Netizen Weekly | Bitcoin Market Update #15

ALL-TIME HIGHS: Bitcoin Breaks $110K & Dollar Weakens

Is President Trump Causing A Dollar Bear Market?

Yesterday Bitcoin broke $110,000, setting a new all-time high—and premium members will know that our dynamic DCA model turned bullish way back on April 26. This rally is being fueled by a weakening U.S. dollar, which has plunged roughly 10% year-to-date as President Trump's aggressive tariff negotiations accelerate global trading partners' rush to reduce their USD dependence. The top-down market regime has also recently transitioned from GOLDILOCKS to REFLATION mode—where both growth and inflation expectations rise together—maintaining a RISK-ON environment where Bitcoin and stocks historically outperform. This dollar decline could deliver an upside surprise when Q2 earnings season arrives, since about 40% of S&P 500 revenue comes from overseas and gets translated back at more favorable exchange rates, potentially fueling continued strength across risk assets. As global de-dollarization accelerates and traditional assets trade sideways, Bitcoin is emerging as the clear winner among alternative stores of value.

TLDR: A potentially sustained dollar bear market makes Bitcoin more attractive as both a hedge against currency debasement and a beneficiary of the global shift toward non-dollar assets.

Are You Late To The Bitcoin Bull Run?

Bitcoin's fresh all-time high above $110,000 has many investors wondering if they've missed the move, but the confluence of factors driving this rally—reflation regime, weak USD, bullish momenum—makes the timing question surprisingly difficult to answer. We're seeing our oscillator signals rise and get closer to potential topping territory, though we're not there yet and would likely need significantly higher prices from here to see that flip. The current readings show elevated but not extreme levels: MVRV (market cap vs. realized value) sits at 1.33, SOPR (spent-output profit ratio) at 0.84, Puell Multiple (miner revenue stress) at 0.33, and Reserve Risk (hodler conviction vs. price) at 0.15. What's encouraging is that our Dynamic DCA model continues buying—it resumed on April 26 when AVIV momentum turned positive, and buys only stop if momentum flips negative or the AVIV Z-score exceeds 1.25 (currently 0.95).

TLDR: We're not early to the party but may not be late either—our models keep buying which supports higher prices.

HODLers Taking Less Profit Than We Expect

The classic bull-market pattern of long-term holders selling into strength is playing out exactly as expected, with these savvy investors distributing supply to eager new buyers. Current hodler net position change shows outflows of 36.2K BTC, which sounds significant until you compare it with prior breakout episodes that saw much heavier selling pressure. Historical context reveals the measured nature of today's distribution: we saw 117.5K BTC outflows during the post-Trump election ATH, 159.4K BTC during March 2024's $70K break, and 155.8K BTC when Bitcoin first hit $40K in January 2021. This smaller wave of selling suggests limited supply overhang, which supports price stability even as Bitcoin reaches new heights. While continued distribution from long-term holders is probable as the rally extends, the current magnitude remains well below the blow-off levels that typically mark cycle peaks.

TLDR: Modest hodler selling creates less supply pressure than past peaks, supporting Bitcoin's price stability at new highs.

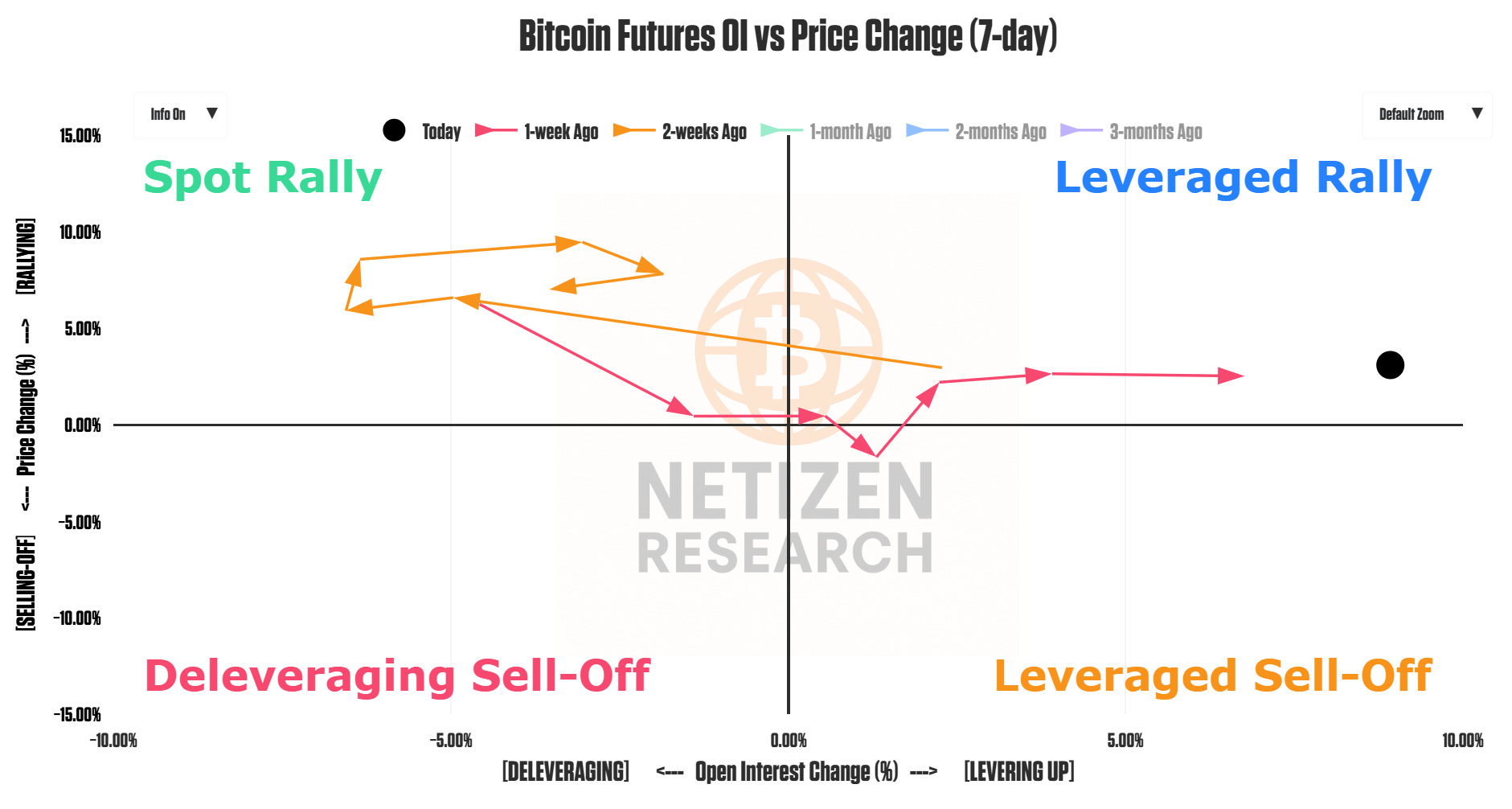

From Spot Rally to Leveraged Speculation

Two weeks ago, Bitcoin's rally was beautifully spot-led as open interest actually declined while price climbed higher, signaling genuine organic demand rather than speculative froth. However, the dynamics have shifted over the past week, with 7-day open interest climbing 8.9% while price rose a more modest 3.1%, indicating that leverage is now helping drive the advance. This evolution introduces rising valuation risk as futures positioning becomes more crowded, yet Bitcoin has a long history of staying euphoric far longer than traditional analysts expect. We're monitoring for signs of a leverage-driven blow-off top, but given our earlier bullish signals from cycle oscillators and on-chain metrics, it's premature to call an end to this bull run.

TLDR: Rising leverage adds risk but Bitcoin's historical tendency to extend beyond expectations supports continued price gains.

No Decoupling = No Problem for Bitcoin

The 30-day correlation between Bitcoin and the S&P 500 has held stubbornly above 0.8 since early May, effectively muting the decoupling narrative that many Bitcoin bulls prefer to see. More interesting is Bitcoin's correlation with actual gold, which flipped to -0.47 after gold peaked at $3,500 per ounce on April 21—notable timing since Bitcoin was below $90K then and now trades above $110K. The BTC-USD correlation has swung wildly from -0.63 on May 1 to +0.8 today, likely representing temporary noise rather than any fundamental shift in their relationship. Even if these high correlations persist, the same macro currents that are undermining the dollar—de-dollarization, sovereign debt stress, sticky inflation—remain potent upside catalysts for Bitcoin regardless of its relationship with traditional assets.

TLDR: Despite messy correlations, the macro forces weakening the dollar continue driving Bitcoin's price higher.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.