driven by technical flows as opposed to bullish demand, as 60/40 targeting portfolios mechanically rebalanced their allocations by purchasing equities into month-end. We consider the rally to be “dumb money” (ie/ passive investments) and believe significant downside risk remains a probable outcome as we head into the summer months.

Looking ahead, the outlook for risk assets continues to be challenged, especially in crypto following the collapse of LUNA/UST (more on this later). Options positioning shows investors adequately hedged at these levels, which may keep the S&P pinned between $4,000 and $4,200 into the 6/15 VIX expiration and 6/17 options expiration. That said, incremental economic data including May CPI (6/10), May PCE (6/30), and May Jobs Report (7/8) keeps us on edge for a downside surprise. Moreover, we expect the 6/15 Fed meeting to be somewhat of a non-event given Fed Funds Futures are pricing in a 100% probability of a 50 bps interest rate increase. It is worth mentioning as well that while Quantitative Tightening technically began on 6/1, we won’t start to see USTs roll off the Federal Reserve balance sheet until 6/15 (coincidently on the same date as the Fed meeting).

With the May options expiry largely behind us, we believe rally fuel for a further bear market melt-up is likely exhausted at these levels. As such, now is a good time to continue building up either cash or short positions. Given the radical sentiment shift in crypto following the LUNA/UST collapse, we believe the only crypto asset worth owning in this environment is Bitcoin – everything else should be sold if you haven’t already.

Medium Term (2-6 months)

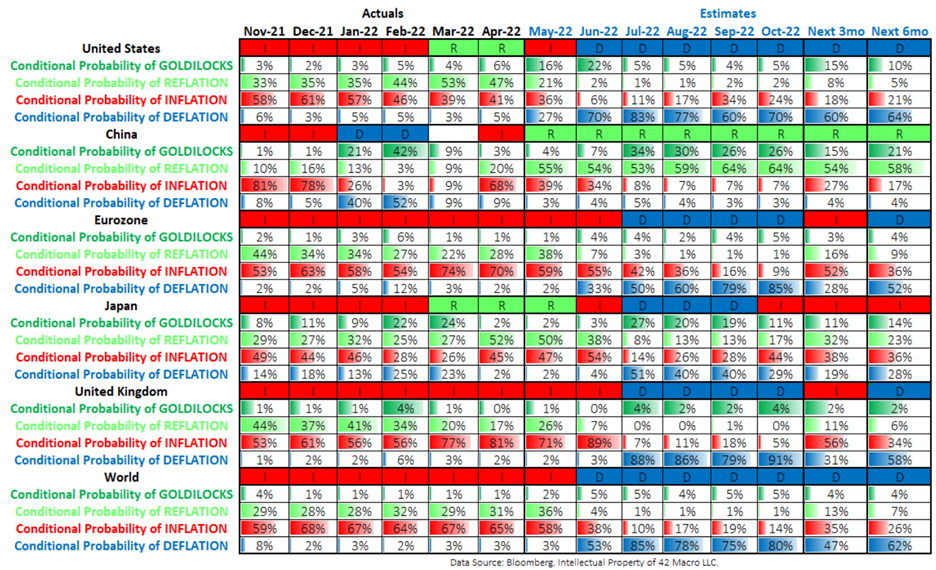

The next 3-6 months will be painful for investors as the Macro Regime decidedly shifts into DEFLATION (growth decelerating, inflation decelerating), which statistically is a challenging environment for equities and crypto. While inflation in the U.S peaked on a YoY basis, sequential inflation momentum in services continues to build. We believe many investors are too dogmatically focused on the YoY rate of change of inflation, and not paying attention to its components. If services inflation continues to accelerate faster than goods inflation decelerates, that could be a negative shock to markets.

Looking ahead into July and August, all eyes are on earnings and forward guidance. Disappointing 1Q earnings began to show cracks in the market, and recent layoffs and hiring freezes at large companies (Netflix, Amazon, Walmart, Tesla, PayPal, Robinhood, Carvana, etc.) makes us cautious of a strong 2Q earnings season. With the S&P 500’s next-12-month earnings estimates still at cycle highs, we expect sell-side analysts will soon revise their earnings estimates lower, which would spark fear into markets.

Finally, President Biden, Treasury Secretary Janet Yellen, and Fed Chair Jerome Powell met this past week for an emergency meeting on the economy and inflation. In his public remarks, President Biden said that he will respect the Fed and the Fed’s independence to fight inflation. Add in Treasury Secretary Yellen’s capitulatory remarks from an interview this past week where she said she was wrong about calling inflation “transitory,” and we now have a perfect storm of policy leaders publicly laser-focused on fighting inflation even if it means missing a “soft landing.”

With the President, U.S. Treasury, and U.S. Federal Reserve all focused on fighting inflation and a likely disastrous 2Q earnings season ahead of us, we would not be surprised if mainstream media announces the U.S. is in an official recession by August after 2Q GDP is released on 7/28. As such, your portfolio should be de-risked (in cash) or net-short into the summer, as we do not see a soft landing from the Fed or dovish monetary policy pivot until the November Fed meeting at the earliest.

Long Term (6-12+ months)

If the Fed pivots dovish in the next 6 months, the next 12 months will be exceedingly bullish for risk assets, in particular Bitcoin, commodities, and equities (ie/ real assets). In a world where money is infinite, scarce assets have unlimited value.

What concerns us the most going forward is the obvious changing world order, ie/ the Great Power Competition between the West (U.S./Europe) and the East (Russia/China). The world is quickly de-globalizing, and as nations become more resource-constrained, geopolitical relationships are breaking down. Energy independence has been a key theme we have written about in past newsletters, and no region is more energy co-dependent than our allies in Europe. Last week the European Union formally adopted a sanctions package banning oil imports from Russia in response to the Ukraine invasion. The sanctions package will phase out Russian crude oil imports over the next 6 months and refined petroleum over the next 8 months. This move feels to us like Europe is cutting off its nose to spite its face, but time will tell.

The geopolitical situation remains tense and is an immense tail-risk to the global economy and financial markets (one that is impossible to price in ahead of time). As we look ahead, it appears that we are inching closer toward a reworking of the global reserve currency (currently held by the USD). If history is any indicator, then the USD may soon join the British Pound and Dutch Guilder as former reserve currencies, in favor of a neutral commodity-backed reserve asset, like gold, oil, or Bitcoin. Of course, these dynamics take years if not decades to play out, but our current framework remains that we are in the middle of a bursting global sovereign debt crisis, that will end in money printing, and a reorganization of the global world order.

Our general philosophy towards the global monetary endgame is that as investors we want to own real assets that have tangible value, as their price will trends towards infinity as fiat money hyperinflates. Given energy is the master commodity input in any economy, we believe investments in Bitcoin, energy, agriculture, metals, and commodity-related infrastructure will be the best stores of value when the fiat system breaks.

Math > Narratives

Once again, markets are in a state of confusion. The battle cries from both bulls and bears alike remain loud, and while we like to stay tapped into the consensus market narrative, we remain disciplined with our quant-fundamental process.

Although we track many data points, none are more important than growth, inflation, and liquidity. Below we will discuss some of the dynamics underlying our analysis that support our bearish views above.

How Far Will The Fed Tighten?

The Fed has explicitly stated they want financial conditions to tighten sufficiently enough to fight inflation. This is primarily achieved through the negative wealth effect. With the majority of household net worth tied to the stock market (via retirement accounts) and housing prices, higher interest rates will lower the value of both equities and housing, making households feel poorer, and thus make them incrementally less likely to spend (ie/ demand destruction).

Currently, the futures market is pricing in a 3% terminal Fed Funds interest rate by early 2023, including a 100% probability of a 50 bps interest rate increase in both June and July. Several weeks ago Federal Reserve Bank of Atlanta President Raphael Bostic said pausing interest rate increases in September might make sense, which relieved risk markets temporarily. However, since then, Fed Vice Chair Lael Brainard came out to throw cold water on that idea, saying the case for a September rate pause is very difficult.

With Fed Presidents haphazardly shooting out their opinions on easing or tightening monetary policy, investors remain paralyzed. Our take is that it’s more likely the Fed over tightens than eases too early. If the Fed pauses rate hikes in September, it’s because the U.S. is already in a recession, in which case we would not be buying risk assets in the middle of a growth slowdown regardless.

Source: Fidelity Investments

Deflation Will Weigh On Risk Assets

As we head into the summer the global economy (ex-China) will begin to enter the DEFLATION macro regime, as growth and inflation continue to decelerate. That said, we believe there is still an upside risk to inflation in Europe specifically given the recent acceleration headline (8.8% YoY) and core (3.8% YoY) inflation. While it looks like inflation has peaked in the U.S., we still believe there is an upside risk to inflation if the services component outpaces the deceleration in goods inflation. That said, any upside surprise in inflation will be swiftly met with further hawkish commentary from the Fed (ie/ monetary tightening), which all else equal is negative for risk assets.

Based on our estimates, we expect to transition into the following macro environment in the next 4-6 weeks:

Growth decelerating 2 std. deviations

Inflation decelerating 1 std. deviation

Monetary policy rate increase

Federal Reserve balance sheet tightening

Fiscal policy tightening

Based on our back-tests from January 1968 to December 1982 and January 1998 to the present (the most analogous period to today), we see the following blended annualized expected returns:

S&P 500 down 7.5%

Nasdaq 100 down 1.3%

Russell 2000 down 19.1%

U.S. Commodity Index down 6.4%

Bitcoin down 37.2%

Ethereum down 119.8%

USD Index up 7.2%

Gold up 6.1%

Bloomberg Barclays US Credit Total Return up 10%

Source: 42 Macro

Inflation Remains the Dominant Market Regime

While we are patiently waiting for the market to transition to DEFLATION, global asset markets are currently pricing in the INFLATION regime (growth decelerating and inflation accelerating). It’s important to understand that both DEFLATION and INFLATION are the two Macro regimes that feature elevated volatility and covariance across asset classes.

As such, our view is that we are in the middle innings of a structural bear market. And while some risk assets like crypto have positive expected annualized returns during the INFLATION regime, we do not think now is the right time to be allocating the fringes of the risk spectrum ahead of a transition into DEFLATION.

Source: 42 Macro

Fed Won’t Pivot Until Inflation Momentum Breaks Down

Last week, the Fed’s preferred measure of inflation, Core PCE, came out still running uncomfortably above trend. While April Core PCE of 6.3% YoY was a deceleration from the 6.6% YoY growth in March, it’s still 300 bps above the Fed’s target of sub 3%. While it is encouraging to see YoY inflation begin to roll over as a function of base effects, the Fed needs to see a convincing slowdown in inflation before considering a dovish pivot.

We believe the 3-month seasonally adjusted annualized rate of change can give us insight into how the U.S. inflation dynamics are inflecting at the margin. Based on our estimates, we don’t think it’s realistic to see a sub 3% Core PCE reading on a 3mo SAAR basis until the September data is released on 10/23. As a result, we think a policy pivot won’t come earlier than the November Fed meeting on 11/2. However, by that time the global economy will likely already be in a deep growth slowdown. Add in the U.S. midterm elections and it’s the perfect storm for policymakers to throw the kitchen sink.

While we eventually expect policymakers to capitulate and print money, we don’t think it’ll happen for another 5 months at the earliest – ie/ don’t step in and start buying the dip just yet.

Source: 42 Macro

White House Messaging Remains In Denial

Last Friday, President Biden took a victory lap and gave a speech discussing the U.S. economy in the context of a strong jobs report. In his most disingenuous speech yet, Biden spewed 20 minutes of misinformation painting a story that the U.S. economy was booming and would grow faster than China this year, which hasn’t happened since 1976.

What was most frustrating however is that Biden cited a Federal Reserve poll stating that more American felt financially comfortable at any point in history since the study began in 2013, supported by less debt and higher savings. This, of course, is factually incorrect as evidenced by consumer credit cards now at the highest level since early 2020 and household savings rates now plummeting below 5%.

An April 2022 report out from LendingClub found that 61% of Americans now live paycheck to paycheck (up 9 pts from 52% in April 2021), and 36% of Americans making over $250,000 per year also live paycheck to paycheck!

The messaging from the U.S. White House and Federal Reserve remains backward-looking and optimistic, unable to face the hard truth that our domestic economy is headed for tougher times. My point here is simple – do your research and think for yourselves. Never accept the messaging given by institutions at face value.

Source: Zerohedge

Still Early Innings of a Growth Cycle Slowdown

A robust economy doesn’t feature consumers who are saving less and using their credit cards more. As household balance sheets continue to be under pressure due to higher costs of living, we would expect retail sales data to continue weakening. Real personal consumption grew 2.8% YoY in April, but on a 3mo SAAR basis consumption only grew 1.2%, suggesting a downside inflection will likely begin to show in future data.

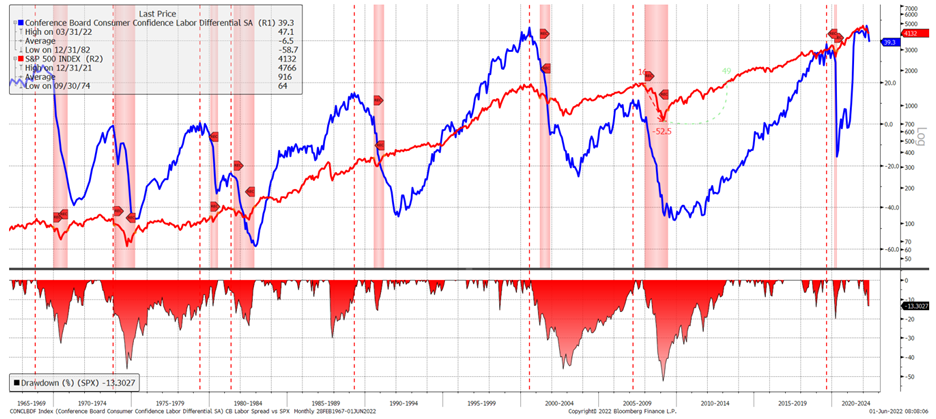

Furthermore, the U.S. Consumer Confidence Labor Differential is a useful leading growth cycle indicator to gauge the health of the U.S. economy. The median S&P 500 drawdown associated with the previous eight cycle peaks in this growth cycle indicator is -35%. When compared to the S&P’s current drawdown of 14%, it suggests we have more asset market downside from here.

Source: 42 Macro

We’re A Long Way From The Bottom

If we look at the high beta/low beta ratio across multiple cycles, we historically have seen drawdowns of -66% (2007-2008), -39% (2011), -35% (2014-2016), and -39% (2018-2020). The current cycle peak from late 2021 is only down 21%, suggesting we still have serious downside ahead of us, particularly across high beta assets (technology, consumer discretionary, financials, industrials, etc.).

We do not think now is the right time to be allocated to high beta assets (including crypto) on the long side unless you want to lose money over the next 3-6 months. While there may be a time later this year to buy high beta assets, we believe a better strategy would be to rotate into low beta/value equities, raise cash, and/or go net-short (if possible).

Source: 42 Macro

Beware of 2Q Earnings Season

As we mentioned earlier, the recent layoffs and hiring freezes announced by Netflix, Amazon, Walmart, Tesla, PayPal, Robinhood, Carvana, etc. are a harbinger of more negativity to come. Earlier this month we also received Walmart earnings, which raised annual sales targets but cut their profit forecast due to higher inflation, particularly in food, fuel, and staffing. The same messaging came out of Target, which also missed its earnings, saw operating margins compress, and lowered profit guidance.

Curiously, next-12-month earnings estimates from sell-side analysts remain at all-time highs. As a former sell-side analyst covering Beverages, Tobacco, and Cannabis, my experience is that earnings estimate revisions are reactive. Due to career risk and existing investment banking relationships with public companies, sell-side analysts are hardly ever able to be proactively bearish on a company or sector until it becomes a consensus narrative.

As such, we expect sell-side estimates to lower once 2Q earnings begin and it becomes abundantly obvious that companies will need to revise their full-year guidance. This of course will continue to weigh on the stock market and cause another shock lower, likely accompanied by higher volatility.

Source: 42 Macro

Foreign Investors Crowded into U.S. Assets During COVID

When COVID hit the global economy, investors crowded into the safest assets they could find. Ironically, this was not USTs, which have historically been considered a safe-haven asset during times of crisis, but instead U.S. equities. Given U.S. technology dominance, aggressive monetary support through QE, and relentless fiscal support through helicopter stimulus – the U.S. was considered the best house in a terrible neighborhood by foreign investors.

This caused an excessive crowding particularly into “pandemic-proof” COVID stocks, like Facebook, Amazon, Apple, Microsoft, Google, etc. We’ve seen this dynamic before however back in the Dot Com Bubble of the early 2000s. Eventually, once economic and market conditions no longer supported the case for being bullish at any price, foreign investors blew out of their positions and reallocated to other investments.

Between 2020 and 2021, nearly $7 trillion of foreign investment entered the U.S. equity markets, excessively propping up valuations, and driving prices higher. If the U.S. does indeed face a growth slowdown (almost certainly in our view), we may see foreign divestitures of U.S. equities catalyze further downside pressure on financial markets as foreign investors reallocate to other asset classes and geographies.

Source: 42 Macro

Volatility Compressing Like A Coiled Spring

One of the most curious developments in financial markets recently has been the compressed levels of volatility as indicated by the VIX, commonly referred to as the fear index. The VIX measures the volatility of the S&P 500 by looking at options prices. After bottoming at 14 in June 2021, the VIX has steadily seen higher lows and higher highs over the following 12 months, indicating a market shift towards a higher volatility regime (which is usually associated with bear markets).

However, following the Russia/Ukraine invasion on February 24, the VIX has not been able to get above 38, as if all the event risk associated with Russia’s invasion was already priced into markets. With the VIX now below 25 again, it suggests fear is dissipating once again from the market. Furthermore, the VVIX, which measures the volatility of the VIX by looking at VIX options pricing, has recently hit 2-year lows. This is indicative of a market that isn’t searching for volatility protection (ie/ a complacent market).

Newsflash – risk still exists in the market. I would argue that with each passing month, the risks to the global economy and financial markets continue to build. Given all the tail risks in the world (growth, inflation, geopolitics, deglobalization, etc.) we believe this coiled spring is ripe for expansion, and we would expect higher levels of volatility in the coming months.

Source: Netizen Capital

The Multi-Billion Dollar Collapse of Terra

The biggest news by far this month across the crypto space was the multi-billion dollar collapse of the Terra ecosystem, a cryptocurrency network based around an algorithmic stablecoin called TerraUSD (UST), which used its native token Luna (LUNA) as its equity capital.

At its peak, LUNA and UST had a $40 bn and $20 bn market cap, respectively, almost all of which is now wiped out. Between May 7 and May 12, the UST peg broke, and LUNA’s equity blew up. The project was heavily invested by crypto VCs, crypto hedge funds, and retail investors. The collapse of the Terra ecosystem was a gut punch to the crypto world.

In March 2022, the Luna Foundation Guard (LFG) was created (so much for decentralization) to protect the Terra ecosystem and began purchasing Bitcoin to be used as collateral to protect the value of LUNA’s equity. In total, LFG purchased $1.3 billion worth of Bitcoin before being forced to eventually liquidate.

The problem with the Terra ecosystem wasn’t technical, but rather a risk built on unstable economic design and unsustainable financial incentives. Terra is a proof-of-stake smart contract cryptocurrency based around UST as their algorithmic dollar stablecoin. LUNA served as a volatility offset for UST, meaning if UST got above $1, then LUNA could be burned to create more UST, and if UST went below $1, then LUNA could be created, and UST burned. The more demand there is for UST over time, the higher UST and LUNA market cap should go. The idea was to essentially be a self-correcting central bank.

However, if LUNA’s price did not keep up with UST’s market cap, then UST would become less and less collateralized by LUNA over time, which began happening in late 2021. The catch however is that demand for UST is driven solely by unsustainable yield farming through Terra’s DeFi protocol, Anchor, which offered investors 20% interest on UST. If the VC-supported yield dried up, demand for UST would decline which could cause a negative feedback loop and liquidity problems for UST and LUNA.

Of course, this did happen in April, as artificially high yields on UST began to decrease meaningfully, reducing demand for UST. Only a month later and the death spiral began, as broad weakness across markets continued to weigh on the crypto prices including LUNA. The unraveling happened so quickly that LFG was forced to sell their BTC in the open market to attempt to defend the UST peg, which ultimately failed.

As UST de-pegged and LUNA collapsed in price, the LFG was forced to liquidate their BTC and AVAX holdings, which were used as “alternative” collateral to defend the ecosystem. This of course was unwise, given the high correlation between all the assets. As such, contagion spread, and thousands of altcoins began to also bleed value. Many VCs, hedge funds, and retail investors were caught in the crossfire, and billions of capital were lost in only a week.

Source: Netizen Capital

Bitcoin Remains The King

There has been an obvious sentiment shift within the crypto space, causing many investors to re-evaluate what they own and if there is any underlying value. Layer 1 smart contract platforms and Layer 2 DeFi protocols were hit particularly hard, but Bitcoin remained a relative outperformer.

As is consistent with most bear markets, Bitcoin dominance continues to rise as quality floats to the top and capital flees from riskier investments. The reality is that Bitcoin was completely unshaken by this event, from both sentiment and technical perspectives. That cannot be said for other Layer 1 protocols, even Ethereum.

My key takeaway from this event is that there is Bitcoin, and then there is everything else. Bitcoin is an emerging macroeconomic asset with real infrastructure and tangible value behind it. Meanwhile, Ethereum and everything else in the crypto space is effectively publicly tradable venture capital digital assets – subject to mass speculation and euphoria. Know what you own.

Source: Netizen Capital

The Decoupling Is Here…To The Downside

For months I’ve been hearing crypto VCs, crypto hedge funds, and retail investors alike all clamoring for the great decoupling between equities and crypto, to the upside. Although crypto once began as an uncorrelated asset class, the institutionalization and mainstreaming of crypto has quickly morphed the asset class into a high beta Nasdaq. This dynamic became particularly evident after the COVID crash and in the following bull market.

However, since the Terra ecosystem collapse in May, we’ve noticed how unloved the crypto asset class has been trading relative to equities. Over the past month, the Nasdaq is -4% vs. Ethereum -38%. With the S&P 500 still above $4,000, we likely have another 20-30% downside for equities, meaning it’s reasonable to see crypto down 50% or more over the course of this bear market.

As such, we now revise our price targets for Bitcoin and Ethereum to $20,000 and sub $1,000, respectively, by the end of this bear market. With Bitcoin’s long-term holder cost basis at $22,000, we believe Bitcoin will be a relative outperformed and start to receive support at those levels, which we would also be buyers of. However, we remain decidedly bearish on all altcoins and expect Layer 1 and Layer 2 protocols to be down significantly over the following 6 months.

Source: 42 Macro

Final Thoughts

I will once again reiterate my stance that now is not the time to buy the dip, as we’re clearly in a structural bear market with no end in sight for the next 6 months. The past two years of excess money and credit in the global economy are finally unwinding, and as a result, so must asset valuations. In fact, given the psychological nature of bull market transitions, we expect the correction to overshoot the fair value for many of these assets to the downside.

Many crypto and tech funds are down over 50% YTD. This structural bear market is exposing bull market geniuses who have only made money when the Fed printer is on, but who have been frankly cavalier about macro risk management. Many investors are still going through the seven stages of grief, stuck in denial that the bull market is finally over. Later this year, some hedge funds will begin to receive redemptions from displeased investors, which may cause aggressive capitulations in markets as positions are unwound. And while economic data on a reported backward-looking basis is good enough, leading indicators continue to support our view that financial markets are poised for more downside.

As it relates to current U.S. equity prices, we believe the recent bear market rally is largely over and we wouldn’t expect to see the S&P 500 above $4,300 after the VIX and options expiry on 6/15 and 6/17, respectively. If you have the ability (or desire) to make money on the downside, we think the risk-reward here is favorable to initiate short positions in higher beta assets (Nasdaq, Russell, Ethereum, etc.). Otherwise, just move to cash. There is no need to continue waiting for a bear market rally that will never come, especially as we approach the 2Q earnings season.

It's unlikely in our view that the Fed will pivot monetary policy until they see a sequential momentum breakdown in inflation, and it appears the Fed now has the public blessing of the White House to do whatever it takes (ie/ slow growth to fight inflation). With Yellen confirming that a soft landing is effectively off the table, we expect the next 6 months to be painful for your retirement and brokerage accounts. For non-savvy investors, hiding in cash is counter-intuitively a good idea right now, despite high single-digit inflation. While it’s nice to make money in a bear market, it’s more important not to lose it. The more money you have to deploy when the Fed pivots monetary policy, the more you’ll be able to make back on the next bull run.

Keep your head on a swivel, and best of luck.

- Netizen Velez