Base Case — Convictionless Markets

Market conditions present a notable disconnect from our macro signals, as we should be in RISK-OFF conditions, yet Bitcoin maintains BULLISH momentum while the S&P 500 has just shifted from bearish to NEUTRAL momentum last week. The US economy appears technically fragile with Q1 GDP slightly negative (-0.3%), yet private real final sales growth remains resilient at 3% or higher for nine consecutive quarters. Inflationary pressures continue to remain sticky with Core PCE at 3.5% (three-month annualized) and housing PCE accelerating to 4.0%, both significantly above the Fed's 2% target. Positioning indicators reveal retail traders underweight stocks with speculators neutral and notably underweight the US dollar. Bitcoin's recent strength may either represent genuine decoupling from traditional markets or simply act as a leading indicator that we're transitioning away from deflation (our current regime signal strength is just 23%) toward either continued risk-off stagflation or potentially even a risk-on regime if markets decide to look past Trump's policy missteps and focus on potential monetary easing ahead.

TLDR: Bitcoin likely maintains strength as a hedge while markets struggle with directionality amid rising stagflationary signals.

Bull Case — Money Printer Go BRRRR

At one extreme of the flattening probability distribution lies a scenario where the convictionless market suddenly realizes monetary policy must loosen dramatically. Continued policy flip-flops from President Trump could trigger further bond market instability, potentially forcing the Federal Reserve to intervene with massive liquidity injections. Remember, the US faces exceptional vulnerability with twin deficits totaling 11% of GDP (7% fiscal, 4% current account), creating dependency on foreign capital that could rapidly reverse following the April 2025 bond market shock. Historical precedent shows how previous monetary expansions have driven explosive growth in alternative assets, with Bitcoin's 2020-2021 surge following pandemic QE serving as a powerful example. The US dollar remains significantly overvalued at 113 on international exchange measures (100 being fair value), setting up conditions where the Fed may need to implement yield curve control and restart quantitative easing. In our view, a Fed backstop of the Treasury market would be the ultimate BUY SIGNAL for Bitcoin, gold, and non-US equities, as global capital would likely flee dollar assets into inflation-resistant alternatives amid a new wave of monetary expansion.

TLDR: Bitcoin could see exponential price appreciation if the Fed is forced to backstop treasury markets through money printing, potentially validating the most aggressive price targets ($100k+).

Bear Case — Trump-Induced Recession

At the opposite extreme lies a scenario Wall Street seems determined to ignore - the combination of tariffs, immigration restrictions, and DOGE budget cuts could push the US from a potential technical recession into an actual one. Tariffs are already functioning as a regressive tax, cutting median household disposable income by approximately 3.5%, effectively canceling out recent wage gains for many Americans. Labor market warning signs are flashing as initial jobless claims have accelerated to +12% on a three-month annualized basis, approaching recession signal thresholds, with government-adjacent sectors particularly vulnerable after accounting for 73% of job growth over the past two years. Consumer resilience would likely crack under these pressures, especially as policy uncertainty indexes have tripled beyond previous record highs, freezing business investment and hiring plans. Most concerning is that Wall Street sales and earnings estimates remain wildly optimistic if policy miscalculations trigger an actual recession, with S&P 500 earnings typically declining 19% in post-war recessions – a scenario where Bitcoin would likely experience an initial selloff alongside traditional assets but could recover faster as the market looks through to the inevitable government bailout.

TLDR: Bitcoin would likely fall alongside stocks in a policy-induced recession, but could stage an earlier recovery as investors recognize its utility during fiscal stress.

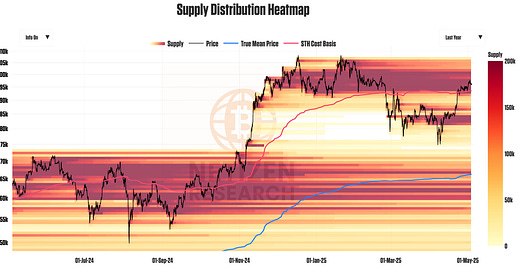

With Bitcoin's direction hinging on policy decisions from the Trump Admin and Fed, let's take a look at what's going on on-chain and underneath the hood so we can better position amid the uncertainty:

Keep reading with a 7-day free trial

Subscribe to Netizen Research | Bitcoin, Macro & Markets to keep reading this post and get 7 days of free access to the full post archives.