The Fed Gives Up On Price Stability

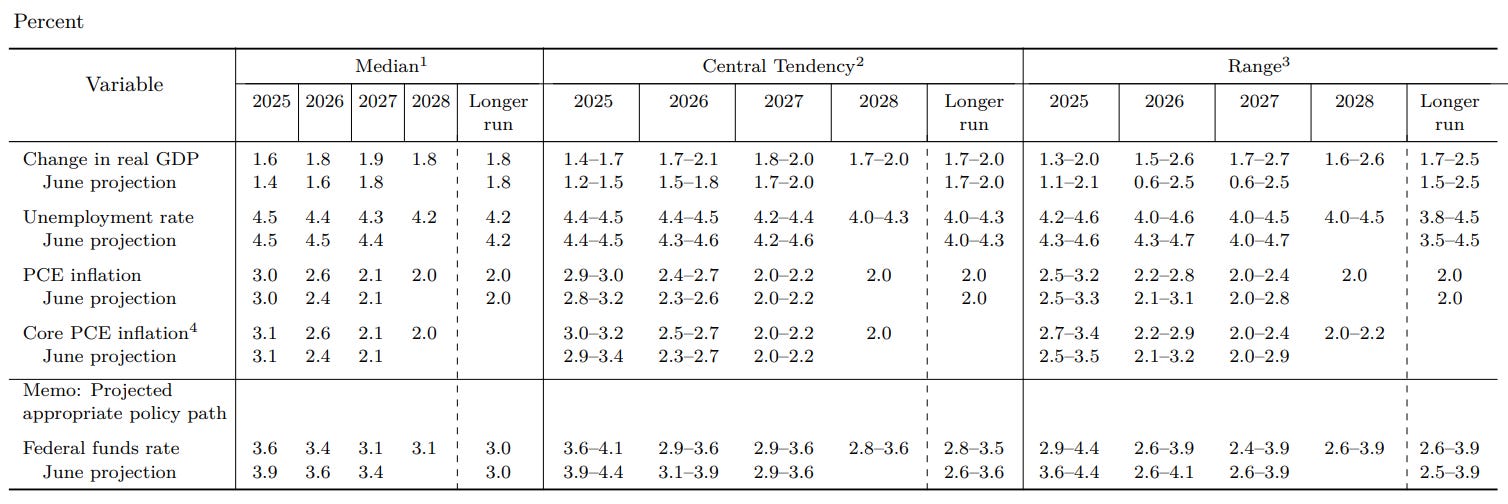

The FOMC's decision last Wednesday to cut interest rates by 0.25% represents more than routine policy recalibration: it signals capitulation to President Trump's core economic strategy of using easy monetary policy and fiscal stimulus to grow the economy faster than debt grows. Powell's press conference framed this as "risk management" rather than emergency easing, with the balance of risks now tilted toward employment downside despite inflation remaining over their 2% target. The Fed's updated economic projections now show an improvement in GDP (now 1.8% vs 1.6% previously) and unemployment (now 4.4% vs. 4.5% previously) in 2026, at the expense of higher inflation (now 2.6% vs. 2.4% previously), revealing the Fed's willingness to prioritize growth over price stability. This mirrors Trump's real estate playbook: leverage cheap financing to generate income growth that outpaces debt service, reducing debt-to-GDP ratios without ever actually paying down principal. This gradual erosion of Fed independence isn't accidental - it's essential to Trump's solution for the U.S. debt crisis. The administration's aggressive onshoring, AI investment, and industrial policy all require sustained monetary accommodation, making Bitcoin's debasement hedge thesis increasingly compelling.

TLDR: Fed accommodation of Trump's debt-financed growth strategy creates the perfect monetary debasement environment for Bitcoin's bull market.

Market Conditions Favor Bitcoin & Stocks

Against this backdrop, the market remains in a GOLDILOCKS regime: a risk-on environment where investors have been rewarded for taking risk as global liquidity trends persistently higher since mid-May 2025. Current momentum signals show the US dollar in BEARISH trajectory but technically overbought, while gold, the S&P 500, and Bitcoin maintain BULLISH momentum. Critically, volatility indices across asset classes (MOVE for bonds, CVIX for currencies, and VIX for equities) are all exhibiting BEARISH momentum, indicating diminished systemic stress and an increasingly supportive backdrop for risk assets. With retail traders holding neutral positioning and active managers overweight equities, the technical setup suggests any near-term correction risk remains minimal. This constellation of factors points toward continued rotation within risk assets rather than broad-based risk-off behavior, creating an optimal macro environment for Bitcoin's bull market as long as real yields stay capped and liquidity conditions remain supportive.

TLDR: Risk-on regime combined with falling volatility creates an ideal macro backdrop for Bitcoin's continued bull market momentum.

Below we’ll look at the on-chain data supporting Bitcoin:

Keep reading with a 7-day free trial

Subscribe to Netizen Research | Bitcoin, Macro & Markets to keep reading this post and get 7 days of free access to the full post archives.