Netizen Weekly | Bitcoin Market Update #24

Bitcoin Absorbs Historic $9.6B Sale Without Breaking a Sweat

Bitcoin Whale Cashes Out Record Profits

Long-term Bitcoin holders just executed the largest profit-taking event in the asset's history, realizing $2.5 billion in gains over the weekend as an early investor dumped 80K BTC through Galaxy Digital's OTC desk. This $9.6 billion sell-side tsunami drove prices from recent highs down to $115K before Bitcoin stabilized near $118K. The market's ability to digest this whale-sized distribution reveals growing institutional demand that Wall St analysts still underestimate. This resilience emerges precisely while Fiscal Dominance is in full effect, as the Trump administration prints $3 trillion to fund the One Big Beautiful Bill. The weekend stress test proves Bitcoin has developed the liquidity depth necessary to serve as a primary safe haven during the coming monetary regime change.

TLDR: Record profit-taking barely dented Bitcoin's price, confirming institutional demand runs deeper than consensus suggests.

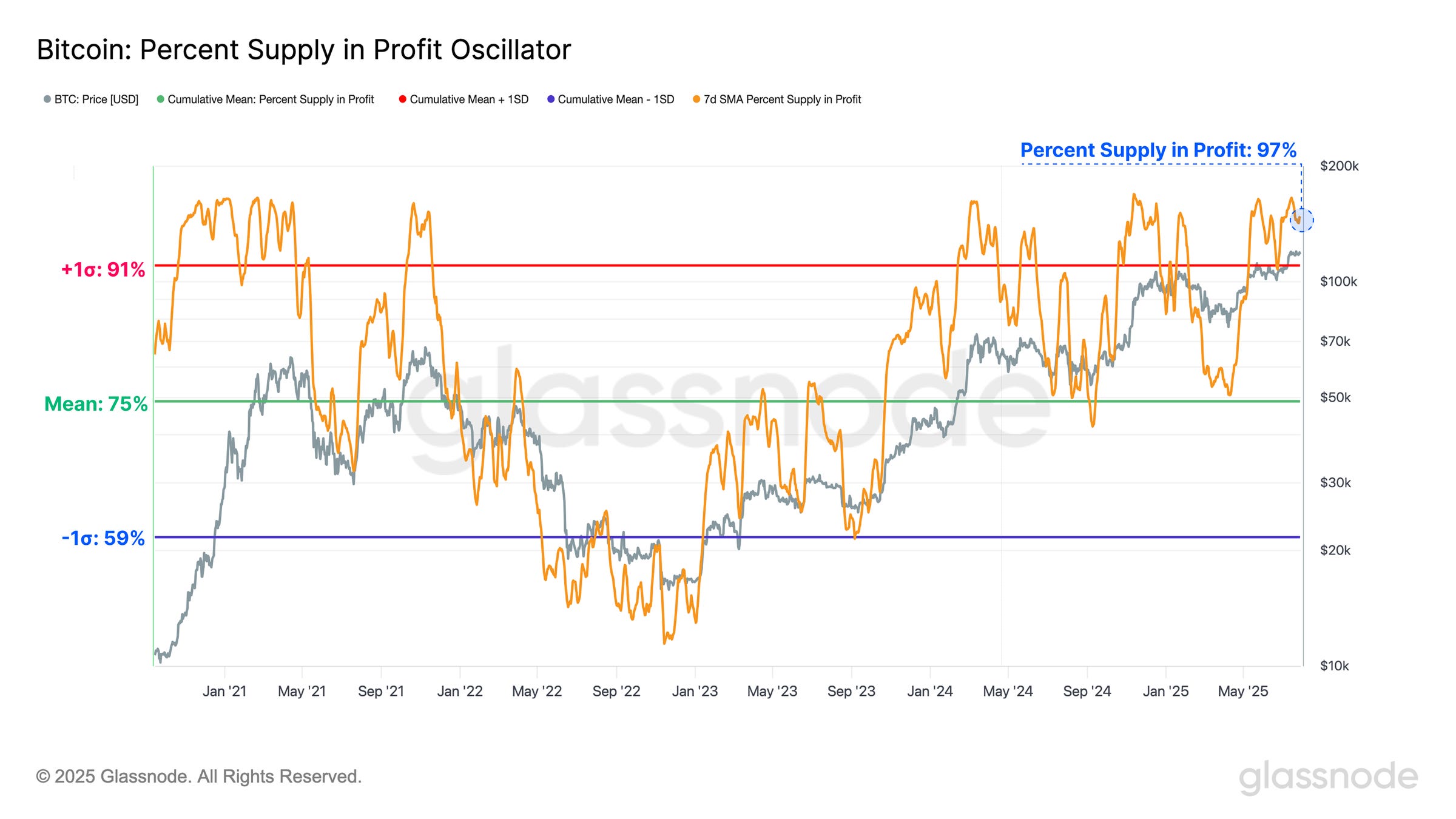

97% Of Bitcoin Is Held In Profit

On-chain data shows 97% of Bitcoin's circulating supply remains profitable at current prices, representing over $1.4 TRILLION in aggregate unrealized gains that creates a massive potential overhang. Yet despite this profit concentration, the weekend sell-off demonstrated Bitcoin has enough demand to absorb significant profit-taking without meaningful price weakness. This holder conviction reflects growing recognition that persistent government deficits favor hard assets over fiat alternatives. Fourth Turning dynamics are accelerating this shift as rising populism fuels fiscal stimulus. Meanwhile, the Trump administration continues to undermine Federal Reserve independence. This macro backdrop explains why Bitcoin holders maintain conviction despite record unrealized gains. They understand dollar debasement is just beginning.

TLDR: Widespread profitability creates selling potential, but many holders remain convicted as currency debasement accelerates.

Watch The Air Gap Between $105K-$115K

On-chain supply distribution reveals a notable air gap between $105K and $115K where minimal Bitcoin changed hands during the recent rally. The short-term holder cost basis sits at $105.4K, establishing crucial downside support. Heavy accumulation occurred between $115K and $120K, demonstrating sophisticated participants aggressively bought even at elevated prices. This technical setup suggests Bitcoin remains range-bound until a catalyst emerges. However, the fundamental backdrop increasingly favors upside resolution as currency debasement continues. The US government has shown they will prioritize fiscal expansion over currency stability, making Bitcoin's monetary alternative thesis increasingly compelling.

TLDR: Key support at $105K provides downside protection while macro forces build pressure for an upside breakout.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.