Regime Shifting from Risk-Off to Risk-On?

Since March 3, markets have been in DEFLATION with Bitcoin showing remarkable strength as it leads the broader market recovery, a position further validated by today's breaking news that the U.S. and China agreed to slash mutual tariffs from 125% to just 10%. Bitcoin maintains BULLISH momentum while US equities are NEUTRAL, though futures markets are surging with Nasdaq-100 jumping 3.5% on tariff de-escalation. Global markets are now pricing in equal probability of DEFLATION and GOLDILOCKS regimes, and over the coming weeks we'll be watching closely to see if this tariff agreement catalyzes a full transition into GOLDILOCKS (growth up, inflation down). This regime will likely be short-lived before persistent inflation pressures push us into REFLATION (growth up, inflation up), which is still a RISK-ON regime and highly favorable for Bitcoin. Even if this 90-day temporary agreement faces future hurdles, Bitcoin has demonstrated its ability to perform well in either scenario—benefiting from risk-on sentiment during trade peace or from de-dollarization trends during trade war escalation.

TLDR: Bitcoin's technical strength signals an all-time high breakthrough as it wins in either trade scenario: benefiting from risk-on sentiment if negotiations succeed or from de-dollarization trends if tariffs escalate.

Powell's Wait-And-See Approach

The Federal Reserve’s decision to hold rates last week creates an increasingly supportive backdrop for Bitcoin as Powell navigates its dual mandates (maximum employment and price stability). Officials appropriately delay cuts while tariff impacts develop, maintaining credibility that paradoxically strengthens Bitcoin's case as a complementary reserve asset in a complex monetary landscape. Rising inflation expectations (1-year consumer expectations now at 3.6%) combined with expansionary fiscal policy contributing approximately 120 basis points to GDP create fundamentally bullish conditions for monetary assets like Bitcoin. Markets correctly interpret Powell's wait-and-see approach as recognition that tariff impacts are unknown and fiscal policy is in the driver’s seat. This unique policy environment may allow Bitcoin to establish itself as a monetary asset while creating the preconditions for substantial new capital inflows once uncertainty resolves in either direction.

TLDR: Bitcoin targets new all-time highs as the Fed's wait-and-see stance creates a win-win: upside from controlled inflation if Powell holds firm, greater upside from inevitable easing if growth falters.

Capital Flight to Hard Money

The current macroeconomic landscape strongly favors Bitcoin's value proposition as secular trends toward hard assets accelerate amid mounting fiscal concerns. The US twin deficits and expanding government debt create an inescapable long-term inflation bias that benefits Bitcoin regardless of near-term growth fluctuations. Bond investors face a losing proposition as term premiums remain artificially suppressed—10-year yields should be 5.5% but sit at just 4.4%—signaling bond markets aren't properly compensating for inflation risks that Bitcoin naturally hedges. Simultaneously, the dollar's global dominance weakens as countries actively diversify reserves away from USD in response to weaponized trade policies, creating direct sovereign demand for non-dollar alternatives including Bitcoin and gold. These dual forces—bonds failing as inflation hedges and dollars weakening as reserve assets—funnel institutional and sovereign capital toward Bitcoin's fixed supply as perhaps the most efficient store of value in an increasingly unstable monetary landscape. Temporary price volatility merely offers entry opportunities into an asset structurally positioned to benefit from the inevitable rebalancing away from traditional safe havens. This fundamental shift in global capital flows from traditional fiat reserves toward mathematically sound alternatives creates the strongest possible foundation for Bitcoin's push toward new record valuations.

TLDR: Bitcoin's hard-coded scarcity positions it for new all-time highs as growing twin deficits, rising secular inflation, and accelerating de-dollarization drive capital toward true monetary havens.

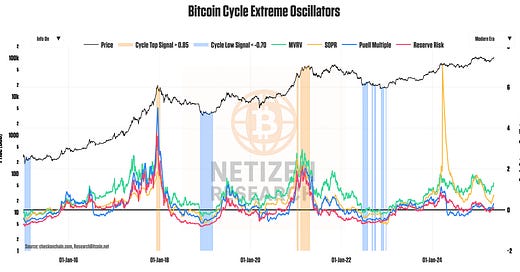

Below, we’ll dive into on-chain data to see how Bitcoin’s recent strength fits in with the macroeconomic environment:

Keep reading with a 7-day free trial

Subscribe to Netizen Research | Bitcoin, Macro & Markets to keep reading this post and get 7 days of free access to the full post archives.