Trump's Fed Revolution Fuels Everything Rally

Yes. Despite Bitcoin and S&P 500 near all-time highs, markets are severely underpricing Trump's plan to replace Jerome Powell with an ultra-dovish Fed chair. Recent headlines show Director of the National Economic Council Kevin Hassett as the front-runner, who has publicly embraced Trump's economic philosophy of outgrowing the debt through lower interest rates. Meanwhile, current Fed Chair Jerome Powell refuses to acknowledge progress on inflation, fearing it would catalyze a dovish policy shift that could ironically reignite inflation pressures. With global asset markets still pricing in GOLDILOCKS conditions, the Everything Rally we've been calling for remains in full effect. We continue to see BULLISH momentum in Bitcoin, S&P 500, and gold while volatility indices remain BEARISH and complacent. A dovish Fed appointment would create explosive upside risk for assets and devastating downside risk for the US dollar as monetary policy turns aggressively accommodative. While pullback risk exists given economic uncertainties, any dips are high-conviction buying opportunities ahead of this regime shift.

TLDR: Trump's ultra-dovish Fed chair will accelerate monetary debasement, making Bitcoin the ultimate beneficiary of US dollar destruction.

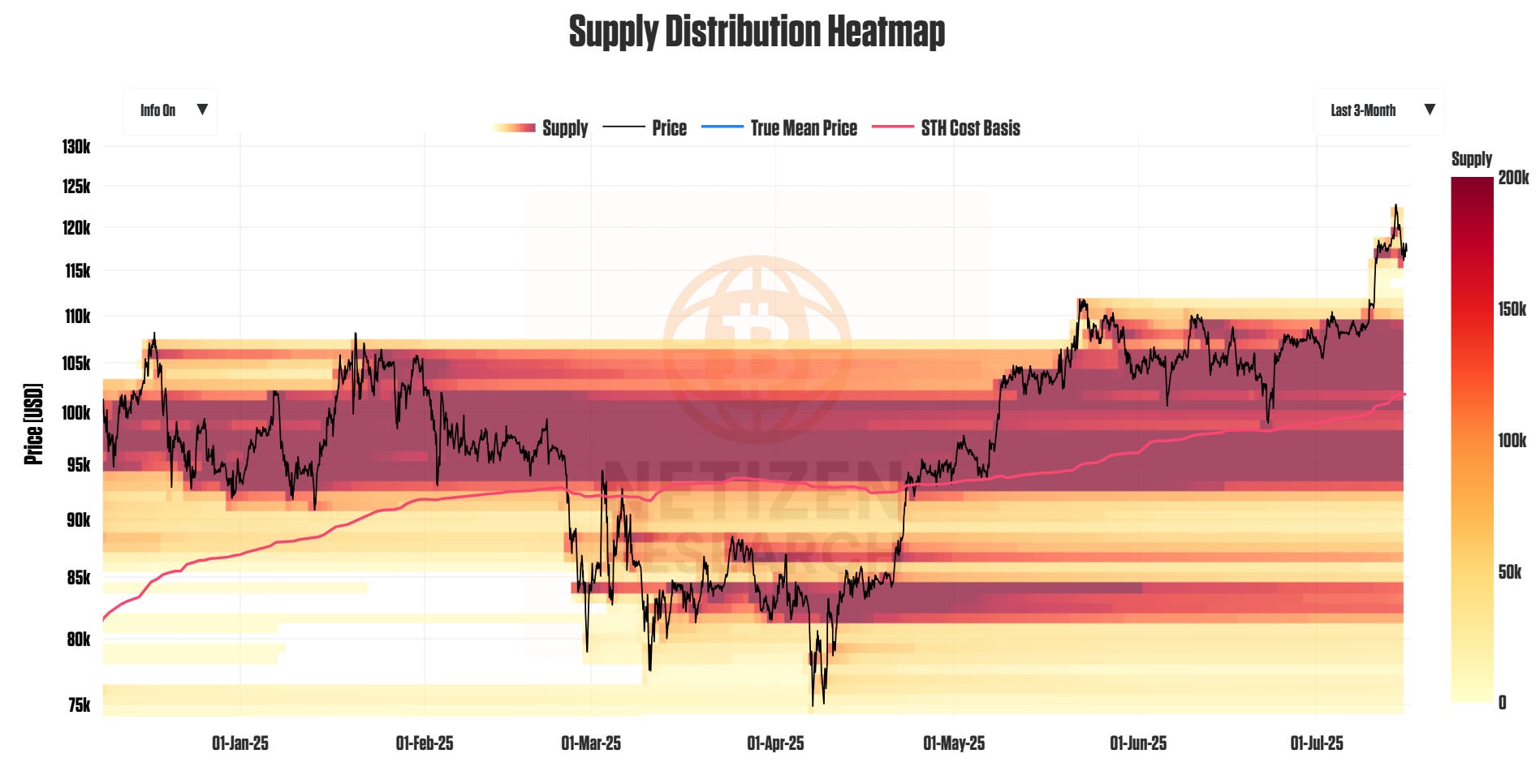

Supply Walls Building Above $100K

Looking at Bitcoin's on-chain data, our supply distribution heat-map reveals a formidable resistance cluster at $117k holding approximately 262k BTC, while the largest concentration sits at $105k with roughly 494k BTC. With 75% of Bitcoin's supply now positioned above $93k, the market has developed a top-heavy structure that creates strong support between $93k-$110k. The short-term holder cost basis of $101.8k represents a critical psychological floor, as recent buyers defend their positions ahead of potential Fed policy shifts. This sturdy on-chain foundation perfectly complements our Everything Rally macro backdrop, where Trump's dovish monetary appointments should drive sustained demand despite being near all-time highs.

TLDR: Strong supply walls above $100k create a solid foundation for Bitcoin's next leg higher as fiscal and monetary easing fuel future demand.

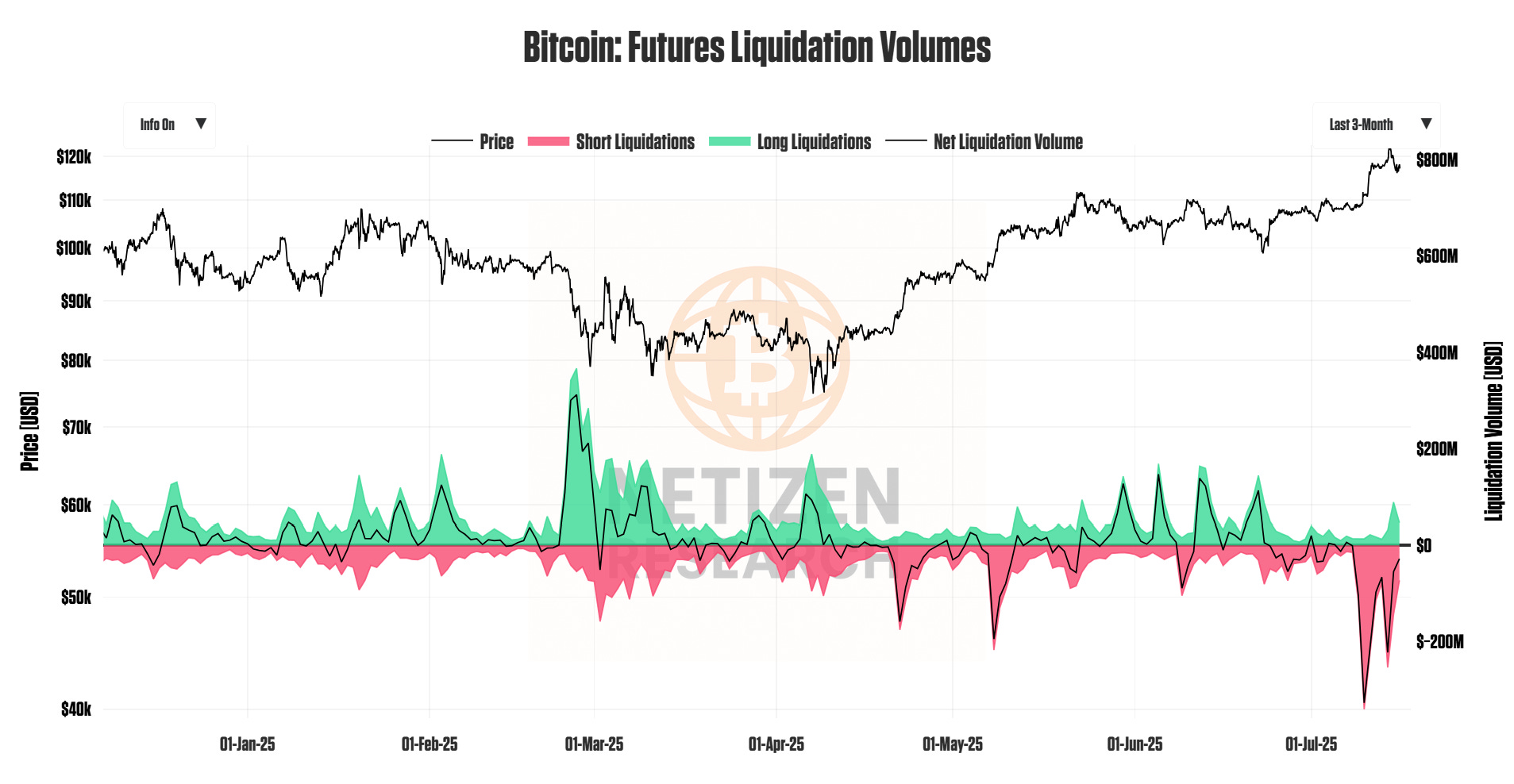

Underlying Demand Remains Despite Leverage

The July 10th short squeeze delivered a devastating $341m in forced buying, the largest liquidation event since July 26, 2021 ($320m), signaling a definitive shift in market sentiment. Four days later, another $254m in shorts were liquidated on July 14th, confirming bears' capitulation as overleveraged traders bet against Bitcoin. The last two weeks place Bitcoin firmly in the Leveraged-Rally quadrant with rising prices and expanding open interest, creating powerful but potentially volatile upside momentum. Meanwhile, ETF inflows remain robust with $700m this week and $770m last week, representing genuine institutional and retail demand beneath the leverage-driven moves. While futures positioning can spark whipsaws, the macro tailwinds and technical momentum of asset markets keep our medium-term bias firmly higher.

TLDR: Massive short squeezes combined with strong ETF flows create explosive upside potential as dovish Fed expectations fuel the Everything Rally.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.