Netizen Premium | Bitcoin Deep Dive #6

QE or Not QE: Why Bitcoin Investors Should Brace for Pain Before Powell Pivots

When Will the Fed Provide Liquidity via QE?

"Don't Fight the Prez" was our warning in last week's free note, and it bears repeating today. President Trump has orchestrated a political narrative, distancing himself from market turmoil by declaring this remains "Biden's Economy" until at least Q4. His economic team consistently sets expectations for short-term pain through their "detox" and "restructuring" language, preparing markets for an "adjustment" phase likely more painful than current prices reflect. The Fed's move to slow balance sheet reduction from $25B to $5B monthly might seem supportive, but don't be fooled – this isn't QE, and it falls dramatically short of the liquidity needed to navigate 2025's massive debt refinancing wave.

TLDR: Not soon enough – significant market pain appears necessary before the Fed pivots from merely slowing QT to implementing the QE that Bitcoin and risk assets desperately need.

Market Regime and Technical Signals Flash Warning Signs

The current Market Regime remains firmly in INFLATION territory – a risk-off environment where defensive assets historically outperform risk assets, including Bitcoin. This weekend Ethereum's momentum deteriorated from Neutral to Bearish, while Bitcoin maintains its Neutral signal, reflecting ETH's typical underperformance during risk-off periods. Gold maintains its Bullish signal, perfectly aligned with inflationary conditions, while equity factors tell a consistent story: the High Beta/Low Beta Ratio is bearish, Cyclicals/Defensives Ratio is bearish, Value/Growth Ratio is bullish, and Small Cap/Mega Cap Ratio is bearish – all classic indicators of slowing growth expectations and defensive positioning.

TLDR: Volatility & momentum signals across asset classes confirm our view that Bitcoin is already in a challenging period and faces significant headwinds.

Uncertainty Is The Market's Kryptonite

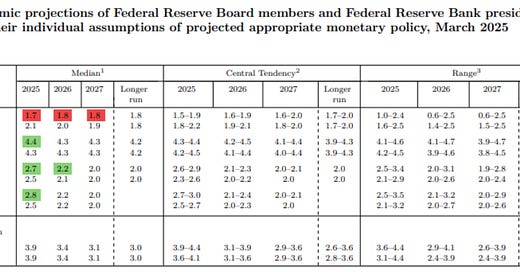

Asset markets despise uncertainty more than almost anything else, and we're currently facing a perfect storm of unknowns. The Fed's drastic revisions to their economic projections – lowering 2025 growth to 1.7%, raising unemployment to 4.4%, and increasing core PCE inflation to 2.8% – come with an alarming admission: their base case is that the economy will slowdown. FOMC members report the highest forecast uncertainty since COVID, despite their army of economists and extensive industry data. Simultaneously, President Trump's unpredictable approach to fiscal, regulatory, and trade policy has pushed the Economic Policy Uncertainty Index to levels not seen since the pandemic. This toxic combination of monetary and policy uncertainty naturally drives investors, business leaders, and consumers toward risk-off behavior, delaying investments and major purchases until clarity emerges.

TLDR: We won't expect relief in risk assets until the Fed provides QE, likely after enough pain has been inflicted in both the real economy and asset markets.

Dynamic DCA Strategy Navigates Mixed Signals in Uncertain Market

Keep reading with a 7-day free trial

Subscribe to Netizen Research | Bitcoin, Macro & Markets to keep reading this post and get 7 days of free access to the full post archives.