Beware of Quantitative Tightening

It’s no secret that monetary (money supply) and fiscal (government spending) stimulus have been the two main driving forces of public markets since 2008. Below is a chart showing the Willshire 5000 (a proxy for the U.S. stock market) and the Federal Reserve’s balance sheet.

While I won’t walk you through Lyn Alden’s annotation of her chart – you’ll notice the following:

The U.S. stock market generally trades sideways when the Fed balance sheet is flat

The U.S. stock market generally trades upwards when the Fed balance sheet is expanding

Government intervention, such as Trump’s corporate tax cuts (or Biden’s Build Back Better Plan), can lead to higher a U.S. stock market in certain situations

As we look ahead, the Fed is now tightening its balance sheet (by ending quantitative easing and raising short-term interest rates). Therefore, we would expect the U.S stock market to enter another period of increased volatility and sideways trading over the intermediate-term.

While mainstream financial media loves focusing on equity markets when discussing the “health” of U.S. capital markets, the real leading indicator is the bond market. And last week was an epic week in bond markets.

Specifically, the 30-Year U.S. Treasury had its worst week in 49 years, down 9.35%. Meanwhile, the 10-Year U.S. Treasury had its worst week in 42 years, with a loss of 4.24%. The last time we saw the 10-Year UST decline more was in 1980, around the time of the Volcker inflation panic when short-term interest rates moved to 20%.

So why is this happening now?

Well, last week the Federal Reserve released the FOMC minutes from their meeting on December 14-15. While most of the information was already known, the minutes from the policy meeting showed Fed officials uniformly concerned about the pace of inflation that was expected to persist, alongside global supply bottlenecks well into 2022. According to the Fed, a tight labor market and unabated inflation would require them to raise interest rates sooner than expected and begin reducing the Fed balance sheet.

You have to appreciate, the Fed is the buyer of last resort in UST markets through quantitative easing. UST prices have an inverse relationship with yields. So when the Fed slows (and eventually stops) their purchases of USTs, bond yields begin to rise. However, when UST yields begin to rise, this impacts the cost of capital across all markets and lowers asset price valuations. We discuss this phenomenon in more detail on page 44 of our Netizen Mega Thesis.

When the Fed stops QE (and there are no foreign purchasers), UST prices decrease, which raises UST yields, and consequently lowers asset valuations in risk markets (equities, crypto, real estate, etc.). We believe the bond market is a leading indicator of what will happen in risk markets over the next few months. Though Bitcoin and crypto markets have already corrected a bit, we would expect the U.S. stock market to be the next asset class to soon see a much-needed correction.

A Looming Global Energy Crisis

I want to zoom out from a U.S.-centric point of view and discuss energy markets more broadly. There seems to be a fundamental misunderstanding about energy infrastructure among policymakers. While there is an ideological push to move away from fossil fuels towards clean energy, the reality is that changing our global energy infrastructure will take decades, not months or years. This push for green stimulus is evident in President Biden’s proposed $1.75 trillion Build Back Better Program, where clean energy and climate investments account for 30% (or $555 billion) of the entire bill.

As Environmental, Social, and Governance (ESG) concerns continue to rise, so has hate towards the fossil fuel industry. Climate change is an undeniable issue, as there is a record amount of scientific evidence to support such claims, however, there are nearly 8 billion people who inhabit Earth who need the energy to survive (and thrive).

While estimates vary, renewable energy only accounted for 11% of global energy in 2019. Solar, wind, hydro, and nuclear, simply aren’t at the scale necessary to usurp fossil fuel energy just yet. And according to U.S. Treasury Secretary Janet Yellen, the transition will require between $100 to $150 trillion in green energy investments over the next three decades to address climate change. I suspect over time ESG concerns may give Central Bankers carte blanche to print money for a greener future, though time will tell.

In the meantime, the world must continue to invest in oil & gas exploration, or else we’ll face an energy shortage in the coming decades – and that’s exactly what’s happening. A recent study from Rystad Energy showed that oil & gas discoveries are at their lowest level since 1946. Political pressure is building up against the fossil fuel industry, and banks are increasingly reluctant to loan money to the sector, according to the Federal Reserve Bank of Dallas. Banks view lending to the energy industry as having “political risk,” which consequently has risen input costs for oil & gas explorers.

We must never forget that energy is the master commodity. Energy is the foundational input for any productive good or service in our economy. So when there is an energy shortage, prices for everything rise. And by prematurely removing capital investment out of the oil & gas industry, we are setting the stage for secular energy inflation without even realizing it.

Over the past month, we’ve seen several headlines alerting us to a brewing global energy crisis. In Indonesia, thermal coal exports were banned due to concerns the country could not meet domestic energy demands. In Poland, coal miners are protesting for more pay due to increased workload amid European energy shortages. Alcoa Corporation reached an agreement to curtail aluminum smelter in Spain for the next two years due to rising European energy prices. In Chile, President-elect Gabriel Boric vowed to halt iron-copper-gold mining projects due to environmental concerns. In China, three rare earth (a key input in electric vehicles and renewables) producers have merged to gain pricing power. And finally, there are growing U.S. concerns about our critical mineral supply chains.

However, nothing is more emblematic of the looming energy crisis than the rising conflict in the former Soviet nation Kazakhstan. For some context, the price of liquid petroleum gas has been spiking in the country, leading to deadly social conflict and a state of emergency. As a result, the government introduced price caps on gas, although the problem runs much deeper than energy prices.

It’s important to understand that Russia and Kazakhstan share the largest continuous international border in the world at 4,700 miles, and news of the conflict has been 24/7 on Russian media. As a result, Russia has sent over troops to aid in the chaos as part of a “peacekeeping” force from the Collective Security Treaty Organization (CSTO), a Russian-led Eurasian military alliance similar to NATO.

As we think about actions U.S. policymakers are taking to combat inflation (quantitative tightening) and contextualizing the lack of investment in the oil & gas industry (as part of ideological ESG initiatives), we believe the above events are pointing to a potential global energy crisis and setting the stage for world-wide secular inflation. We will continue to monitor the situation; however, it’s worth noting that while the U.S. can print money whenever there is a shortage of liquidity in capital markets, policymakers cannot print energy when there is a shortage. Energy is the master input in any economy.

Bitcoin Is Historically Undervalued

Bitcoin and crypto markets are not for the faint of heart. While Bitcoin has been in free-fall over the past week as UST yields have risen, we will once again talk you off the ledge. Recall, many have claimed Bitcoin is dead over the past decade, yet all have been proven to be wrong so far.

Below we highlight what the derivatives and on-chain data are showing us over the short term and how we should think about long-term on-chain activity on Bitcoin’s network.

Short Term - HODLers vs. The Shorts

The recent Bitcoin buying behavior at the sub-$45k level has been dominated by HODLers, with limited activity from new market entrants. As coins are held in investor wallets, they accrue coin days, known as aging. One way we can dissect this buying activity is by looking at HODLer Net Position Change, which measures the age of coins being sold into the market.

Positive (green) values indicate that coins are aging (being held) at a higher rate than are being sold. This historically happens when markets are weak, and higher conviction buyers step into the market to purchase coins from retail traders.

Negative (red) values indicate older coins are selling at a higher rate than are being accumulated. This is often observed during the height of a bull market because long-term investors want to be rewarded by selling their coins for profit after holding for so long.

Interestingly, the market selloff since November coincided with higher levels of HODLer accumulation, which would signify that most of the selling over the past few months has come from retail traders and short-term holders, aka weaker hands. Therefore, we can conclude that at these price levels, mostly HODLers, aka strong hands, remain in Bitcoin.

As we noted in our last newsletter, the recent selloff from $60k to the $40k range was largely due to overleverage and growing open interest in the futures market. While open interest does not tell us directionally if leverage is long or short, it is a good indicator to identify if volatility is building up in the derivatives market.

However, despite the recent sell-off, Bitcoin’s Futures Open Interest Leverage Ratio is still rising (around 2% of its market cap), which has historically been a volatile level for cascading long or short liquidations. Digging a bit deeper, however, if we look at the most recent data, Bitcoin futures liquidations have been dominated by long traders, implying that the most recent build-up in open interest is likely on the short side.

Wrapping this up, while Bitcoin HODLers have been accumulating coins from retail traders in the sub-$45k range, we are now starting to see Bitcoin futures traders pile up on the short side expecting further downside. In the short term, this could lead to two outcomes, either:

1) an upward short squeeze in price if HODLer buying remains strong at these levels and shorts need to cover their positions, or 2) a sharper downward move testing HODLer conviction.

Long Term - Bitcoin Attractive Around $40k-$45k

While derivatives data is generally more useful in evaluating Bitcoin’s short-term price action, there are a few other key on-chain metrics we like to look at to evaluate where Bitcoin’s price action is on a macro level.

Short-Term Holder Cost Basis – Glassnode defines a short-term holder (traders) as anyone who has owned Bitcoin for fewer than 155 days, or roughly 5 months. At the 155-day mark, Bitcoins are probabilistically less likely to be sold and become recategorized as long-term holders (investors). Historically, the short-term holder cost basis has proved to be a reliable bull-market support level (or bear-market ceiling). With Bitcoin’s STH cost basis hovering around $52k, we view this as a necessary ceiling for us to get above to confirm a bull market.

Stock to Flow Deflection – As we covered briefly before, Stock-to-Flow is a supply model popularized by PlanB, based on commodity markets to value Bitcoin using its fixed supply schedule. The deflection model looks at the projected price of Bitcoin using S2F and compares it to the current price of Bitcoin. At $43,000, Bitcoin’s value is 40% of S2F’s target of $108,000. The last two times we traded at 40% of S2F’s target price was in May 2021 (after the Bitcoin China ban), and in July 2017 (5 months before Bitcoin’s meteoric rise to $20,000 in December 2017). Based on the S2F Model, Bitcoin is 60% undervalued at its current price.

Illiquid Supply Shock Ratio – This metric looks at how many Bitcoins are liquid (on exchanges) or illiquid (moved into cold storage). Historically, the illiquid supply shock ratio rises as a leading indicator when long-term HODLers are accumulating, and the ratio decreases when old Bitcoins are being sold in the market. Bitcoin Illiquid Supply Shock Ratio has been increasing consistently since May 2021, indicating incremental buyers are moving their coins into cold storage and not selling.

Net Unrealized Profit & Loss – This metric gives us insight into investor sentiment based on what percent of Bitcoin owned is in profit or loss if everyone were to hypothetically sell all their coins today. We can break this into 5 distinct ranges: 1) Euphoria/Greed, 2) Belief/Denial, 3) Optimism/Anxiety, 4) Hope/Fear, and 5) Capitulation. As the great Warren Buffett once said, “Be fearful when others are greedy.” With Bitcoin trading at $43,000, roughly 44% of Bitcoins are in unrealized profit, putting us in the Optimism/Anxiety range.

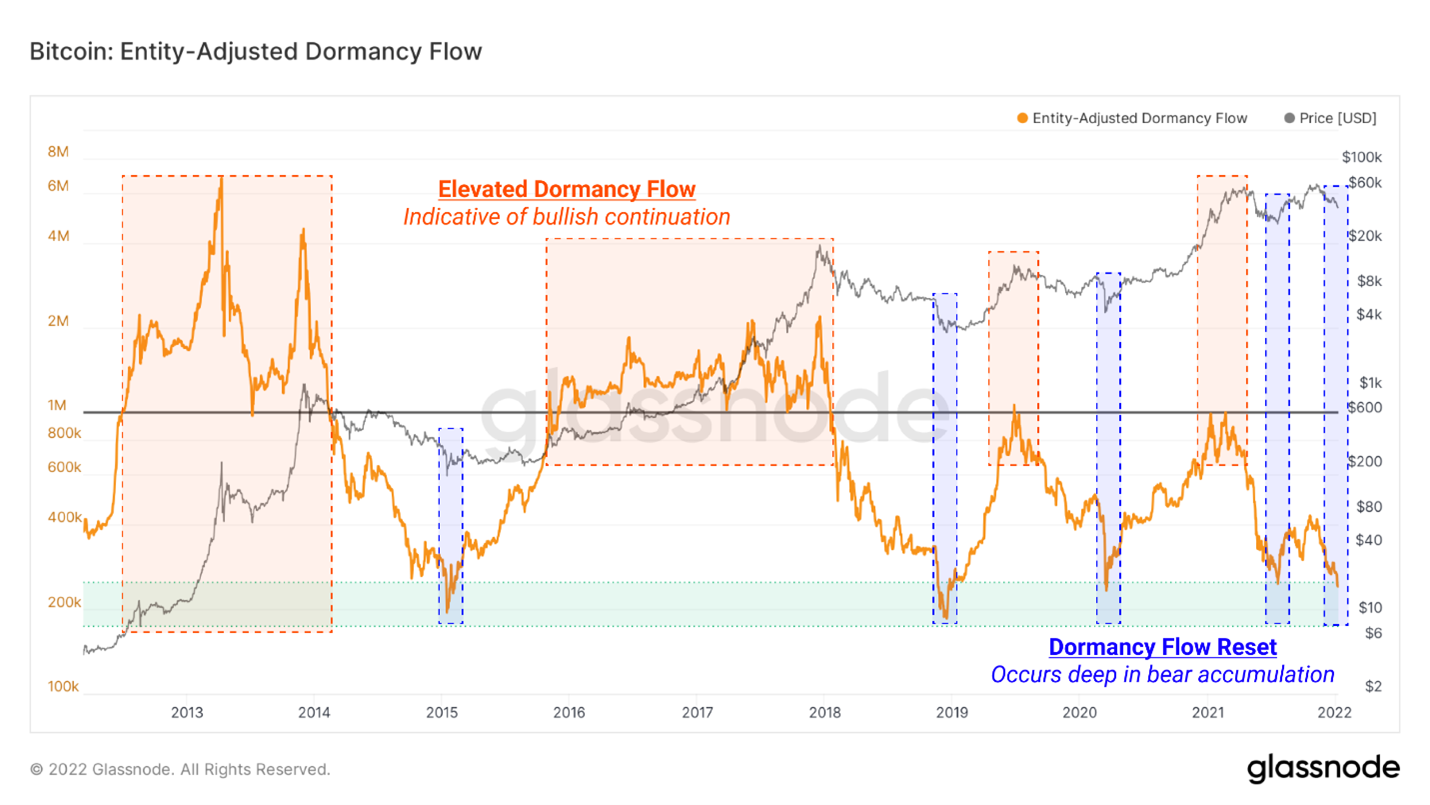

Entity-Adjusted Dormancy Flow – This metric measures the average number of days each Bitcoin transacted remains dormant (unmoved). The higher the dormancy flow, the older the coins sold that day are on average, meaning older hands are selling Bitcoin. When dormancy flow is low, this has historically indicated a price bottom. Bitcoin’s dormancy flow is currently at levels seen only five previous times in its history, all of which were followed by a significant price appreciation.

In summary, while the Bitcoin derivatives data indicates more volatility in the short term, it appears we are nearing a macro price bottom in Bitcoin around $40,000. All the longer-term on-chain data indicates Bitcoin is undervalued at these prices; however, we would be wise to acknowledge quantitative tightening can lead to more downside from here. That said, if you have a longer investment horizon than 12-24 months and can stomach volatility, we think these are great prices to build up a position.

The Web3 Brain Drain

When I graduated from Columbia Engineering in 2014, my brightest classmates took one of two routes – either Wall St. or Silicon Valley. These jobs paid the best, they offered the best network and had the most career upside. However, over the past few years, I’ve noticed a trend of people leaving these historically prestigious roles to venture into crypto/web3 – myself included.

What we’re witnessing is a crypto brain drain. Many tech executives and engineers are quitting Google, Facebook (Meta), Amazon, and other Fortune 500 companies for a “once-in-a-generation opportunity” within crypto. While those companies are titans of web2, they’re now behind the innovation curve of the web3 future. If you’re talented, young, and entrepreneurial, why would you give up the opportunity to build the next Facebook, Google, Amazon, for safety and comfort? And this is exactly the dynamic fueling the mass exodus out of Wall St. and Silicon Valley.

To quantify this demographic shift, Electric Capital recently released their annual developer report, which looked at the number of web3 developers entering the crypto space by combing through open-source code repositories and code commits. Below are some high-level takeaways:

18,000+ monthly active developers committed code in open source crypto and Web3 projects

34,000+ new developers committed code in 2021 — the highest in history

65% of active developers in Web3 joined in 2021; 45% of full-time developers in Web3 joined in 2021

What’s even more impressive is that the number of web3 developers continues to grow regardless of the price action of crypt markets. Digging a bit deeper, it’s unsurprising that developers are flocking to the largest Layer 1 ecosystems, while there is markedly less development (though still active and growing) in Layer 2 dApps. Here are some other takeaways to consider:

The largest ecosystems are Ethereum, Bitcoin, Polkadot, Cosmos, Solana, BSC, NEAR, Avalanche, Tezos, Polygon, and Cardano, each with 250+ monthly active developers

Polkadot, Solana, NEAR, BSC, Avalanche, and Terra are growing faster than Ethereum did at similar points in its history

2,500+ developers are working on DeFi projects. Less than 1,000 full-time developers are responsible for over $100 billion in total value locked in smart contracts

In the context of Layer 1 blockchain adoption, we believe Former Microsoft CEO Steve Ballmer hit the nail on the head when he said:

“Platform wars are fought over developers first, users second.”

As of a few months ago, 70% of the top 10 smart contract platforms are Ethereum Virtual Machine (EVM) compatible, while 30% are not. You can think of the EVM as Android OS or Apple iOS. Developers are the key to any platform’s success – they create the attractions that bring users to the theme park.

When we look at historical analogs to the Layer 1 smart contract platform wars, a few technologies stand out:

PC Operating Systems used to be Windows, Mac, Os2, BeOS, Linux, etc., and eventually converged to Windows and Mac.

Mobile Operating Systems used to be Symbian, Blackberry, Android, iOS, Palm OS, Tizen, etc., and eventually converged to Android and iOS.

Browsers used to be Netscape Navigator, Internet Explorer, Chrome, Firefox, Opera, etc., and eventually converged to Chrome and Firefox.

PC Chipsets used to be Intel, AMD, Qualcomm, TI, Broadcom, etc., and eventually converged to Intel and AMD.

Graphics Cards used to be Nvidia, AMD, Asus, Intel, etc., and eventually converged to Nvidia and AMD.

Like the Sith’s Rule of Two, technology often trends toward a duopoly. The challenge today when evaluating competing Layer 1 blockchains is to determine which ones will stand the test of time. It appears EVM-compatible blockchains have a significant head start, but it’s still early. Therefore, developer activity is a useful leading indicator to figure out which Layer 1 blockchains will gain the most adoption over time.

Final Thoughts

We became buyers once Bitcoin crossed the $45k range given the bullish on-chain support, however, we are still maintaining a healthy stablecoin (cash-equivalent) position in case of a deflationary shock. Despite the selloff in Bitcoin and crypto, equity markets are still near all-time highs. As quantitative tightening continues and U.S. Treasury yields continue to rise, we are watching for any weakness in equity markets as a potential trigger for a deflationary shock. It’s important to understand that since March 2020, the correlation between Bitcoin and equity markets has increased, meaning that any significant correction in equity markets (10-20%+) could translate to sub-$40k Bitcoin.

On the macroeconomic front, we are grappling with two realities. On one hand, the Federal Reserve is trying to tighten the money supply to fight consumer price inflation, however, there are signs of a looming energy crisis in foreign markets that deserve investor attention. Central Banks can tighten the money supply all they want, but if energy production is constrained (due to lack of investment in oil & gas), this could lead to global secular inflation and trigger a depressionary event. We affirm our belief that tighter monetary and fiscal policy will likely be short-lived once there is “enough” asset-price pain. Given global debt levels, we would expect U.S. policymakers to eventually reverse course and begin easing at some point later this year (or pass fiscal stimulus to aid Americans). A reversal in monetary or fiscal policy towards easing would be a signal for us to get more aggressive in our portfolio.

On a long-term horizon, all signals indicate that Bitcoin, crypto, and web3 are here to stay. The Bitcoin on-chain data is very encouraging. Bitcoins are being accumulated by long-term holders, it’s 40% off all-time highs, Bitcoins are moving off exchanges into cold storage, and Bitcoin is undervalued across several on-chain metrics. If your time horizon is longer than 12-24 months, we believe right now is a great time to be buying. Furthermore, the brain drain occurring from Silicon Valley and Wall St. into web3 development is undeniable and gives us good insight into which projects we want to invest in. Overall, while there may be some short-term pain, we believe long-term gains will follow.

I hope you enjoyed this letter. I didn’t expect to write another one so soon after the first, however, given the recent price action, I felt like I needed to get my thoughts together.

Wishing you all a wonderful week and I hope your 2022 has gotten off to an incredible start!

- Netizen Velez