Bitcoin Crosses the Trillion Dollar Threshold

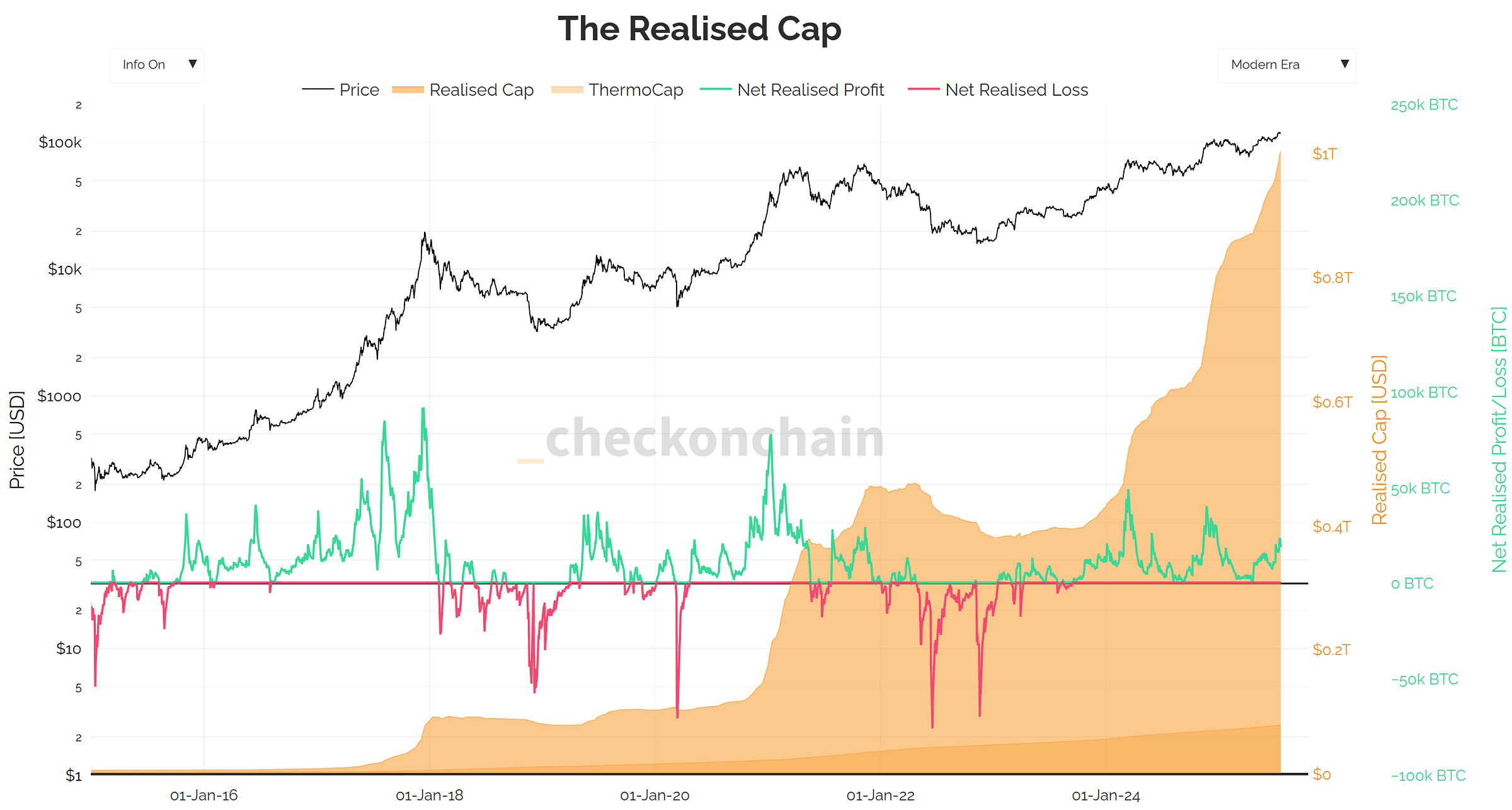

Bitcoin's realized cap, the cumulative dollar value ever invested in the network, just crossed $1 trillion for the first time in history. This milestone coincides perfectly with our 98th-percentile GOLDILOCKS risk-on regime where Bitcoin, gold, and the S&P 500 all maintain BULLISH momentum while the US dollar stays BEARISH. We continue to think we’re in the early innings of an Everything Rally fueled by fiscal dominance and an imminent dovish Federal Reserve pivot. Governments worldwide are broke, setting up a secular US dollar bear market that drives capital into hard assets like Bitcoin. This isn't speculative froth, it's institutional recognition that Bitcoin has matured into a legitimate macro hedge against currency debasement.

TLDR: The $1 trillion realized cap validates Bitcoin as the premier hard asset in a weakening dollar environment.

Altcoin Season Officially Begins

For the first time since early 2024, altcoins are outperforming Bitcoin across every subsector as crypto investors go deeper out on the risk-curve. Ethereum leads the charge while Bitcoin consolidates, creating a capital rotation pattern that defines alt-season amid broad risk-asset strength. Glassnode’s altseason indicator triggered on July 9th and remains active as stablecoin liquidity builds and momentum shifts toward higher-risk digital assets. The same macro forces driving our bullish Bitcoin thesis (fiscal dominance and easy monetary policy), are amplifying demand for the entire crypto ecosystem. However, any sustained Bitcoin weakness could quickly reverse this trend given BTC's outsized 64% market dominance influence.

TLDR: The macro Everything Rally is driving systematic altcoin outperformance, but Bitcoin strength remains the foundation.

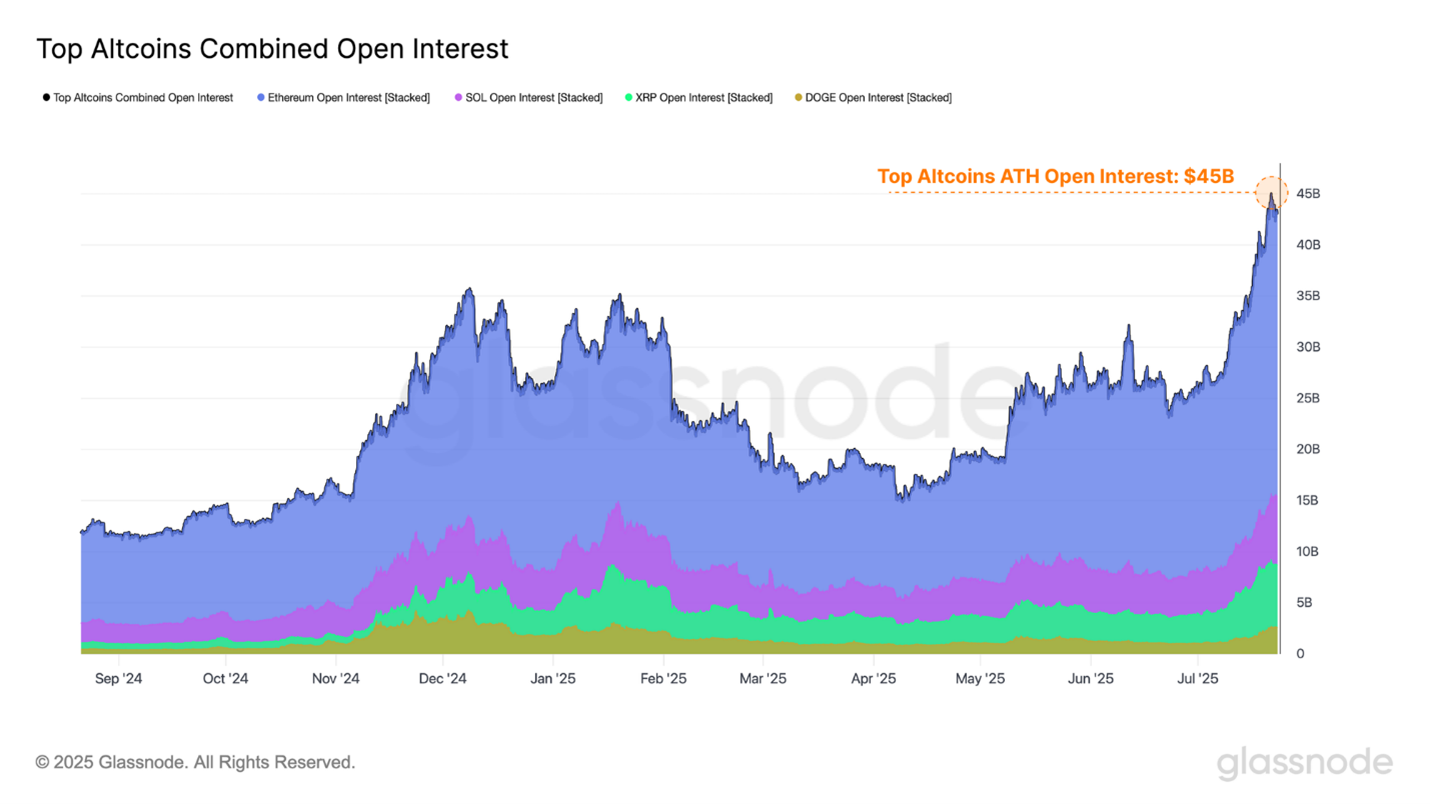

Derivatives Leverage Hits Dangerous Levels

Combined open interest across major altcoins (Ethereum, Solana, XRP, Dogecoin) exploded from $26 billion to $44 billion in July alone, the longest stretch of elevated speculative positioning on record. Meanwhile, Ethereum perpetual futures now dominate trading volume over Bitcoin for the first time since the 2022 bear market bottom. Monthly funding costs for leveraged long positions reached $32.9 million, approaching the $42 million peak seen during Bitcoin's March 2024 all-time high. This surge in derivatives activity signals dangerous levels of speculative froth building in the market. High leverage amplifies both gains and losses, making the current environment increasingly fragile and prone to violent corrections.

TLDR: Explosive derivatives growth suggests speculative excess that could trigger sharp volatility in either direction.

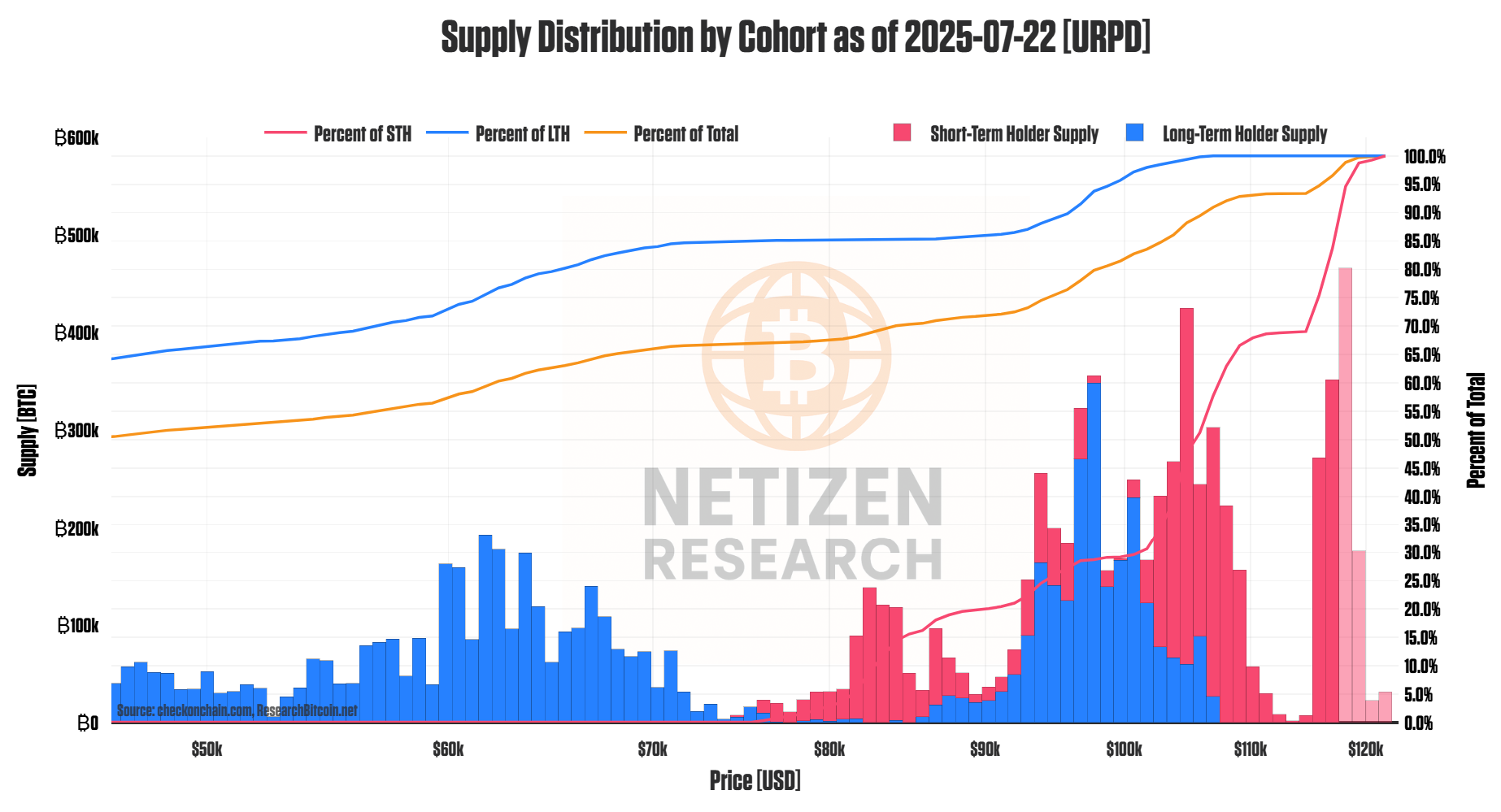

Mind The Supply Gap Between $110K-$115K

On-chain analysis reveals an obvious supply gap between $110K-$115K which we expect will be back-filled at some point. Short-term holders (STH) have an average cost basis around $104K, establishing a natural battleground for profit-taking behavior. Currently, 31% of STH supply sits above $115K, indicating a mildly top-heavy distribution that could pressure prices if sentiment shifts. In our view, the strongest support cluster remains at $98K where long-term holders own 348K BTC. Any correction toward the STH cost basis around $104K would likely represent a healthy reset before the next leg higher.

TLDR: A pullback to $104k would flush out weak hands while maintaining the bull market's structural integrity.

Thanks for reading this week's note! See you next week – and as always, hit reply if you have any questions, comments, or suggestions!

Take care -Brian

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

buying BTC 🫡