Netizen Premium | Bitcoin Deep Dive #8

Is Trump Creating A Recession? What This Means for Bitcoin & Markets

The Trump 'Kitchen Sink' Strategy: Engineering a Downturn to Force a Pivot

With global markets tumbling after Liberation Day tariffs, we're witnessing a deliberate economic "kitchen sinking" strategy that's inherently political. Trump's post-selloff Truth Social message—"THE OPERATION IS OVER! THE PATIENT LIVED...THE PROGNOSIS IS THAT THE PATIENT WILL BE FAR STRONGER"—reveals his approach: trigger downturn early, blame predecessors, then engineer recovery ahead of midterms. According to Yale's Budget Lab, the proposed tariffs could reduce GDP growth by 1.3% through 2026 while creating stagflationary pressure, yet Wall Street's earnings projections show a baffling linear acceleration in S&P 500 sales growth and a hockey-stick recovery in Q3—estimates that appear wildly disconnected from economic reality. Both political parties share addiction to debt, with Republican administrations historically increasing federal debt by 36-39% compared to Democrats' 26%, making the proposed "DOGE" spending cuts ($1 trillion annually) all the more consequential as it’s estimated to raise unemployment by 0.3%-0.7%.

TLDR: Expect significant market volatility and further equity weakness as Wall Street earnings estimates reset lower, while Bitcoin may also be weak until the fiscal and monetary pivot we're all waiting for (i.e., QE).

The macroeconomic picture shows multiple stress factors that make a technical recession likely, though not necessarily a full-blown downturn given the current strength of private sector balance sheets. Household cash sits at $9.5 trillion (5% of total household assets), while corporate cash stands at $2.9 trillion (5% of corporate assets)—both at levels not seen since the early 1950s. However, 73% of recent job creation came from government and government-adjacent payrolls, putting a substantial cohort of workers at risk as spending cuts materialize. Our analysis indicates the magnitude of market correction hinges on whether policymakers respond proactively (limiting declines to 15-20%) or reactively (risking 30-40% drawdowns) with monetary and fiscal relief. Market history teaches that policy paths matter more than initial conditions, with the speed of central bank response determining whether corrections become crashes.

TLDR: The market correction could be limited to 15-20% with quick policy response or extend to 30-40% with delayed action, suggesting defensive equity positioning while maintaining Bitcoin exposure for when policy pivots back to QE.

Global liquidity is approaching a dangerous "debt refinancing air pocket" in 2025—the single largest risk to asset markets this year—as approximately $28 trillion in debt needs refinancing while liquidity expands at an insufficient 1-2% monthly. We believe Trump's strategy is deliberately forcing a downturn now so this debt wall can be refinanced at much lower rates later this year, part of a comprehensive "America First" strategy that paradoxically accelerates de-dollarization trends. The simultaneous decline in US stocks, Treasury yields, and the US dollar following tariff announcements signals worrying capital flight away from US assets. Foreign investors own $24 trillion more of our assets than we own of theirs, creating an underappreciated vulnerability to the recent tariff announcement—a vulnerability that's particularly worrisome when considering that all three traditional "buyers" of US debt (Fed, commercial banks, and foreign central banks) have been reducing their Treasury holdings while the private sector has been forced to absorb the difference, increasing from 36% to 57% of marketable Treasury securities since 2021.

TLDR: Capital flight from US assets could intensify if liquidity concerns persist, harming domestic stocks while potentially benefiting gold and Bitcoin as alternative assets outside the fiat monetary system.

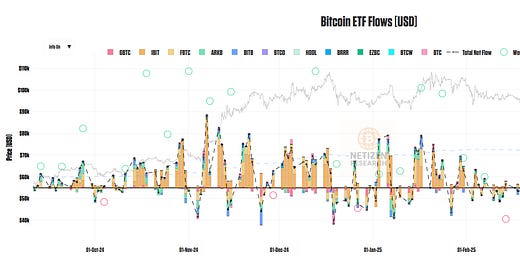

Bitcoin's initial stability during last week's market turbulence gave way to weakness as prices broke below $80K during Sunday trading. While the market regime (top-down, based on asset price behavior) has shifted to DEFLATION, our economic data analysis suggests we remain in a STAGFLATION macro regime (bottom-up, based on economic data showing growth down, inflation up)—either way, we're firmly in RISK-OFF territory that typically punishes both stocks and crypto. Although Bitcoin showed brief uncorrelated movement post-Liberation Day, its subsequent breakdown confirms our skepticism about declaring any permanent "decoupling" from traditional risk assets at this stage. The global financial system remains heavily dollar-dependent (60% of FX reserves, 70% of international debt securities), creating systemic vulnerability as America prioritizes domestic concerns over global stability. For investors navigating this landscape, Bitcoin could potentially emerge as a solution to government largesse and monetary debasement if it eventually develops gold-like behavior through further market stress, but recent price action suggests we're not there yet.

TLDR: Bitcoin's break below $80K into our predicted supply air gap confirms it remains subject to risk-off pressures for now, casting doubt on any immediate decoupling narrative despite the potential for Bitcoin to eventually evolve toward a monetary hedge during de-dollarization.

As Trump's economic reset triggers market-wide turbulence, our on-chain metrics and proprietary Dynamic DCA Model reveal a critical Bitcoin path most investors are unprepared for:

Keep reading with a 7-day free trial

Subscribe to Netizen Research | Bitcoin, Macro & Markets to keep reading this post and get 7 days of free access to the full post archives.